Synopsis:

This VERY IMPORANT article describes the main method by which the tax laws are illegally imposed and enforced upon those who are not subject within states of the Union. The entire system is based on false reports which are forbidden by the Bible in Prov. 19:9, Deut. 19:16-21, Exodus 10:16, and Exodus, 23:1. The illegal and fraudulent enforcement of the tax laws will not and cannot stop until:

- The flow of these false reports are stopped.

- The government vigorously prosecutes those who submit false information returns just as doggedly as they prosecute those who submit false tax returns.

- IRS is held accountable for the accuracy AND completeness of its publications instead of denying responsibility for their accuracy in IRM 4.10.7.2.8.

- A detailed and complete treatment of what a "trade or business" is appears within all IRS publications.

- Courts quit covering up the nature of the I.R.C. Subtitle A as a franchise and excise tax upon public offices in the government. Right now, they are making cases unpublished that address this issue in order to plunder the public and protect wrongdoers.

Selective enforcement and omission by the IRS and the DOJ collectively in implementing the above reforms are the main reason the illegal enforcement continues.

Related articles:

- The "Trade or Business" Scam, Form #05.001 -describes basis for filing information returns. By SEDM

-

State Created Office of "Person" -how you surrendered sovereign immunity to become a "person", "subject", "citizen", or "resident" of the state

-

"Public" v. "Private" Employment: You Will Be ILLEGALLY Treated as a Public Officer if you Apply for or Receive Government Benefits-fascinating and true

-

Why Statutory

Civil Law is Law for Government and Not Private Persons, Form #05.037

(OFFSITE LINK)-By SEDM

Why Statutory

Civil Law is Law for Government and Not Private Persons, Form #05.037

(OFFSITE LINK)-By SEDM -

Government Instituted

Slavery Using Franchises, Form #05.030 (OFFSITE LINK)-describes

how franchises such as the "trade or business" franchise work generally.

By SEDM

Government Instituted

Slavery Using Franchises, Form #05.030 (OFFSITE LINK)-describes

how franchises such as the "trade or business" franchise work generally.

By SEDM -

Legal Deception, Propaganda, and Fraud, Form #05.014 (OFFSITE LINK)-describes how government and legal profession violate

the rules of statutory construction to enrich themselves, including

with the word "trade or business"

Legal Deception, Propaganda, and Fraud, Form #05.014 (OFFSITE LINK)-describes how government and legal profession violate

the rules of statutory construction to enrich themselves, including

with the word "trade or business" -

Policy

Document: Pete Hendrickson's "Trade or Business" Approach, Form #08.001

(OFFSITE LINK)-describes differences in approach between this website

and Pete Hendrickson's Lost Horizons

website. By SEDM

Policy

Document: Pete Hendrickson's "Trade or Business" Approach, Form #08.001

(OFFSITE LINK)-describes differences in approach between this website

and Pete Hendrickson's Lost Horizons

website. By SEDM -

A Treatise on the Law of Public Offices and Officers (OFFSITE LINK) -Floyd Mechem, 1890. Google Books. Excellent.

-

Treatise on the Law of Agency (OFFSITE LINK) - Floyd R. Mechem, 1889. Google Books. Excellent!

-

Information

Return FOIA: "Trade or Business", Form #03.023 (OFFSITE LINK)-use

this as a "reliance defence" to develop evidence that the government

KNOWS you are not engaged in a "trade or business' and is committing

a crime by not admitting it.. By SEDM

Information

Return FOIA: "Trade or Business", Form #03.023 (OFFSITE LINK)-use

this as a "reliance defence" to develop evidence that the government

KNOWS you are not engaged in a "trade or business' and is committing

a crime by not admitting it.. By SEDM -

Why Your

Government is a Thief or You Are a "public officer" for Income Tax Purposes,

Form 05.008 (OFFSITE LINK)-proves that nearly all "taxpayers" within

I.R.C. Subtitle A are "public officials" engaged in a "trade or business".

