![]() Web capture of this article-Right

click and select "save As" to download an Adobe Acrobat copy of this important

article

Web capture of this article-Right

click and select "save As" to download an Adobe Acrobat copy of this important

article

![]() Memorandum of Law of this article -(OFFSITE LINK) Includes the entire

content of this article PLUS tables of authorities and questions at the

end. Designed to attach to legal pleadings. Right click and

select "save As" to download an Adobe Acrobat copy of this important article

Memorandum of Law of this article -(OFFSITE LINK) Includes the entire

content of this article PLUS tables of authorities and questions at the

end. Designed to attach to legal pleadings. Right click and

select "save As" to download an Adobe Acrobat copy of this important article

Table of contents:

- Introduction

1.1 Income Taxation is a Proprietorial Power Limited to Federal Property

1.2 Main Technique of Corruption: Introduce Franchises to replace UNALIENABLE PRIVATE Rights with REVOCABLE PUBLIC Statutory PRIVILEGES

1.3 Why is the tax upon a "trade or business" instead of ALL earnings?

1.4 It is ILLEGAL for the Average American to call their earnings "trade or business" earnings

1.5 Historical significance and evolution of the legal term "trade or business"

- Heart of the Income Tax FRAUD

- Overview of the Income Taxation Process

- Proof IRC Subtitle A is primarily an excise tax on activities in connection with a "trade or business"

- Social Security Numbers (SSNs) and Taxpayer Identification Numbers are what the FTC calls a "franchise mark"

- Public v. Private

6.1 Introduction

6.2 What is "Property"?

6.3 "Public" v. "Private" property ownership

6.4 The purpose and foundation of de jure government: Protection of EXCLUSIVELY PRIVATE rights

6.5 The Ability to Regulate Private Rights and Private Conduct is Repugnant to the Constitution

6.6 The Right to be left alone

6.7 The PUBLIC You (straw man) vs. the PRIVATE You (human)

6.8 All PUBLIC/GOVERNMENT law attaches to government territory, all PRIVATE law attaches to your right to contract

6.9 Taxation of "Public" v. "Private" property

6.10 "Political (PUBLIC) law" v. "civil" (PRIVATE) law"

6.11 Lawful methods for converting PRIVATE property into PUBLIC property

6.12 Unlawful methods abused by government to convert PRIVATE property to PUBLIC property

6.13 The public office is a "fiction of law"

- Introduction to the Law of Agency

7.1 Agency generally

- Synonyms for "trade

or business"

8.1 "wages"

8.2 "personal services"

8.3 "United States"

8.4 Statutory "citizen of the United States" or "U.S.** citizen" - I.R.C. requirements for the exercise of a "trade or business"

- What kind of tax is it?: Direct or Indirect, Constitutional ro Unconstitutional?

- Who's "trade or business": The PAYER, the PAYEE, or BOTH?

- Public office generally

12.1 Legal requirements for holding a "public office"

12.2 De Facto Public Officers

12.3 How do ordinary government workers not holding public office become "taxpayers" - Methods

for Connecting You To the Franchise

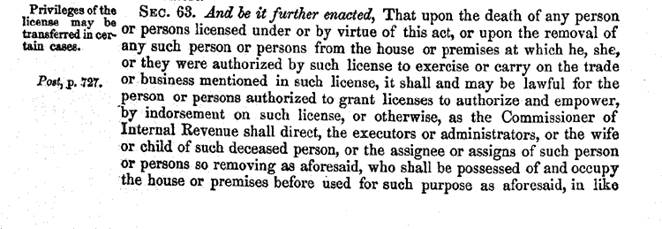

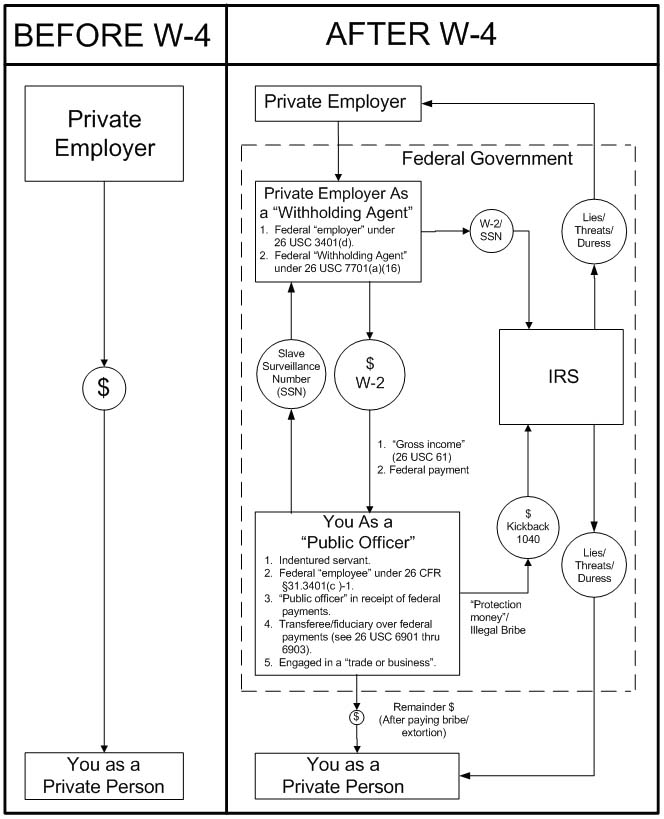

13.1 W-4 Agreements or Contracts: Illegal for Private People

13.2 Reductions in Liability: Graduated Rate of Tax, Deductions, and Earned Income Credits13.3 Information Returns

13.4 Government Identifying Numbers: SSN and TIN

13.5 Domicile, Residence, and Resident Tax Returns such as IRS Form 1040

13.6 "Electing" (consenting) to treat your earnings as "effectively connected with a trade or business"

- Government propaganda and deception about the scam

14.1 Willful government deception in connection with a "trade or business"

14.2 Proving the government deception yourself

14.3 False IRS presumptions that must be rebutted

14.4 Why the IRS and the Courts WON'T Talk about what a "trade or business" or "public office" is and collude to Cover Up the Scam - Defenses

15.1 How nonresidents in the states of the Union are deceived and coerced to enlist in the scam

15.2 How to prevent being involuntarily or fraudulently connected to the "trade or business" franchise

15.3 Administrative Remedies to Prevent Identity Theft on Governmwent Formst

- Rebutted Arguments Against this Memorandum

16.1 Argument is "frivolous"

16.2 "trade or business" includes lots of activities other than simply a public office - Other important implications of the scam

- Conclusions and Summary

- Resources for Further Study and Rebuttal

Related articles:

-

Income Tax Reality Check:

Income Tax is slavery-proves that the government thinks of you as

their property. Assuming you are engaged in a "trade or business"

is their method of doing that

Income Tax Reality Check:

Income Tax is slavery-proves that the government thinks of you as

their property. Assuming you are engaged in a "trade or business"

is their method of doing that - The Information Return Scam -excellent!

- State Created Office of "Person" -how you surrendered sovereign immunity to become a "person", "subject", "citizen", or "resident" of the state

- "Public" v. "Private" Employment: You Really Work for Uncle Sam if you Receive Federal Benefits-fascinating and true

Why Statutory Civil Law is Law for Government and Not Private Persons,

Form #05.037 (OFFSITE LINK)-By SEDM

Why Statutory Civil Law is Law for Government and Not Private Persons,

Form #05.037 (OFFSITE LINK)-By SEDM  Government Instituted Slavery Using Franchises, Form #05.030 (OFFSITE

LINK)-describes how franchises such as the "trade or business" franchise

work generally. By SEDM

Government Instituted Slavery Using Franchises, Form #05.030 (OFFSITE

LINK)-describes how franchises such as the "trade or business" franchise

work generally. By SEDM  Legal Deception, Propaganda, and Fraud, Form #05.014 (OFFSITE LINK)-describes how government and legal profession violate

the rules of statutory construction to enrich themselves, including

with the word "trade or business"

Legal Deception, Propaganda, and Fraud, Form #05.014 (OFFSITE LINK)-describes how government and legal profession violate

the rules of statutory construction to enrich themselves, including

with the word "trade or business"  Policy Document: Pete Hendrickson's "Trade or Business" Approach, Form

#08.001 (OFFSITE LINK)-describes differences in approach between

this website and Pete

Hendrickson's Lost Horizons website. By SEDM

Policy Document: Pete Hendrickson's "Trade or Business" Approach, Form

#08.001 (OFFSITE LINK)-describes differences in approach between

this website and Pete

Hendrickson's Lost Horizons website. By SEDM - A Treatise on the Law of Public Offices and Officers (OFFSITE LINK) -Floyd Mechem, 1890. Google Books. Excellent.

- Treatise on the Law of Agency (OFFSITE LINK) - Floyd R. Mechem, 1889. Google Books. Excellent!