SEDM Forms page

Why Your

Government is a Thief or You Are a "public officer" for Income Tax Purposes,

Form 05.008 (OFFSITE LINK)-proves that nearly all "taxpayers" within

I.R.C. Subtitle A are "public officials" engaged in a "trade or business".

SEDM Forms page -

Pete Hendrickson about the meaning of "Income" (VERY IMPORTANT!)-the John Clifton Show, Google Video

Remedies:

-

Federal and State Tax Withholding Options for Private Employers

- describes options for lawfully exiting federal and state tax roles

Federal and State Tax Withholding Options for Private Employers

- describes options for lawfully exiting federal and state tax roles -

Demand for Verified Evidence of "Trade or Business" Activity: Information

Return Form #04.007 (OFFSITE LINK)-form to give to employers and

financial institutions who are illegally preparing W-2's, 1042-S', 1098's,

and 1099's. SEDM Forms

page

Demand for Verified Evidence of "Trade or Business" Activity: Information

Return Form #04.007 (OFFSITE LINK)-form to give to employers and

financial institutions who are illegally preparing W-2's, 1042-S', 1098's,

and 1099's. SEDM Forms

page -

Demand for Verified Evidence of "Trade or Business" Activity: Currency

Transaction Report (CTR), Form #04.008 (OFFSITE LINK)-form

to give to financial institutions who are illegally preparing CTR's.

SEDM Forms page

Demand for Verified Evidence of "Trade or Business" Activity: Currency

Transaction Report (CTR), Form #04.008 (OFFSITE LINK)-form

to give to financial institutions who are illegally preparing CTR's.

SEDM Forms page -

"trade or business" defined-Sovereignty Forms and Instructions: Cites by Topic

-

About IRS W-8BEN, Form #04.202 (OFFSITE LINK)-how to change your status to nonresident alien

-

Correcting Erroneous Information Returns, Form #04.001 (OFFSITE

LINK)-how to correct most information returns. Incorporates the

following four documents.

SEDM Forms page

Correcting Erroneous Information Returns, Form #04.001 (OFFSITE

LINK)-how to correct most information returns. Incorporates the

following four documents.

SEDM Forms page -

Corrected Information Return Attachment Letter, Form #04.002

(OFFSITE LINK)-attach this to corrected information returns you send

into the IRS. SEDM

Forms page

Corrected Information Return Attachment Letter, Form #04.002

(OFFSITE LINK)-attach this to corrected information returns you send

into the IRS. SEDM

Forms page -

Correcting Erroneous IRS Form 1042s, Form #04.003 (OFFSITE LINK)-how to remove the false presumption that income on a 1042 is connected with a "trade or business". SEDM Forms page

-

Correcting Erroneous IRS Form 1098s, Form #04.004 (OFFSITE LINK)-how to remove the false presumption that income on a 1098 is connected with a "trade or business". SEDM Forms page

-

Correcting Erroneous IRS Form 1099s, Form #04.005 (OFFSITE LINK)-how to remove the false presumption that income on a 1099 is connected with a "trade or business". SEDM Forms page

-

Correcting Erroneous IRS Form W-2s, Form #04.006 (OFFSITE LINK)-how to remove employment earnings from being connected with a "trade or business". SEDM Forms page

- Precious Metal Transaction Reporting, Form #04.106 (OFFSITE LINK)-legal requirements for the reporting of precious metal transactions

Related references:

-

26 U.S.C. §7434: Civil Damages for Fraudulent Filing of Information Returns

-

26 U.S.C. §7207: Fraudulent Returns, Statements, and Other Documents

-

18 U.S.C. §912: Falsely impersonating an officer [PUBLIC OFFICER] or employee of the United States

-

26 U.S.C. §6041: Information at source-Cornell. Shows that you must have "trade or business" earnings to have reportable income under the I.R.C.

-

26 C.F.R. §1.6041-1: Return of information as to payments of $600 or more-GPO website. Shows that information returns are only required in the case of "trade or business" earnings

-

26 C.F.R. §1.6049-5: Interest and original issue discount subject to reporting after December 31, 1982-reporting of interest connected to trade or business

"The taxpayer-- that's someone who works for the federal government but doesn't have to take the civil service examination."

[President Ronald W. Reagan]

As we said in the preceding section, the income tax described by Internal Revenue Code, Subtitle A is a franchise and excise tax upon “public offices” within the U.S. government, which the code defines as a “trade or business”. Before an income tax can lawfully be enforced or collected, the subject of the tax must be connected to the activity with court-admissible evidence. Information returns are the method by which the activity is connected to the subject of the tax under the authority of 26 U.S.C. §6041(a). When this connection is made, the person engaging in the excise taxable activity is called “effectively connected with the conduct of a trade or business within the United States”.

TITLE 26 > Subtitle F > CHAPTER 61 > Subchapter A > PART III > Subpart B > § 6041

§ 6041. Information at source(a) Payments of $600 or more

All persons engaged in a trade or business and making payment in the course of such trade or business to another person, of rent, salaries, wages, premiums, annuities, compensations, remunerations, emoluments, or other fixed or determinable gains, profits, and income (other than payments to which section 6042 (a)(1), 6044 (a)(1), 6047 (e), 6049 (a), or 6050N (a) applies, and other than payments with respect to which a statement is required under the authority of section 6042 (a)(2), 6044 (a)(2), or 6045), of $600 or more in any taxable year, or, in the case of such payments made by the United States, the officers or employees of the United States having information as to such payments and required to make returns in regard thereto by the regulations hereinafter provided for, shall render a true and accurate return to the Secretary, under such regulations and in such form and manner and to such extent as may be prescribed by the Secretary, setting forth the amount of such gains, profits, and income, and the name and address of the recipient of such payment.

The government cannot lawfully regulate private conduct. The ability to regulate private conduct is, in fact, “repugnant to the constitution” as held by the U.S. Supreme Court. The only thing the government can regulate is “public conduct” and the “public rights” and franchises that enforce or implement it. Consequently, the government must deceive private parties into submitting false reports connecting their private labor and private property to such a public use, public purpose, and public office in order that they can usurp jurisdiction over it and thereby tax and plunder it.

In a sense, the function of an information return therefore is to:“The power to "legislate generally upon" life, liberty, and property, as opposed to the "power to provide modes of redress" against offensive state action, was "repugnant" to the Constitution. Id., at 15. See also United States v. Reese, 92 U.S. 214, 218 (1876); United States v. Harris, 106 U.S. 629, 639 (1883) ; James v. Bowman, 190 U.S. 127, 139 (1903) . Although the specific holdings of these early cases might have been superseded or modified, see, e.g., Heart of Atlanta Motel, Inc. v. United States, 379 U.S. 241 (1964); United States v. Guest, 383 U.S. 745 (1966), their treatment of Congress' §5 power as corrective or preventive, not definitional, has not been questioned.”

[City of Boerne v. Florez, Archbishop of San Antonio, 521 U.S. 507 (1997) ]

- Provide evidence that the owner is consensually and lawfully engaged in the “trade or business” and public office franchise. These reports cannot lawfully be filed if this is not the case. 26 U.S.C. §7206 and 7207 make it a crime to file a false report.

- Donate formerly private property described on the report to a public use, a public purpose, and a public office with the consent of the owner without any immediate or monetary compensation in order to procure the “benefits” incident to participation in the franchise.

- Subject the property to excise taxation upon the “trade or business” activity.

- Subject the property to use and control by the government:

“Men are endowed by their Creator with certain unalienable rights,-'life, liberty, and the pursuit of happiness;' and to 'secure,' not grant or create, these rights, governments are instituted. That property [or income] which a man has honestly acquired he retains full control of, subject to these limitations: First, that he shall not use it to his neighbor's injury, and that does not mean that he must use it for his neighbor's benefit [e.g. SOCIAL SECURITY, Medicare, and every other public “benefit”]; second, that if he devotes it to a public use, he gives to the public a right to control that use; and third, that whenever the public needs require, the public may take it upon payment of due compensation.”