Officers of the United States Within the Meaning of the Appointments

Clause, U.S. Attorney Memorandum Opinion-describes what the U.S. government

thinks a "public officer" is

Officers of the United States Within the Meaning of the Appointments

Clause, U.S. Attorney Memorandum Opinion-describes what the U.S. government

thinks a "public officer" is  Information Return FOIA: "Trade or Business", Form #03.023 (OFFSITE LINK)-use this as a "reliance defence" to develop evidence

that the government KNOWS you are not engaged in a "trade or business'

and is committing a crime by not admitting it.. By SEDM

Information Return FOIA: "Trade or Business", Form #03.023 (OFFSITE LINK)-use this as a "reliance defence" to develop evidence

that the government KNOWS you are not engaged in a "trade or business'

and is committing a crime by not admitting it.. By SEDM  Why Your Government is a Thief or You Are a "public officer" for Income

Tax Purposes, Form 05.008 (OFFSITE LINK)-proves that nearly all

"taxpayers" within I.R.C. Subtitle A are "public officials" engaged

in a "trade or business". SEDM Forms

page

Why Your Government is a Thief or You Are a "public officer" for Income

Tax Purposes, Form 05.008 (OFFSITE LINK)-proves that nearly all

"taxpayers" within I.R.C. Subtitle A are "public officials" engaged

in a "trade or business". SEDM Forms

page - Pete Hendrickson about

the meaning of "Income" (VERY

IMPORTANT!)-the John Clifton Show, Google Video

- Audio (MP3, 28 Minutes)

- Minimum Qualifications for Public Office (OFFSITE LINK) - Alabama Secretary of State's office

- Eligibility for Public Office (OFFSITE LINK) - Wikipedia

Remedies:

-

Federal and State Tax Withholding Options for Private Employers - describes options for lawfully exiting federal and state tax roles

Federal and State Tax Withholding Options for Private Employers - describes options for lawfully exiting federal and state tax roles -

Demand for Verified Evidence of "Trade or Business" Activity: Information

Return Form #04.007 (OFFSITE LINK)-form to give to employers and

financial institutions who are illegally preparing W-2's, 1042-S', 1098's,

and 1099's. SEDM Forms

page

Demand for Verified Evidence of "Trade or Business" Activity: Information

Return Form #04.007 (OFFSITE LINK)-form to give to employers and

financial institutions who are illegally preparing W-2's, 1042-S', 1098's,

and 1099's. SEDM Forms

page -

Demand for Verified Evidence of "Trade or Business" Activity: Currency

Transaction Report (CTR), Form #04.008 (OFFSITE LINK)-form

to give to financial institutions who are illegally preparing CTR's. SEDM Forms

page

Demand for Verified Evidence of "Trade or Business" Activity: Currency

Transaction Report (CTR), Form #04.008 (OFFSITE LINK)-form

to give to financial institutions who are illegally preparing CTR's. SEDM Forms

page - "trade or business" defined-Sovereignty Forms and Instructions: Cites by Topic

-

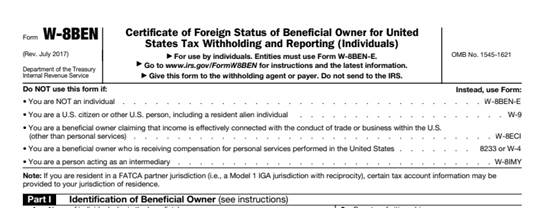

About IRS W-8BEN, Form #04.202 (OFFSITE LINK, COMPLIANT MEMBERS ONLY CONTENT)-how to change your status to nonresident alien

-

Corrected Information Return Attachment Letter, Form #04.002

(OFFSITE LINK)-attach this to corrected information returns you send

into the IRS. SEDM Forms

page

Corrected Information Return Attachment Letter, Form #04.002

(OFFSITE LINK)-attach this to corrected information returns you send

into the IRS. SEDM Forms

page -

Correcting Erroneous Information Returns, Form #04.001 (OFFSITE

LINK)-how to correct most information returns. Incorporates the

following four documents. SEDM Forms

page

Correcting Erroneous Information Returns, Form #04.001 (OFFSITE

LINK)-how to correct most information returns. Incorporates the

following four documents. SEDM Forms

page - Correcting Erroneous IRS Form 1042s, Form #04.003 (OFFSITE LINK)-how to remove the false presumption that income on a 1042 is connected with a "trade or business". SEDM Forms page

- Correcting Erroneous IRS Form 1098s, Form #04.004 (OFFSITE LINK)-how to remove the false presumption that income on a 1098 is connected with a "trade or business". SEDM Forms page

- Correcting Erroneous IRS Form 1099s, Form #04.005 (OFFSITE LINK)-how to remove the false presumption that income on a 1099 is connected with a "trade or business". SEDM Forms page

- Correcting Erroneous IRS Form W-2s, Form #04.006 (OFFSITE LINK)-how to remove employment earnings from being connected with a "trade or business". SEDM Forms page

- Precious Metal Transaction Reporting, Form #04.106 (OFFSITE LINK)-legal requirements for the reporting of precious metal transactions

Related law:

- 26 U.S.C. §7434: Civil Damages for Fraudulent Filing of Information Returns

- 26 U.S.C. §7207: Fraudulent Returns, Statements, and Other Documents

- 18 U.S.C. §912: Falsely impersonating an officer [PUBLIC OFFICER] or employee of the United States

- 26 U.S.C. §6041: Information at source-Cornell. Shows that you must have "trade or business" earnings to have reportable income under the I.R.C.

- 26 U.S.C. §6721: Failure to Correct Information Returns

- 26 C.F.R. §1.6041-1: Return of information as to payments of $600 or more-GPO website. Shows that information returns are only required in the case of "trade or business" earnings

- 26 C.F.R. §1.6049-5: Interest and original issue discount subject to reporting after December 31, 1982-reporting of interest connected to trade or business

SOURCE:

Great IRS Hoax, section 5.6.12

______________________________________

"The taxpayer-- that's someone who works for the federal government but doesn't have to take the civil service examination."

[President Ronald W. Reagan]

1. Introduction

One must be engaged in a “trade or business”, which is defined as “the functions of a public office”, within the statutory but not constitutional “United States**”, which is geographically defined as federal territory or as the national government if non-geographical, in order to earn “gross income”. The only exception to this is nonresident aliens with income from the statutory "United States**" (federal terriorty) under 26 U.S.C. §871(a). This is because:

- The income tax under Subtitle A of the Internal Revenue Code is an indirect excise tax, as the Supreme Court pointed out repeatedly. See section 5.1.3 of the Great IRS Hoax, Form #11.302 The “subject of” all indirect excise taxes are voluntary “taxable activities” that are privileged and in many cases licensed. The tax may only be instituted by the agency or government entity that issues the license or bestows the privilege to the person who volunteers to be the “licensee”, and the tax is only enforceable within the legislative jurisdiction of the taxing entity. The “privileged activity” in this case of the federal income tax under Subtitle A of the Internal Revenue Code is that of holding “public office” in the U.S. Government. A “public office” is therefore the only excise taxable activity that a biological person can involve themselves in that will make them the subject of the municipal donation program for the District of Columbia called the Internal Revenue Code.

- According to 4 U.S.C. §72, all "public offices" may be exercised ONLY in the District of Columbia and not elsewhere, except as "expressly provided by law". That is why the "United States" is defined in Subtitle A of the I.R.C. as federal territory in 26 U.S.C. §7701(a)(9) and (a)(10) and 4 U.S.C. §110(d). There is also no provision of law which authorizes "public offices" outside the District of Columbia other than 48 U.S.C. §1612, and therefore, the I.R.C. Subtitle A Income tax upon "public offices" can apply nowhere outside the District of Columbia other than the Virgin Islands. This is also consistent with the definition of "U.S. sources" found in 26 U.S.C. §864(c)(3), which identifies all earnings originating from the "United States" as "effectively connected with the conduct of a trade or business".

- “Income” has the meaning it was given in the Constitution, which is “gain and profit” in connection with an excise taxable activity. Congress is forbidden to define the word “income” because the Constitution defines it. This was pointed out by several rulings of the U.S. Supreme Court, including Eisner v. Macomber, 252 U.S. 189 (1920); So. Pacific v. Lowe, 247 U.S. 330 (1918); Merchant’s Loan & Trust Co. v. Smietanka, 255 U.S. 509 (1921). Where there is no “taxable activity”, there can be no “taxable income”. We covered this earlier in sections 5.6.5 if you want more detail.

- Because all "taxpayers"

under Subtitle A of the I.R.C. are “public officers” and work for

a federal corporation called the “United States” (see 28 U.S.C. §3002(15)(A)), then they are acting as an “officer

or employee of a federal corporation” and they:

4.1. Are the proper subject of the penalty statutes, as defined under 26 U.S.C. §6671(b). This is true even though the Constitution prohibits “Bills of Attainder” in Article 1, Section 10, because the penalty isn’t on the natural person, but upon the “office” or “agency” he volunteered to maintain in the process of declaring that he has “taxpable income”.

4.2. May have the code enforced against you without implementing regulations as required by 44 U.S.C. §1505(a)(1) and 5 U.S.C. §553(a)(2)

4.3 Are the proper subject for the criminal provisions of the Internal Revenue Code, which identify officers of corporations as the only "persons" within 26 U.S.C. §7343

- Earnings not connected with a “trade

or business” under 26 U.S.C. §871(b) and 26 U.S.C. §864 and not originating from the statutory

"United States**" (federal territory):

5.1. Are identified as part of a “foreign estate” in 26 U.S.C. §7701(a)(31). A foreign estate is not includible in gross income either, based on the definition of “foreign estate”, BECAUSE it is not connected with a “trade or business”.