[Budd v. People of State of New York, 143 U.S. 517 (1892)]

On the other hand, if the information return:

- Was filed against an owner of the property described who is not lawfully engaged in a public office or a “trade or business” in the U.S. government. . .OR

- Was filed in a case where the owner of the private property did not consent to donate the property described to a public use and a public office by signing a contract or agreement authorizing such as an IRS Form W-4. . .OR

- Was filed mistakenly or fraudulently.

. . .then the following crimes have occurred:

1. A violation of the Fifth Amendment Takings Clause has occurred:

U.S. Constitution, Fifth Amendment

No person shall be held to answer for a capital, or otherwise infamous crime, unless on a presentment or indictment of a Grand Jury, except in cases arising in the land or naval forces, or in the Militia, when in actual service in time of War or public danger; nor shall any person be subject for the same offence to be twice put in jeopardy of life or limb; nor shall be compelled in any criminal case to be a witness against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.

2. A violation of due process has occurred. Any taking of property without the consent of the owner is a violation of due process of law.

3. The subject of the information return is being compelled to impersonate a public officer in criminal violation of 18 U.S.C. §912.

TITLE 18 > PART I > CHAPTER 43 > § 912

§ 912. Officer or employee of the United StatesWhoever falsely assumes or pretends to be an officer or employee acting under the authority of the United States or any department, agency or officer thereof, and acts as such, or in such pretended character demands or obtains any money, paper, document, or thing of value, shall be fined under this title or imprisoned not more than three years, or both.

4. An unlawful conversion of private property to public property has occurred in criminal violation of 18 U.S.C. §654. Only officers of the government called “withholding agents” appointed under the authority of 26 U.S.C. §7701(a)(16) and the I.R.C. can lawfully file these information returns or withhold upon the proceeds of the transaction. All withholding and reporting agents are public officers, not private parties, whether they receive direct compensation for acting in that capacity or not.

TITLE 18 > PART I > CHAPTER 31 > § 654

§ 654. Officer or employee of United States converting property of anotherWhoever, being an officer or employee of the United States or of any department or agency thereof, embezzles or wrongfully converts to his own use the money or property of another which comes into his possession or under his control in the execution of such office or employment, or under color or claim of authority as such officer or employee, shall be fined under this title or not more than the value of the money and property thus embezzled or converted, whichever is greater, or imprisoned not more than ten years, or both; but if the sum embezzled is $1,000 or less, he shall be fined under this title or imprisoned not more than one year, or both.

If you would like to learn more about how the above mechanisms work, see:

|

The “Trade or Business”

Scam, Section 2, Form #05.001 http://sedm.org/Forms/FormIndex.htm |

Nearly all private Americans are not in fact and in deed lawfully engaged in a “public office” and cannot therefore serve within such an office without committing the crime of impersonating a public officer. This is exhaustively proven in the following:

|

The “Trade or Business”

Scam, Section 11, Form #05.001 http://sedm.org/Forms/FormIndex.htm |

What makes someone a “private American” is, in fact, that they are not lawfully engaged in a public office or any other government franchise. All franchises, in fact, make those engaged into public officers of one kind or another and cause them to forfeit their status as a private person and give up all their constitutional rights in the process. See:

|

Government Instituted

Slavery Using Franchises, Form #05.030 http://sedm.org/Forms/FormIndex.htm |

IRS therefore mis-represents and mis-enforces the Internal Revenue Code by abusing their tax forms and their untrustworthy printed propaganda as a method:

- To unlawfully create public offices in the government in places they are forbidden to even exist pursuant to 4 U.S.C. §72.

- To “elect” the average American unlawfully into such an office.

- To cause those involuntarily serving in the office to unlawfully impersonate a public officer in criminal violation of 18 U.S.C. §912.