5.2. Are not includable as “gross income” if paid by a "nonresident alien". See 26 U.S.C. §864(b)(1)(A). Remember: The Great IRS Hoax showed in sections 5.2.13 and 5.6.15 that states of the union are "foreign countries" with respect to the Internal Revenue Code and all of their inhabitants are "non-resident non-persons". ”. The subsect of state inhabitants who are also public officers are also “nonresident alien individuals”

This means one must be engaged in a “public office” in the District of Columbia in order to earn “gross income” as a human being. Statutory and not ordinary “gross income” that meets this criteria is described in the code simply as “income effectively connected with a trade or business from sources within the United States”. This is confirmed by 26 U.S.C. §7701(a)(31), which says that an estate that is in no way connected with a "trade or business" and whose sources of income are outside the statutory but not constitutional "United States**" (federal territory) may not have its earnings identified as statutory "gross income" and is a "foreign estate", which means it is not subject in any way to the provisions of the Internal Revenue Code:

TITLE 26 > Subtitle F > CHAPTER 79 > Sec. 7701.

(a)(31) Foreign estate or trust

(A) Foreign estate

The term ''foreign estate'' means an estate the income of which, from sources without the United States [under 26 U.S.C. §871(a)] which is not effectively connected with the conduct of a trade or business within the United States [under 26 U.S.C. §871(b) and 26 U.S.C. §864], is not includible in gross income under subtitle A.

In this section, we will demonstrate all the evidence we can find that supports these conclusions, and also show you how the IRS has, with the implicit collusion and approval of the Congress and the Treasury Department, tried to do the following within their deceptive publications:

- Taken great pains to hide and obfuscate the fact that Subtitle A of the Internal Revenue Code is an indirect excise tax upon licensed, privileged activities. They have done this by burying the sordid truth deep in regulations that they hope people will never read and which have been carefully obfuscated over the years to make them virtually unintelligible for the average American.

- Confuse the meaning of the term “trade or business” in their publications so that everyone thinks they meet this criteria.

- Create a false and unsupportable presumption that all people and all earnings within states of the Union are connected with a “trade or business in the United States".

- Create the illusion and deception that IRC Subtitle A describes a direct, unapportioned tax upon natural

persons that cannot be avoided or shifted. Once IRS can establish

the false presumption Subtitle A as a direct unapportioned tax,

then they:

4.1. Can label those who choose not to volunteer as “frivolous” or worst yet, penalize them for filing an accurate return reflecting no “gross income” because not connected to a “trade or business”.

4.2. Have a way to exploit the false presumption and ignorance of juries to claim that those who avoid paying or filing are lawbreakers, even though they broke no laws and exercised their constitutionally protected choice not to volunteer to connect their earnings to a “trade or business”.

4.3. Have an excuse to ignore those who complain that private employers are forcing them to sign and submit W-4 withholding agreements under duress, or be denied employment. Instead, they have a presumptuous and mistaken excuse to say that it isn’t voluntary and that everyone must submit the form, when in fact, the regulations at 26 C.F.R. §31.3402(p)-1 clearly show otherwise.

If you read the IRS' Civil and Criminal Actions website at the address below, you will see that ALL of their propaganda in fact focuses on the above goals, as we predicted:

The IRS warned us it was going to try to deceive us by stating in its own Internal Revenue Manual that you can't rely upon any of its own publications. The federal courts warned us that the IRS was going to do this by telling us that we can't rely upon the phone or oral advice of anyone in the IRS, even if they signed their recommendation under penalty of perjury! Why didn’t we listen to any of these warnings? See the surprising truth for yourself:

http://famguardian.org/Subjects/Taxes/Articles/IRSNotResponsible.htm

We must, however, remember what the Supreme Court said about false presumptions that come from deliberately deceptive IRS publications and phone advice:

"The power to create [false] presumptions is not a means of escape from constitutional restrictions,"

[New York Times v. Sullivan, 376 U.S. 254 (1964)]

1.1. Income Taxation is a Proprietorial Power Limited to Federal Property

Legislative power to institute income taxation under Subtitle A of the Internal Revenue Code originates from Article 4, Section 3, Clause 2 of the Constitution:

U.S. Constitution, Article IV § 3 (2).

The Congress shall have Power to dispose of and make all needful Rules and Regulations respecting the Territory or other Property belonging to the United States [***]

"[1] The power of Congress, in the imposition of taxes and providing for the collection thereof in the possessions of the United States, is not restricted by constitutional provision (section 8, article 1), which may limit its general power of taxation as to uniformity and apportionment when legislating for the mainland or United States proper, for it acts in the premises under the authority of clause 2, section 3, article 4, of the Constitution, which clothes Congress with power to make all needful rules and regulations respecting the territory or other property belonging to the United States. Binns v. United States, 194 U.S. 486, 24 Sup.Ct. 816, 48 L.Ed. 1087; Downes v. Bidwell, 182 U.S. 244, 21 Sup.Ct. 770, 45 L.Ed. 1088."

[Lawrence v. Wardell, Collector. 273 F. 405 (1921). Ninth Circuit Court of Appeals]

The “property” of the national government subject to income taxation is the OFFICES it creates and owns. That office is legislatively created in 5 U.S.C. §2105. The creator of a thing is always the ABSOLUTE OWNER.[1] The income tax therefore functions as a user fee for the use of that federal property. Uncle is in the property rental business! All franchises are implemented with loans of government property with legal strings or conditions attached.

FRANCHISE. A special privilege conferred by government on individual or corporation, and which does not belong to citizens of country generally of common right. Elliott v. City of Eugene, 135 Or. 108, 294 P. 358, 360. In England it is defined to be a royal privilege in the hands of a subject.

A "franchise," as used by Blackstone in defining quo warranto, (3 Com. 262 [4th Am. Ed.] 322), had reference to a royal privilege or branch of the king's prerogative subsisting in the hands of the subject, and must arise from the king's grant, or be held by prescription, but today we understand a franchise to be some special privilege conferred by government on an individual, natural or artificial, which is not enjoyed by its citizens in general. State v. Fernandez, 106 Fla. 779, 143 So. 638, 639, 86 A.L.R. 240.

In this country a franchise is a privilege or immunity of a public nature, which cannot be legally exercised without legislative grant. To be a corporation is a franchise. The various powers conferred on corporations are franchises. The execution of a policy of insurance by an insurance company [e.g. Social Insurance/Socialist Security], and the issuing a bank note by an incorporated bank [such as a Federal Reserve NOTE], are franchises. People v. Utica Ins. Co., 15 Johns. (N.Y.) 387, 8 Am.Dec. 243. But it does not embrace the property acquired by the exercise of the franchise. Bridgeport v. New York & N.H. R. Co., 36 Conn. 255, 4 Am.Rep. 63. Nor involve interest in land acquired by grantee. Whitbeck v. Funk, 140 Or. 70, 12 P.2d. 1019, 1020. In a popular sense, the political rights of subjects and citizens are franchises, such as the right of suffrage. etc. Pierce v. Emery, 32 N.H. 484; State v. Black Diamond Co., 97 Ohio.St. 24, 119 N.E. 195, 199, L.R.A.1918E, 352.

Elective Franchise. The right of suffrage: the right or privilege of voting in public elections.

Exclusive Franchise. See Exclusive Privilege or Franchise.

General and Special. The charter of a corporation is its "general" franchise, while a "special" franchise consists in any rights granted by the public to use property for a public use but-with private profit. Lord v. Equitable Life Assur. Soc., 194 N.Y. 212, 87 N.E. 443, 22 L.R.A. (N.S.) 420.

Personal Franchise. A franchise of corporate existence, or one which authorizes the formation and existence of a corporation, is sometimes called a "personal" franchise. as distinguished from a "property" franchise, which authorizes a corporation so formed to apply its property to some particular enterprise or exercise some special privilege in its employment, as, for example, to construct and operate a railroad. See Sandham v. Nye, 9 Misc.Rep. 541, 30 N.Y.S. 552.

Secondary Franchises. The franchise of corporate existence being sometimes called the "primary" franchise of a corporation, its "secondary" franchises are the special and peculiar rights, privileges, or grants which it may, receive under its charter or from a municipal corporation, such as the right to use the public streets, exact tolls, collect fares, etc. State v. Topeka Water Co., 61 Kan. 547, 60 P. 337; Virginia Canon Toll Road Co. v. People, 22 Colo. 429, 45 P. 398 37 L.R.A. 711. The franchises of a corporation are divisible into (1) corporate or general franchises; and (2) "special or secondary franchises. The former is the franchise to exist as a corporation, while the latter are certain rights and privileges conferred upon existing corporations. Gulf Refining Co. v. Cleveland Trust Co., 166 Miss. 759, 108 So. 158, 160.

Special Franchisee. See Secondary Franchises, supra.

[Black’s Law Dictionary, Fourth Edition, pp. 786-787]

All franchises create or recognize an “office”. In the case of the Internal Revenue Code, that office is called “person”, "citizen", "resident", or “taxpayer”.

privilege \ˈpriv-lij, ˈpri-və-\ noun

[Middle English, from Anglo-French, from Latin privilegium law for or against a private person, from privus private + leg-, lex law] 12th century: a right or immunity granted as a peculiar benefit, advantage, or favor: prerogative especially: such a right or immunity attached specifically to a position or an office

[Mish, F. C. (2003). Preface. Merriam-Websters collegiate dictionary. (Eleventh ed.). Springfield, MA: Merriam-Webster, Inc.]