- To enforce the obligations of the office upon those who are not lawfully occupying said office.

- Of election fraud, whereby the contributions collected cause those who contribute them to bribe a public official to procure the office that they occupy with unlawfully collected monies, in criminal violation of 18 U.S.C. §210. IRS Document 6209 identifies all IRS Form W-2 contributions as “gifts” to the U.S. government, which is a polite way of describing what actually amounts to a bribe.

TITLE 18 > PART I > CHAPTER 11 > § 210

§ 210. Offer to procure appointive public officeWhoever pays or offers or promises any money [withheld unlawfully] or thing of value, to any person, firm, or corporation in consideration of the use or promise to use any influence to procure any appointive [public] office or place under the United States for any person, shall be fined under this title or imprisoned not more than one year, or both.

For instance, innocent Americans ignorant of the law are deceived into volunteering to unlawfully accept the obligations of a public office by filing an IRS Form W-4 “agreement” to withhold pursuant to 26 U.S.C. §3402(p), 26 C.F.R. §31.3401(a)-3(a), and 26 C.F.R. §31.3402(p)-1. To wit:

26 C.F.R. §31.3401(a)-3 Amounts deemed wages under voluntary withholding agreements.

(a) In general.

Notwithstanding the exceptions to the definition of wages specified in section 3401(a) and the regulations thereunder, the term “wages” includes the amounts described in paragraph (b)(1) of this section with respect to which there is a voluntary withholding agreement in effect under section 3402(p). References in this chapter to the definition of wages contained in section 3401(a) shall be deemed to refer also to this section (§31.3401(a)–3).

_________________________________________________________________________________________

26 C.F.R. § 31.3402(p)-1 Voluntary withholding agreements.

(a) In general.

An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding of income tax upon payments of amounts described in paragraph (b)(1) of §31.3401(a)–3, made after December 31, 1970. An agreement may be entered into under this section only with respect to amounts which are includible in the gross income of the employee under section 61, and must be applicable to all such amounts paid by the employer to the employee. The amount to be withheld pursuant to an agreement under section 3402(p) shall be determined under the rules contained in section 3402 and the regulations thereunder. See §31.3405(c)–1, Q&A–3 concerning agreements to have more than 20-percent Federal income tax withheld from eligible rollover distributions within the meaning of section 402.

Those who have not voluntarily signed and submitted the IRS Form W-4 contract/agreement and who are were not lawfully engaged in a “public office” within the U.S. government BEFORE they signed any tax form cannot truthfully or lawfully earn reportable “wages” as legally defined in 26 U.S.C. §3402. Therefore, even if the IRS sends a “lock-down” letter telling the private employer to withhold at a rate of “single with no exemptions”, he must withhold ONLY on the amount of “wages” earned, which is still zero. If a W-2 is filed against a person who does not voluntarily sign and submit the W-4 or who is not lawfully engaged in a public office:

- 1. The amount reported must be ZERO for everything on the form, and especially for “wages”.

- 2. If any amount reported is other than zero, then the payroll clerk submitting the W-2 is criminally liable for filing a false return under 26 U.S.C. §7206 , punishable as a felony for up to a $100,000 fine and three years in jail.

- 3. If you also warned the payroll clerk that they were doing it improperly in writing and have a proof you served them with it, their actions also become fraudulent and they are additionally liable under 26 U.S.C. §7207 , punishable as a felony for up to $10,000 and up to one year in jail.

The heart of the tax fraud and SCAM perpetrated on a massive scale by our government then is:

1. To publish IRS forms and publications which contain untrustworthy information that deceives the public into believing that they have a legal obligation to file false information returns against their neighbor.

"IRS Publications, issued by the National Office, explain the law in plain language for taxpayers and their advisors... While a good source of general information, publications should not be cited to sustain a position."