A “public officer” is merely a fiction in charge of THE PROPERTY of the grantor of the franchise:

“Public office. The right, authority, and duty created and conferred by law, by which for a given period, either fixed by law or enduring at the pleasure of the creating power, an individual is invested with some portion of the sovereign functions of government for the benefit of the public. Walker v. Rich, 79 Cal.App. 139, 249 P. 56, 58. An agency for the state, the duties of which involve in their performance the exercise of some portion of the sovereign power, either great or small. Yaselli v. Goff, C.C.A., 12 F.2d. 396, 403, 56 A.L.R. 1239; Lacey v. State, 13 Ala.App. 212, 68 So. 706, 710; Curtin v. State, 61 Cal.App. 377, 214 P. 1030, 1035; Shelmadine v. City of Elkhart, 75 Ind.App. 493, 129 N.E. 878. State ex rel. Colorado River Commission v. Frohmiller, 46 Ariz. 413, 52 P.2d. 483, 486. Where, by virtue of law, a person is clothed, not as an incidental or transient authority, but for such time as de- notes duration and continuance, with Independent power to control the property of the public, or with public functions to be exercised in the supposed interest of the people, the service to be compensated by a stated yearly salary, and the occupant having a designation or title, the position so created is a public office. State v. Brennan, 49 Ohio.St. 33, 29 N.E. 593.

[Black’s Law Dictionary, Fourth Edition, p. 1235]

The I.R.C. Subtitles A and C therefore constitute the terms of a grant or loan of the “public office” (government property) to an otherwise private human:

“In a legal or narrower sense, the term "franchise" is more often used to designate a right or privilege conferred by law, [2] and the view taken in a number of cases is that to be a franchise, the right possessed must be such as cannot be exercised without the express permission of the sovereign power [3] –that is, a privilege or immunity of a public nature which cannot be legally exercised without legislative grant. [4] It is a privilege conferred by government on an individual or a corporation to do that "which does not belong to the citizens of the country generally by common right." [5] For example, a right to lay rail or pipes, or to string wires or poles along a public street, is not an ordinary use which everyone may make of the streets, but is a special privilege, or franchise, to be granted for the accomplishment of public objects [6] which, except for the grant, would be a trespass. [7] In this connection, the term "franchise" has sometimes been construed as meaning a grant of a right to use public property, or at least the property over which the granting authority has control. [8] ”

[American Jurisprudence 2d, Franchises, §1: Definitions (1999)]

Anyone in receipt, custody, or control of government property MUST be a public officer under the control of the person who lent it to them. It is a crime to use government property for PERSONAL gain.

The fact that the government continues to be the ABSOLUTE OWNER of the thing being loaned even after you receive it and possess it means they can take it back ANY TIME THEY WANT without your consent or permission or punish you for the misuse of the property. Below are the people subject to such punishment, ALL of whom are either officers of a federal corporation or in partnership with the government:

- Definition of “person” for the purposes of “assessable penalties” within the Internal Revenue Code means an officer or employee of a corporation or partnership within the federal United States:

TITLE 26 > Subtitle F > CHAPTER 68 > Subchapter B > PART I > Sec. 6671.

Sec. 6671. - Rules for application of assessable penalties

(b) Person definedThe term ''person'', as used in this subchapter, includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs

- Definition of “person” for the purposes of “miscellaneous forfeiture and penalty provisions” of the Internal Revenue Code means an officer or employer of a corporation or partnership within the federal United States:

TITLE 26 > Subtitle F > CHAPTER 75 > Subchapter D > Sec. 7343.

Sec. 7343. - Definition of term ''person''The term ''person'' as used in this chapter [Chapter 75] includes an officer or employee of a corporation, or a member or employee of a partnership, who as such officer, employee, or member is under a duty to perform the act in respect of which the violation occurs

Note that the government cannot regulate or tax contracts where all parties are PRIVATE. The ability to regulate or tax PRIVATE property is repugnant to the Constitution. Therefore the only type of “partnership” they can be talking about in the above definitions are partnerships between an otherwise PRIVATE party and the government.

Constitutional states of the Union are not “Territory or other Property” of the United States.

Corpus Juris Secundum Legal Encyclopedia

"§1. Definitions, Nature, and Distinctions

"The word 'territory,' when used to designate a political organization has a distinctive, fixed, and legal meaning under the political institutions of the United States, and does not necessarily include all the territorial possessions of the United States, but may include only the portions thereof which are organized and exercise governmental functions under act of congress."

"While the term 'territory' is often loosely used, and has even been construed to include municipal subdivisions of a territory, and 'territories of the' United States is sometimes used to refer to the entire domain over which the United States exercises dominion, the word 'territory,' when used to designate a political organization, has a distinctive, fixed, and legal meaning under the political institutions of the United States, and the term 'territory' or 'territories' does not necessarily include only a portion or the portions thereof which are organized and exercise government functions under acts of congress. The term 'territories' has been defined to be political subdivisions of the outlying dominion of the United States, and in this sense the term 'territory' is not a description of a definite area of land but of a political unit governing and being governed as such. The question whether a particular subdivision or entity is a territory is not determined by the particular form of government with which it is, more or less temporarily, invested.

"Territories' or 'territory' as including 'state' or 'states." While the term 'territories of the' United States may, under certain circumstances, include the states of the Union, as used in the federal Constitution and in ordinary acts of congress "territory" does not include a foreign state.

"As used in this title, the term 'territories' generally refers to the political subdivisions created by congress, and not within the boundaries of any of the several states."

[86 Corpus Juris Secundum (C.J.S.), Territories, §1 (2003)]

Therefore, federal income taxes within Constitutional states are limited to federal enclaves within the states of the Union. They do not apply within areas subject to the exclusive jurisdiction of the Constitutional State:

California Revenue and Taxation Code - RTC

DIVISION 1. PROPERTY TAXATION [50 - 5911]( Division 1 enacted by Stats. 1939, Ch. 154. )

PART 1. GENERAL PROVISIONS [101 - 198.1]( Part 1 enacted by Stats. 1939, Ch. 154. )

CHAPTER 1. Construction [101 - 136] ( Chapter 1 enacted by Stats. 1939, Ch. 154. )RTC 130 (f) "In this state" means within the exterior limit of the State of California, and includes all territory within these limits owned by, or ceded to, the United States of America.

California Revenue and Taxation Code – RTC

DIVISION 2. OTHER TAXES [6001 - 60709]( Heading of Division 2 amended by Stats. 1968, Ch. 279. ) PART 1. SALES AND USE TAXES [6001 - 7176]( Part 1 added by Stats. 1941, Ch. 36. )

CHAPTER 1. General Provisions and Definitions [6001 - 6024]( Chapter 1 added by Stats. 1941, Ch. 36. )RTC 6017.“In this State” or “in the State” means within the exterior limits of the State of California and includes all territory within these limits owned by or ceded to the United States of America.

California Revenue and Taxation Code - RTC

DIVISION 2. OTHER TAXES [6001 - 60709] ( Heading of Division 2 amended by Stats. 1968, Ch. 279. )

PART 3. USE FUEL TAX [8601 - 9355]( Part 3 added by Stats. 1941, Ch. 38. )

CHAPTER 1. General Provisions and Definitions [8601 - 8621] Chapter 1 added by Stats. 1941, Ch. 388609. “In this State” or “in the State” means within the exterior limits of the State of California and includes all territory within these limits owned by or ceded to the United States of America.

California Revenue and Taxation Code – RTC

DIVISION 2. OTHER TAXES [6001 - 60709]( Heading of Division 2 amended by Stats. 1968, Ch. 279. )

PART 10. PERSONAL INCOME TAX [17001 - 18181]( Part 10 added by Stats. 1943, Ch. 659. )

CHAPTER 1. General Provisions and Definition [17001 - 17039.2]17018.“State” includes the District of Columbia, and the possessions of the United States.

For an explanation why excise taxable public offices do not lawfully exist in constitutional statues outside of federal enclaves and why the Constitution does not authorize Congress to abuse grants or loans of government property to create NEW public offices in the constitutional states that are subject to taxation, see:

| Challenge to Income Tax Enforcement Authority Within Constitutional States of the Union, Form #05.052 https://sedm.org/Forms/05-Memlaw/ChallengeToIRSEnforcementAuth.pdf |

Income taxation is based on domicile. See District of Columbia v. Murphy, 314 U.S. 441 (1941). As such, anyone domiciled OUTSIDE the exclusive jurisdiction of the national government is a “nonresident” in respect to the income tax. They cannot have a “civil status” such as “person” or “taxpayer” in relation to the civil statutory laws regulating these areas WITHOUT one or more of the following circumstances:

- A physical presence in that place. The status would be under the COMMON law. Common law is based on physical location of people on land rather than their statutory status.

- CONSENSUALLY doing business in that place. The status would be under the common law. See the Foreign Sovereign Immunities Act, 28 U.S.C. Chapter 97 and International Shoe Co. v. Washington, 326 U.S. 310 (1945).

- A domicile in that place. This would be a status under the civil statutes of that place. See Federal Rule of Civil Procedure 17(a).

- CONSENSUALLY representing an artificial entity (a legal fiction) that has a domicile in that place. This would be a status under the civil statutes of that place. See Federal Rule of Civil Procedure 17(b).

- Consenting to a civil status under the laws of that place. Anything done consensually cannot form the basis for an injury in a court of law. Such consent is usually manifested by filling out a government form identifying yourself with a specific statutory status, such as a W-4, 1040, driver license application, etc. This is covered in:

Avoiding Traps in Government Forms Course, Form #12.023

https://sedm.org/Forms/FormIndex.htm

Those who do not fit any of the above 4 classifications are statutory “non-resident non-persons” and cannot be subject to federal income taxation. More on “civil status” can be found at:

|

Your Exclusive Right to Declare or Establish Your Civil Status, Form #13.008 https://sedm.org/Forms/FormIndex.htm |

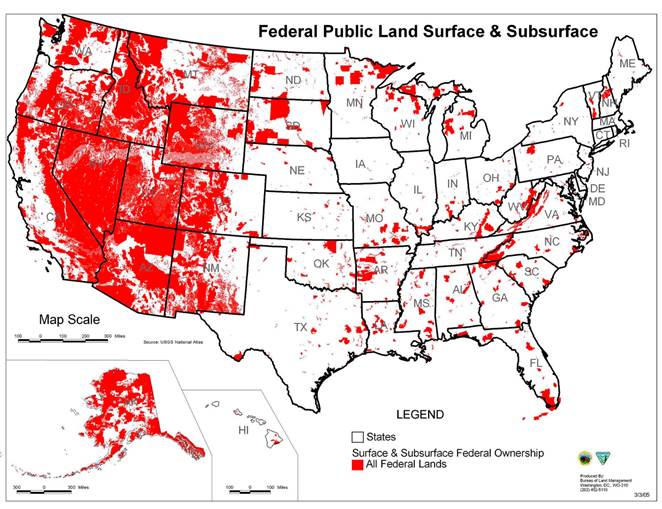

Below is a geographical map showing all of the areas within the COUNTRY “United States*” that are subject to the income tax:

Figure 3: Federal areas and enclaves subject to the income tax

An entire memorandum on the subject of this section can be found at:

|

Why the Federal Income Tax is a Privilege Tax Upon Government Property, Form #04.404 https://sedm.org/Forms/FormIndex.htm |

An abbreviated version of the above is provided below in presentation format for use in front of juries. It is mentioned in our 1040NR Attachment, Form #09.077 for those filing nonresident alien returns:

| Property View of Income Taxation Course, Form #12.046 https://sedm.org/LibertyU/PropertyViewOfIncomeTax.pdf |

FOOTNOTES:

[1] See Hierarchy of Sovereignty: The Power to Create is the Power to Tax, Family Guardian Fellowship; https://famguardian.org/Subjects/Taxes/Remedies/PowerToCreate.htm.

[2] People ex rel. Fitz Henry v. Union Gas & E. Co. 254 Ill. 395, 98 N.E. 768; State ex rel. Bradford v. Western Irrigating Canal Co. 40 Kan 96, 19 P. 349; Milhau v. Sharp, 27 N.Y. 611; State ex rel. Williamson v. Garrison (Okla), 348 P.2d. 859; Ex parte Polite, 97 Tex Crim 320, 260 S.W. 1048.

The term "franchise" is generic, covering all the rights granted by the state. Atlantic & G. R. Co. v. Georgia, 98 U.S. 359, 25 L.Ed. 185.

A franchise is a contract with a sovereign authority by which the grantee is licensed to conduct a business of a quasi-governmental nature within a particular area. West Coast Disposal Service, Inc. v. Smith (Fla App), 143 So.2d. 352.

[3] The term "franchise" is generic, covering all the rights granted by the state. Atlantic & G. R. Co. v. Georgia, 98 U.S. 359, 25 L.Ed. 185.

A franchise is a contract with a sovereign authority by which the grantee is licensed to conduct a business of a quasi-governmental nature within a particular area. West Coast Disposal Service, Inc. v. Smith (Fla App), 143 So.2d. 352.

[4] State v. Real Estate Bank, 5 Ark. 595; Brooks v. State, 3 Boyce (Del) 1, 79 A. 790; Belleville v. Citizens’ Horse R. Co., 152 Ill. 171, 38 N.E. 584; State ex rel. Clapp v. Minnesota Thresher Mfg. Co. 40 Minn 213, 41 N.W. 1020.

[5] New Orleans Gaslight Co. v. Louisiana Light & H. P. & Mfg. Co., 115 U.S. 650, 29 L.Ed. 516, 6 S.Ct. 252; People’s Pass. R. Co. v. Memphis City R. Co., 10 Wall (US) 38, 19 L.Ed. 844; Bank of Augusta v. Earle, 13 Pet (U.S.) 519, 10 L.Ed. 274; Bank of California v. San Francisco, 142 Cal. 276, 75 P. 832; Higgins v. Downward, 8 Houst (Del) 227, 14 A. 720, 32 A. 133; State ex rel. Watkins v. Fernandez, 106 Fla. 779, 143 So. 638, 86 A.L.R. 240; Lasher v. People, 183 Ill. 226, 55 N.E. 663; Inland Waterways Co. v. Louisville, 227 Ky. 376, 13 S.W.2d. 283; Lawrence v. Morgan’s L. & T. R. & S. S. Co., 39 La.Ann. 427, 2 So. 69; Johnson v. Consolidated Gas E. L. & P. Co., 187 Md. 454, 50 A.2d. 918, 170 A.L.R. 709; Stoughton v. Baker, 4 Mass 522; Poplar Bluff v. Poplar Bluff Loan & Bldg. Asso., (Mo App) 369 S.W.2d. 764; Madden v. Queens County Jockey Club, 296 N.Y. 249, 72 N.E.2d. 697, 1 A.L.R.2d. 1160, cert den 332 U.S. 761, 92 L.Ed. 346, 68 S.Ct. 63; Shaw v. Asheville, 269 N.C. 90, 152 S.E.2d. 139; Victory Cab Co. v. Charlotte, 234 N.C. 572, 68 S.E.2d. 433; Henry v. Bartlesville Gas & Oil Co., 33 Okla 473, 126 P. 725; Elliott v. Eugene, 135 Or. 108, 294 P. 358; State ex rel. Daniel v. Broad River Power Co. 157 S.C. 1, 153 S.E. 537; State v. Scougal, 3 S.D. 55, 51 N.W. 858; Utah Light & Traction Co. v. Public Serv. Com., 101 Utah 99, 118 P.2d. 683.

A franchise represents the right and privilege of doing that which does not belong to citizens generally, irrespective of whether net profit accruing from the exercise of the right and privilege is retained by the franchise holder or is passed on to a state school or to political subdivisions of the state. State ex rel. Williamson v. Garrison (Okla), 348 P.2d. 859.

Where all persons, including corporations, are prohibited from transacting a banking business unless authorized by law, the claim of a banking corporation to exercise the right to do a banking business is a claim to a franchise. The right of banking under such a restraining act is a privilege or immunity by grant of the legislature, and the exercise of the right is the assertion of a grant from the legislature to exercise that privilege, and consequently it is the usurpation of a franchise unless it can be shown that the privilege has been granted by the legislature. People ex rel. Atty. Gen. v. Utica Ins. Co., 15 Johns (NY) 358.

[6] New Orleans Gaslight Co. v. Louisiana Light & H. P. & Mfg. Co., 115 U.S. 650, 29 L.Ed. 516, 6 S.Ct. 252; People’s Pass. R. Co. v. Memphis City R. Co., 10 Wall (US) 38, 19 L.Ed. 844; Bank of Augusta v. Earle, 13 Pet (U.S.) 519, 10 L.Ed. 274; Bank of California v. San Francisco, 142 Cal. 276, 75 P. 832; Higgins v. Downward, 8 Houst (Del) 227, 14 A. 720, 32 A. 133; State ex rel. Watkins v. Fernandez, 106 Fla. 779, 143 So. 638, 86 A.L.R. 240; Lasher v. People, 183 Ill. 226, 55 N.E. 663; Inland Waterways Co. v. Louisville, 227 Ky. 376, 13 S.W.2d. 283; Lawrence v. Morgan’s L. & T. R. & S. S. Co., 39 La.Ann. 427, 2 So. 69; Johnson v. Consolidated Gas E. L. & P. Co., 187 Md. 454, 50 A.2d. 918, 170 A.L.R. 709; Stoughton v. Baker, 4 Mass 522; Poplar Bluff v. Poplar Bluff Loan & Bldg. Asso. (Mo App) 369 S.W.2d. 764; Madden v. Queens County Jockey Club, 296 N.Y. 249, 72 N.E.2d. 697, 1 A.L.R.2d. 1160, cert den 332 U.S. 761, 92 L.Ed. 346, 68 S.Ct. 63; Shaw v. Asheville, 269 N.C. 90, 152 S.E.2d. 139; Victory Cab Co. v. Charlotte, 234 N.C. 572, 68 S.E.2d. 433; Henry v. Bartlesville Gas & Oil Co., 33 Okla 473, 126 P. 725; Elliott v. Eugene, 135 Or. 108, 294 P. 358; State ex rel. Daniel v. Broad River Power Co. 157 S.C. 1, 153 S.E. 537; State v. Scougal, 3 S.D. 55, 51 N.W. 858; Utah Light & Traction Co. v. Public Serv. Com., 101 Utah 99, 118 P.2d. 683.