[Internal Revenue Manual, Section 4.10.7.2.8 (05-14-1999)]

2. To reinforce the deliberate deception and omissions in their publications with verbal advice that is equally damaging and untrustworthy:

p. 21: "As discussed in §2.3.3, the IRS is not bound by its statements or positions in unofficial pamphlets and publications."

p. 34: "6. IRS Pamphlets and Booklets. The IRS is not bound by statements or positions in its unofficial publications, such as handbooks and pamphlets."

p. 34: "7. Other Written and Oral Advice. Most taxpayers' requests for advice from the IRS are made orally. Unfortunately, the IRS is not bound by answers or positions stated by its employees orally, whether in person or by telephone. According to the procedural regulations, 'oral advice is advisory only and the Service is not bound to recognize it in the examination of the taxpayer's return.' 26 C.F.R. §601.201(k)(2). In rare cases, however, the IRS has been held to be equitably estopped to take a position different from that stated orally to, and justifiably relied on by, the taxpayer. The Omnibus Taxpayer Bill of Rights Act , enacted as part of the Technical and Miscellaneous Revenue Act of 1988 , gives taxpayers some comfort, however. It amended section 6404 to require the Service to abate any penalty or addition to tax that is attributable to advice furnished in writing by any IRS agent or employee acting within the scope of his official capacity. Section 6404 as amended protects the taxpayer only if the following conditions are satisfied: the written advice from the IRS was issued in response to a written request from the taxpayer; reliance on the advice was reasonable; and the error in the advice did not result from inaccurate or incomplete information having been furnished by the taxpayer. Thus, it will still be difficult to bind the IRS even to written statements made by its employees. As was true before, taxpayers may be penalized for following oral advice from the IRS."

[Tax Procedure and Tax Fraud, Patricia Morgan, 1999, ISBN 0-314-06586-5 , West Group]

3. To make it very difficult to describe yourself as either a “nontaxpayer” or a person not subject to the Internal Revenue Code on any IRS form. IRS puts the “exempt” option on their forms, but has no option for “not subject”. You can be “not subject” and a “nontaxpayer” without being “exempt” and if you want to properly and lawfully describe yourself that way, you have to either modify their form or create your own substitute. You cannot, in fact be an “exempt individual” as defined in 26 U.S.C. §7701(b)(5) without first being an “individual” and therefore subject to the I.R.C.. The following entity would be “not subject” but also not an “exempt individual” or “exempt”, and could include people as well as property:

TITLE 26 > Subtitle F > CHAPTER 79 > § 7701

§ 7701. Definitions(a) When used in this title, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof—

(31) Foreign estate or trust

(A) Foreign estate

The term “foreign estate” means an estate the income of which, from sources without the United States which is not effectively connected with the conduct of a trade or business within the United States, is not includible in gross income under subtitle A.

If you would like to know more about this SCAM, see:

|

Flawed Tax Arguments,

Form #08.004, Section 5.10 http://sedm.org/Forms/FormIndex.htm |

4. For the IRS to be protected by a judicial “protection racket” implemented by judges who have a conflict of interest as “taxpayers” in violation of 18 U.S.C. §208 , 28 U.S.C. §144 , and 28 U.S.C. §455 . This protection racket was instituted permanently upon federal judges with the Revenue Act of 1932 as documented in:

4.1. Evans v. Gore, 253 U.S. 245 (1920)

4.2. O'Malley v. Woodrough, 307 U.S. 277 (1939)

4.3. United States v. Hatter, 121 S.Ct 1782 (2001)

5. To receive what they know in nearly all cases are false information returns against innocent private parties who are nontaxpayers and to act as money launderers for all amounts withheld from these innocent parties.

6. To protect the filers of these false reports.

6.1. IRS Forms W-2, 1042-S, 1098, and 1099 do not contain the individual identity of the person who prepared the form.

6.2. Only IRS Forms 1096 and W-3 contain the identity and statement under penalty of perjury signed by the specific individual person who filed the false information return.