A franchise represents the right and privilege of doing that which does not belong to citizens generally, irrespective of whether net profit accruing from the exercise of the right and privilege is retained by the franchise holder or is passed on to a state school or to political subdivisions of the state. State ex rel. Williamson v. Garrison (Okla), 348 P.2d. 859.

Where all persons, including corporations, are prohibited from transacting a banking business unless authorized by law, the claim of a banking corporation to exercise the right to do a banking business is a claim to a franchise. The right of banking under such a restraining act is a privilege or immunity by grant of the legislature, and the exercise of the right is the assertion of a grant from the legislature to exercise that privilege, and consequently it is the usurpation of a franchise unless it can be shown that the privilege has been granted by the legislature. People ex rel. Atty. Gen. v. Utica Ins. Co., 15 Johns (NY) 358.

[7] People ex rel. Foley v. Stapleton, 98 Colo. 354, 56 P.2d. 931; People ex rel. Central Hudson Gas & E. Co. v. State Tax Com. 247 N.Y. 281, 160 N.E. 371, 57 A.L.R. 374; People v. State Tax Comrs. 174 N.Y. 417, 67 N.E. 69, affd 199 U.S. 1, 50 L.Ed. 65, 25 S.Ct. 705.

[8] Young v. Morehead, 314 Ky. 4, 233 S.W.2d. 978, holding that a contract to sell and deliver gas to a city into its distribution system at its corporate limits was not a franchise within the meaning of a constitutional provision requiring municipalities to advertise the sale of franchises and sell them to the highest bidder.

A contract between a county and a private corporation to construct a water transmission line to supply water to a county park, and giving the corporation the power to distribute water on its own lands, does not constitute a franchise. Brandon v. County of Pinellas (Fla App), 141 So.2d. 278.

1.2. Main Technique of Corruption: Introduce Franchises to replace UNALIENABLE PRIVATE Rights with REVOCABLE PUBLIC Statutory PRIVILEGES

“The rich ruleth over the poor, and the borrower [is] servant to the lender.”

[Prov. 22:7, Bible, NKJV]

The secret to how scoundrels corrupt our republic based on inalienable rights and replace it with a democracy based on revocable statutory privileges is to offer to loan you government property with conditions or legal strings attached. That process is called a "franchise". The Bible and the U.S. Supreme Court both describe EXACTLY, from a legal perspective, WHEN AND HOW you personally facilitate this inversion of the de jure hierarchy in the previous section to make public servants into masters and make you the sovereign into a government employee or officer. It is done with loans of government property that have legal strings attached. This loan is what we call “government franchises” (Form #05.030) on our website. The word “privilege” in fact is synonymous with loans of absolutely owned GOVERNMENT property and the legal strings attached to the loan.

“The rich rules over the poor,

And the borrower is servant to the lender.”

[Prov. 22:7, Bible, NKJV]“The State in such cases exercises no greater right than an individual may exercise over the use of his own property when leased or loaned to others. The conditions upon which the privilege shall be enjoyed being stated or implied in the legislation authorizing its grant, no right is, of course, impaired by their enforcement. The recipient of the privilege, in effect, stipulates to comply with the conditions. It matters not how limited the privilege conferred, its acceptance implies an assent to the regulation of its use and the compensation for it.”

[Munn v. Illinois, 94 U.S. 113 (1876) ]_______________________________________________________________________________________

Curses of Disobedience [to God’s Laws]

“The alien [Washington, D.C. is legislatively “alien” in relation to states of the Union] who is among you shall rise higher and higher above you, and you shall come down lower and lower [malicious destruction of EQUAL PROTECTION and EQUAL TREATMENT by abusing FRANCHISES]. He shall lend to you [Federal Reserve counterfeiting franchise], but you shall not lend to him; he shall be the head, and you shall be the tail.

“Moreover all these curses shall come upon you and pursue and overtake you, until you are destroyed, because you did not obey the voice of the Lord your God, to keep His commandments and His statutes which He commanded you. And they shall be upon you for a sign and a wonder, and on your descendants forever.

“Because you did not serve [ONLY] the Lord your God with joy and gladness of heart, for the abundance of everything, therefore you shall serve your [covetous thieving lawyer] enemies, whom the Lord will send against you, in hunger, in thirst, in nakedness, and in need of everything; and He will put a yoke of iron [franchise codes] on your neck until He has destroyed you. The Lord will bring a nation against you from afar [the District of CRIMINALS], from the end of the earth, as swift as the eagle flies [the American Eagle], a nation whose language [LEGALESE] you will not understand, a nation of fierce [coercive and fascist] countenance, which does not respect the elderly [assassinates them by denying them healthcare through bureaucratic delays on an Obamacare waiting list] nor show favor to the young [destroying their ability to learn in the public FOOL system]. And they shall eat the increase of your livestock and the produce of your land [with “trade or business” franchise taxes], until you [and all your property] are destroyed [or STOLEN/CONFISCATED]; they shall not leave you grain or new wine or oil, or the increase of your cattle or the offspring of your flocks, until they have destroyed you.

[Deut. 28:43-51, Bible, NKJV]

The problem with all such loans is that the covetous de facto (Form #05.043) government offering them can theoretically attach ANY condition they want to the loan. If the property is something that is life -threatening to do without, then they can destroy ALL of your constitutional rights and leave you with no judicial or legal remedy whatsoever for the loss of your fundamental or natural PRIVATE rights and otherwise PRIVATE property! This, in fact, is EXACTLY what Pharaoh did to the Israelites during the famine in Egypt, described in Genesis 47.

“But when Congress creates a statutory right [a “privilege” or “public right” in this case, such as a “trade or business”], it clearly has the discretion, in defining that right, to create presumptions, or assign burdens of proof, or prescribe remedies; it may also provide that persons seeking to vindicate that right must do so before particularized tribunals created to perform the specialized adjudicative tasks related to that right. FN35 Such provisions do, in a sense, affect the exercise of judicial power, but they are also incidental to Congress' power to define the right that it has created. No comparable justification exists, however, when the right being adjudicated is not of congressional creation. In such a situation, substantial inroads into functions that have traditionally been performed by the Judiciary cannot be characterized merely as incidental extensions of Congress' power to define rights that it has created. Rather, such inroads suggest unwarranted encroachments upon the judicial power of the United States, which our Constitution reserves for Art. III courts.”

[Northern Pipeline Const. Co. v. Marathon Pipe Line Co., 458 U.S. 50, 102 S.Ct. 2858 (1983)]_______________________________________________________________________________________

The Court developed, for its own governance in the cases confessedly within its jurisdiction, a series of rules under which it has avoided passing upon a large part of all the constitutional questions pressed upon it for decision. They are:

[. . .]

6. The Court will not pass upon the constitutionality of a statute at the instance of one who has availed himself of its benefits.FN7 Great Falls Mfg. Co. v. Attorney General, 124 U.S. 581, 8 S.Ct. 631, 31 L.Ed. 527; Wall v. Parrot Silver & Copper Co., 244 U.S. 407, 411, 412, 37 S.Ct. 609, 61 L.Ed. 1229; St. Louis Malleable Casting Co. v. Prendergast Construction Co., 260 U.S. 469, 43 S.Ct. 178, 67 L.Ed. 351.

FN7 Compare Electric Co. v. Dow, 166 U.S. 489, 17 S.Ct. 645, 41 L.Ed. 1088; Pierce v. Somerset Ry., 171 U.S. 641, 648, 19 S.Ct. 64, 43 L.Ed. 316; Leonard v. Vicksburg, etc., R. Co., 198 U.S. 416, 422, 25 S.Ct. 750, 49 L.Ed. 1108.

[Ashwander v. Tennessee Valley Authority, 297 U.S. 288, 56 S.Ct. 466 (1936)]_______________________________________________________________________________________

"The words "privileges" and "immunities," like the greater part of the legal phraseology of this country, have been carried over from the law of Great Britain, and recur constantly either as such or in equivalent expressions from the time of Magna Charta. For all practical purposes they are synonymous in meaning, and originally signified a peculiar right or private law conceded to particular persons or places whereby a certain individual or class of individuals was exempted from the rigor of the common law. Privilege or immunity is conferred upon any person when he is invested with a legal claim to the exercise of special or peculiar rights, authorizing him to enjoy some particular advantage or exemption. "

[The Privileges and Immunities of State Citizenship, Roger Howell, PhD, 1918, pp. 9-10;

SOURCE: http://famguardian.org/Publications/ThePrivAndImmOfStateCit/The_privileges_and_immunities_of_state_c.pdf]See Magill v. Browne, Fed.Cas. No. 8952, 16 Fed.Cas. 408; 6 Words and Phrases, 5583, 5584; A J. Lien, “Privileges and Immunities of Citizens of the United States,” in Columbia University Studies in History, Economics, and Public Law, vol. 54, p. 31.

Whether you know it or not, by accepting such physical or intangible property you are, in effect, manifesting your implied consent (assent) under the Uniform Commercial Code (U.C.C.) to enter into a contract with the government that offered it in the process. Lawyers commonly call this type of interaction a "quid pro quo" or "quasi-contract". That contract represents a constructive waiver of the sovereignty and sovereign immunity that comes from God Himself.

"The constitutional right [Form #10.015] against unjust taxation is given for the protection of private property [Form #12.046], but it may be waived by those affected who consent [Form #05.003] to such action to their property as would otherwise be invalid [or even ILLEGAL or CRIMINAL]."

[Wight v. Davidson, 181 U.S. 371 (1901)][EDITORIAL: A mistake on a tax form through legal ignorance is not CONSENT which creates an actual liability or CONSENSUAL conversion of property from PRIVATE to PUBLIC. The amounts paid are recoverable when paid under protest per 28 U.S.C. §1346 when claimed within the statute of limitations. See United States v. Williams, 514 U.S. 527 (1995)]

Because the government is BRIBING you to donate or GIVE PRIVATE/CONSTITUTIONAL rights in relation to them as consideration that would otherwise be INALIENABLE (Form #12.038), they are acting in a private, non-governmental capacity as a de facto government (Form #05.043) with no real official, judicial, or sovereign immunity. That franchise contract (Form #12.012) will, almost inevitably, end up being an adhesion contract that will be extremely one-sided and will not only NOT "benefit" you (the "Buyer") in the aggregate, but will work an extreme injury, inequality, and injustice (Form #05.050) that God actually forbids:

Lending to the Poor

If one of your brethren becomes poor [desperate], and falls into poverty among you, then you shall help him, like a stranger or a sojourner [transient foreigner and/or non-resident non-person, Form #05.020], that he may live with you. Take no usury or interest from him; but fear your God, that your brother may live with you. You shall not lend him your money for usury, nor lend him your food at a profit. I am the Lord your God, who brought you out of the land of Egypt, to give you the land of Canaan and to be your God.

The Law Concerning Slavery

And if one of your brethren who dwells by you becomes poor, and sells himself to you, you shall not compel him to serve as a slave. As a hired servant and a sojourner he shall be with you, and shall serve you until the Year of Jubilee. And then he shall depart from you—he and his children with him—and shall return to his own family. He shall return to the possession of his fathers. For they are My servants [Form #13.007] , whom I brought out of the land of Egypt; they shall not be sold as slaves. You shall not rule over him with rigor, but you shall fear your God.”

[Lev. 25:35-43, Bible, NKJV]

Adhesion Contract

Also found in: Dictionary, Thesaurus, Financial, Wikipedia.Related to Adhesion Contract: unilateral contract, exculpatory clause, personal contract, Unconscionable contractAdhesion Contract

A type of contract, a legally binding agreement between two parties to do a certain thing, in which one side has all the bargaining power and uses it to write the contract primarily to his or her advantage.

An example of an adhesion contract is a standardized contract form that offers goods or services to consumers on essentially a "take it or leave it" basis without giving consumers realistic opportunities to negotiate terms that would benefit their interests. When this occurs, the consumer cannot obtain the desired product or service unless he or she acquiesces to the form contract.

There is nothing unenforceable or even wrong about adhesion contracts. In fact, most businesses would never conclude their volume of transactions if it were necessary to negotiate all the terms of every Consumer Credit contract. Insurance contracts and residential leases are other kinds of adhesion contracts. This does not mean, however, that all adhesion contracts are valid. Many adhesion contracts are Unconscionable; they are so unfair to the weaker party that a court will refuse to enforce them. An example would be severe penalty provisions for failure to pay loan installments promptly that are physically hidden by small print located in the middle of an obscure paragraph of a lengthy loan agreement. In such a case a court can find that there is no meeting of the minds of the parties to the contract and that the weaker party has not accepted the terms of the contract.

West's Encyclopedia of American Law, edition 2. Copyright 2008 The Gale Group, Inc. All rights reserved.adhesion contract (contract of adhesion)

n. a contract (often a signed form) so imbalanced in favor of one party over the other that there is a strong implication it was not freely bargained. Example: a rich landlord dealing with a poor tenant who has no choice and must accept all terms of a lease, no matter how restrictive or burdensome, since the tenant cannot afford to move. An adhesion contract can give the little guy the opportunity to claim in court that the contract with the big shot is invalid. This doctrine should be used and applied more often, but the same big guy-little guy inequity may apply in the ability to afford a trial or find and pay a resourceful lawyer. (See: contract)

Copyright © 1981-2005 by Gerald N. Hill and Kathleen T. Hill. All Right reserved.[The Free Dictionary by Farlex: Adhesion Contract; Downloaded 10/9/2019; SOURCE: https://legal-dictionary.thefreedictionary.com/Adhesion+Contract]

The temptation of the offer of the government franchise as an adhesion contract is exhaustively described, personified, and even dramatized in the following:

- The Temptation of Jesus by Satan on the Mountain in Matthew 4:1-11.

- Devil's Advocate: What We are Up Against (OFFSITE LINK)

- Philosophical Implications of the Temptation of Jesus (OFFSITE LINK) -Stefan Molyneux

Social Security: Mark of the Beast, Form #11.407

Social Security: Mark of the Beast, Form #11.407

James Madison, whose notes were used to draft the Bill of Rights, predicted this perversion of the de jure Constitutional design, when he very insightfully said the following:

“With respect to the words general welfare, I have always regarded them as qualified by the detail of powers connected with them. To take them in a literal and unlimited sense would be a metamorphosis of the Constitution into a character which there is a host of proofs was not contemplated by its creator.”

“If Congress can employ money indefinitely to the general welfare, and are the sole and supreme judges of the general welfare, they may take the care of religion into their own hands; they may appoint teachers in every State, county and parish and pay them out of their public treasury; they may take into their own hands the education of children, establishing in like manner schools throughout the Union; they may assume the provision of the poor; they may undertake the regulation of all roads other than post-roads; in short, every thing, from the highest object of state legislation down to the most minute object of police, would be thrown under the power of Congress…. Were the power of Congress to be established in the latitude contended for, it would subvert the very foundations, and transmute the very nature of the limited Government established by the people of America.”

“If Congress can do whatever in their discretion can be done by money, and will promote the general welfare, the government is no longer a limited one possessing enumerated powers, but an indefinite one subject to particular exceptions.”

[James Madison. House of Representatives, February 7, 1792, On the Cod Fishery Bill, granting Bounties]

The term “general welfare” is synonymous with "benefit" in franchise language. "general welfare" as used above is, in fact, the basis for the entire modern welfare state that will eventually lead to a massive financial collapse and crisis worldwide.[NOTE 1] Anyone who therefore supports such a system is ultimately an anarchist intent on destroying our present dysfunctional government and thereby committing the crime of Treason:[NOTE 2]

|

Socialism: The New American Civil Religion, Form #05.016 https://sedm.org/Forms/05-MemLaw/SocialismCivilReligion.pdf |

The Bible also describes how to REVERSE this inversion, how to restore our constitutional rights, and how to put public servants back in their role as servants rather than masters. Note that accepting custody or “benefit” or loans of government property in effect behaves as an act of contracting, because it accomplishes the same effect, which is to create implied “obligations” in a legal sense:

"For the Lord your God will bless you just as He promised you; you shall lend to many nations, but you shall not borrow; you shall reign over many nations, but they shall not reign over you."

[Deut. 15:6, Bible, NKJV]______________________________________________________________________________________

"The Lord will open to you His good treasure, the heavens, to give the rain to your land in its season, and to bless all the work of your hand. You shall lend to many nations, but you shall not borrow."

[Deut. 28:12, Bible, NKJV]“You shall make no covenant [contract or franchise] with them [foreigners, pagans], nor with their [pagan government] gods [laws or judges]. They shall not dwell in your land [and you shall not dwell in theirs by becoming a “resident” or domiciliary in the process of contracting with them], lest they make you sin against Me [God]. For if you serve their [government] gods [under contract or agreement or franchise], it will surely be a snare to you.”

[Exodus 23:32-33, Bible, NKJV]_______________________________________________________________________________________

"I [God] brought you up from Egypt [slavery] and brought you to the land of which I swore to your fathers; and I said, 'I will never break My covenant with you. And you shall make no covenant [contract or franchise or agreement of ANY kind] with the inhabitants of this [corrupt pagan] land; you shall tear down their [man/government worshiping socialist] altars.' But you have not obeyed Me. Why have you done this?

"Therefore I also said, 'I will not drive them out before you; but they will become as thorns [terrorists and persecutors] in your side and their gods will be a snare [slavery!] to you.'"

So it was, when the Angel of the LORD spoke these words to all the children of Israel, that the people lifted up their voices and wept.

[Judges 2:1-4, Bible, NKJV]

Following the above commandments requires not signing up for and quitting any and all government benefits and services you may have consensually signed up for or retained eligibility for. All such applications and/or eligibility is called “special law” in the legal field.

“special law. One relating to particular persons or things; one made for individual cases or for particular places or districts; one operating upon a selected class, rather than upon the public generally. A private law. A law is "special" when it is different from others of the same general kind or designed for a particular purpose, or limited in range or confined to a prescribed field of action or operation. A "special law" relates to either particular persons, places, or things or to persons, places, or things which, though not particularized, are separated by any method of selection from the whole class to which the law might, but not such legislation, be applied. Utah Farm Bureau Ins. Co. v. Utah Ins. Guaranty Ass'n, Utah, 564 P.2d. 751, 754. A special law applies only to an individual or a number of individuals out of a single class similarly situated and affected, or to a special locality. Board of County Com'rs of Lemhi County v. Swensen, Idaho, 80 Idaho 198, 327 P.2d. 361, 362. See also Private bill; Private law. Compare General law; Public law.”

[Black’s Law Dictionary, Sixth Edition, pp. 1397-1398]

We also prove that all such “special law” is not “law” in a classical sense, but rather an act of contracting, because it does not apply equally to all. It is what the U.S. Supreme Court referred to as “class legislation” in Pollock v. Farmers Loan and Trust in which they declared the first income tax unconstitutional:

“The income tax law under consideration is marked by discriminating features which affect the whole law. It discriminates between those who receive an income of four thousand dollars and those who do not. It thus vitiates, in my judgment, by this arbitrary discrimination, the whole legislation. Hamilton says in one of his papers, (the Continentalist,) "the genius of liberty reprobates everything arbitrary or discretionary in taxation. It exacts that every man, by a definite and general rule, should know what proportion of his property the State demands; whatever liberty we may boast of in theory, it cannot exist in fact while [arbitrary] assessments continue." 1 Hamilton's Works, ed. 1885, 270. The legislation, in the discrimination it makes, is class legislation. Whenever a distinction is made in the burdens a law imposes or in the benefits it confers on any citizens by reason of their birth, or wealth, or religion, it is class legislation, and leads inevitably to oppression and abuses, and to general unrest and disturbance in society [e.g. wars, political conflict, violence, anarchy]. It was hoped and believed that the great amendments to the Constitution which followed the late civil war had rendered such legislation impossible for all future time. But the objectionable legislation reappears in the act under consideration. It is the same in essential character as that of the English income statute of 1691, which taxed Protestants at a certain rate, Catholics, as a class, at double the rate of Protestants, and Jews at another and separate rate. Under wise and constitutional legislation every citizen should contribute his proportion, however small the sum, to the support of the government, and it is no kindness to urge any of our citizens to escape from that obligation. If he contributes the smallest mite of his earnings to that purpose he will have a greater regard for the government and more self-respect 597*597 for himself feeling that though he is poor in fact, he is not a pauper of his government. And it is to be hoped that, whatever woes and embarrassments may betide our people, they may never lose their manliness and self-respect. Those qualities preserved, they will ultimately triumph over all reverses of fortune.”

[Pollock v. Farmers' Loan & Trust Co., 157 U.S. 429 (Supreme Court 1895)]

To realistically apply the above biblical prohibitions against contracting with any government so as to eliminate the reversal of roles and destroy the dulocracy, see:

|

Path to Freedom, Form #09.015 https://sedm.org/Forms/09-Procs/PathToFreedom.pdf |

Section 5 of the above document in particular deals with how to eliminate the dulocracy. Section 5.6 also discusses the above mechanisms.

The idea of a present-day dulocracy is entirely consistent with the theme of our website, which is the abuse of government franchises and privileges to destroy PRIVATE rights, STEAL private property, promote unhappiness, and inject malice and vitriol into the political process, as documented in:

|

Government Instituted Slavery Using Franchises, Form #05.030 FORMS PAGE: https://sedm.org/Forms/FormIndex.htm DIRECT LINK: https://sedm.org/Forms/05-MemLaw/Franchises.pdf |

The U.S. Supreme Court and the Bible both predicted these negative and unintended consequences of the abuse of government franchises, when they said:

“Here I close my opinion. I could not say less in view of questions of such gravity that they go down to the very foundations of the government. If the provisions of the Constitution can be set aside by an act of Congress, where is the course of usurpation to end?

The present assault upon capital [THEFT! and WEALTH TRANSFER by unconstitutional CONVERSION of PRIVATE property to PUBLIC property] is but the beginning. It will be but the stepping stone to others larger and more sweeping, until our political contest will become war of the poor against the rich; a war of growing intensity and bitterness.”

[Pollock v. Farmers’ Loan & Trust Co., 157 U.S. 429, 158 U.S. 601 (1895), hearing the case against the first income tax passed by Congress that included people in states of the Union. They declared that first income tax UNCONSTITUTIONAL, by the way]

_______________________________________________________________________________________

“Where do wars and fights come from among you? Do they not come from your desires for pleasure [unearned money or “benefits”, privileges, or franchises, from the government] that war in your members [and your democratic governments]? You lust [after other people's money] and do not have. You murder [the unborn to increase your standard of living] and covet [the unearned] and cannot obtain [except by empowering your government to STEAL for you!]. You fight and war [against the rich and the nontaxpayers to subsidize your idleness]. Yet you do not have because you do not ask [the Lord, but instead ask the deceitful government]. You ask and do not receive, because you ask amiss, that you may spend it on your pleasures. Adulterers and adulteresses! Do you not know that friendship [statutory “citizenship”] with the world [or the governments of the world] is enmity with God? Whoever therefore wants to be a friend [STATUTORY “citizen”, “resident”, “inhabitant”, “person” franchisee] of the world [or the governments of the world] makes himself an enemy of God.”

[James 4:4, Bible, NKJV]

The “foundations of the government” spoken of above are PRIVATE property, separation between public and private, and equality of treatment and opportunity, which collectively are called “legal justice”, as we point out on our opening page:

Our ministry accomplishes the above goals by emphasizing:

12. The pursuit of legal “justice” (Form #05.050), which means absolutely owned private property (Form #10.002), and equality of TREATMENT and OPPORTUNITY (Form #05.033) under REAL LAW (Form #05.048). The following would be INJUSTICE, not JUSTICE:

12.1 Outlawing or refusing to recognize or enforce absolutely owned private property (Form #12.025).

12.2 Imposing equality of OUTCOME by law, such as by abusing taxing powers to redistribute wealth. See Form #11.302.

12.3 Any attempt by government to use judicial process or administrative enforcement to enforce any civil obligation derived from any source OTHER than express written consent or to an injury against the equal rights of others demonstrated with court-admissible evidence. See Form #09.073 and Form #12.040.

12.4 Offering, implementing, or enforcing any civil franchise (Form #05.030). This enforces superior powers on the part of the government as a form of inequality and results in religious idolatry. This includes making justice into a civil public privilege (Form #05.050, Section 13) or turning CONSTITUTIONAL PRIVATE citizens into STATUTORY PUBLIC citizens engaged in a public office and a franchise (Form #05.006).

Not only would the above be INJUSTICE, it would outlaw HAPPINESS, because the right to absolutely own private property is equated with “the pursuit of happiness” in the Declaration of Independence, according to the U.S. Supreme Court. See Form #05.050 for the definition of “justice”. Click here to view a video on why all franchises produce selfishness, unhappiness, inequality, and ingratitude.

[SEDM Website Opening Page; SOURCE: http://sedm.org]

Too many public servants have assumed absolute authority over the people they are supposed to serve. This REVERSAL of roles and making the SERVANTS into the MASTERS was never the intent of the Founding Fathers who established the American governments as republics where the rights of the people are to be paramount and the sovereignty of the governments are limited by the rights of the people. Sovereignty in America is not based on the same premise as sovereignty in Europe. Sovereignty in Europe was based on the notion of the Divine Right of Kings where the king's sovereignty was absolute and the people were his subjects. Sovereignty in America is based on the notion that citizens are endowed by the Creator with unalienable rights and then lend their permission to the governments to carry out certain, limited responsibilities on their behalf. In a republican form of government, the government is never allowed to overstep its authority or trample on the rights of the citizen no matter how egalitarian the political arguments may be.

Jesus Himself also emphasized that public SERVANTS should never become RULERS or have superior authority to the people they are supposed to SERVE when He said the following.

“You know that the rulers of the Gentiles [unbelievers] lord it over them [govern from ABOVE as pagan idols] , and those who are great exercise authority over them [supernatural powers that are the object of idol worship]. Yet it shall not be so among you; but whoever desires to become great among you, let him be your servant [serve the sovereign people from BELOW rather than rule from above]. And whoever desires to be first among you, let him be your slave—just as the Son of Man did not come to be served, but to serve, and to give His life a ransom for many.”

[Matt. 20:25-28, Bible, NKJV]

Notice the word “ransom for many” in the above. This is an admission that Jesus acknowledges that cunning public servant lawyers have KIDNAPPED our legal identity from the protection of God’s law and that legal identity has been transported to a legislatively foreign jurisdiction, the District of Criminals. We exhaustively prove this with evidence in the following memorandum of law:

|

Government Identity Theft, Form #05.042 https://sedm.org/Forms/05-MemLaw/GovernmentIdentityTheft.pdf |

Jesus also states in Matt. 20:25-28 that it is the DUTY and obligation of every Christian to fight this corruption of our political system. The Holy Bible is our Delegation of Authority to do precisely this, in fact, and to restore God to His proper role as the ruler of ALL nations and ALL politicians and the only rightful Lawgiver of all human law. That delegation of authority is described in:

|

Delegation of Authority Order from God to Christians, Form #13.007 https://sedm.org/Forms/13-SelfFamilyChurchGovnce/DelOfAuthority.pdf |

___________________________

FOOTNOTES:

1. For details on the devastating political effects of the modern welfare state, see:

| Communism, Socialism, Collectivism Page, Section 10: Welfare State, Family Guardian Fellowship, https://famguardian.org/Subjects/Communism/Communism.htm#Welfare_State. |