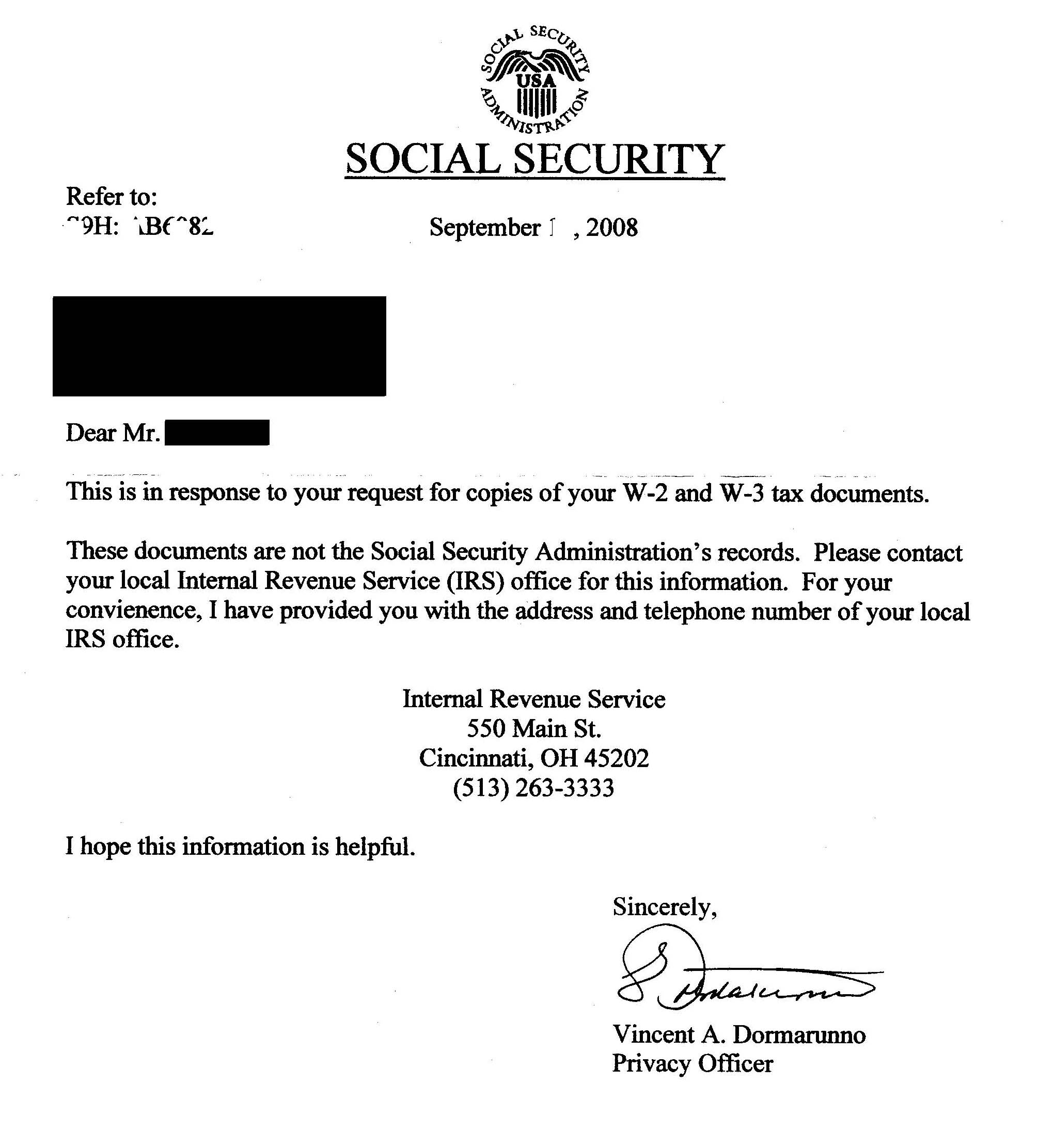

6.3. If you send a FOIA to the Social Security Administration asking for the IRS Forms 1096 and W-3 connected to the specific information returns filed against you, they very conveniently will tell you that they don’t have the documents, even though they are the ONLY ones who receive them in the government! They instead tell you to send a FOIA to the IRS to obtain them. For example, see the following:

If you want to see the document the above request responds to, see:

|

Information Return

FOIA: "Trade or Business", Form #03.023 http://sedm.org/Forms/FormIndex.htm |

6.4. The IRS then comes back and says they don’t keep the original Forms 1096 and W-3 either! Consequently, there is no way to identify the specific individual who filed the original false reports or to prosecute them criminally under 26 U.S.C. §§7206 and 7207 or civilly under 26 U.S.C. §7434 . In that sense, IRS FOIA offices act as “witness protection programs” for those communist informants for the government willfully engaged in criminal activity.

Internal Revenue Manual

3.5.20.19 (10-01-2003)Information Returns Transcripts - 1099 Information

1. Generally, information returns are destroyed upon processing. Therefore, original returns cannot be retrieved. In addition, the IRS may not have record of all information returns filed by payers. The Information Returns Master File (IRMF), accessed by CC IRPTR, contains records of many information returns. The master files are not complete until October of the year following the issuance of the information document, and contain the most current year and five (5) previous years. Taxpayers should be advised to first seek copies of information documents from the payer. However, upon request, taxpayers or their authorized designee may receive "information return " information.

2. Follow guidelines IRM 3.5.20.1 through 3.5.20.11, to ensure requests are complete and valid.

3. This information can be requested on TDS.

4. This information is also available using IRPTR with definer W.

5. If IRPTR is used without definer W, the following items must be sanitized before the information is released:

· CASINO CTR

· CMIR Form 4790

· CTR

6. Form 1099 information is not available through Latham.

7. To deliberately interfere with efforts to correct these false reports by those who are the wrongful subject of them:

7.1 By penalizing filers of corrected information returns up to $5,000 for each Form 4852 filed pursuant to 26 U.S.C. §6702.

7.2. By not providing forms to correct the false reports for ALL THOSE who could be the subject of them. IRS Form 4852, for instance, says at the top “Attach to Form 1040, 1040A, 1040-EZ, or 1040X .” There is no equivalent form for use by nonresident aliens who are victims of false IRS Form W-2 or 1099-R and who file a 1040NR.

7.3. To refuse to accept W-2C forms filed by those other than “employers”.

7.4. To refuse to accept custom, substitute, or modified forms that would correct the original reports.

7.5. To not help those submitting the corrections by saying that they were not accepted, why they were not accepted, or how to make them acceptable.

8. To ignore correspondence directed at remedying all the above abuses and thereby obstruct justice and condone and encourage further unlawful activity.

So what we have folks is a deliberate, systematic plan that:

1. Turns innocent parties called “nontaxpayers” into guilty parties called “taxpayers”, which the U.S. Supreme Court said they cannot do.

"In Calder v. Bull, which was here in 1798, Mr. Justice Chase said, that there were acts which the Federal and State legislatures could not do without exceeding their authority, and among them he mentioned a law which punished a citizen for an innocent act; a law that destroyed or impaired the lawful private [labor] contracts [and labor compensation, e.g. earnings from employment through compelled W-4 withholding] of citizens; a law that made a man judge in his own case; and a law that took the property from A [the worker]. and gave it to B [the government or another citizen, such as through social welfare programs]. 'It is against all reason and justice,' he added, 'for a people to intrust a legislature with such powers, and therefore it cannot be presumed that they have done it. They may command what is right and prohibit what is wrong; but they cannot change innocence into guilt, or punish innocence [being a "nontaxpayer"] as a crime [being a "taxpayer"], or violate the right of an antecedent lawful private [employment] contract [by compelling W-4 withholding, for instance], or the right of private property. To maintain that a Federal or State legislature possesses such powers [of THEFT!] if they had not been expressly restrained, would, in my opinion, be a political heresy altogether inadmissible in all free republican governments.' 3 Dall. 388."

[Sinking Fund Cases, 99 U.S. 700 (1878) ]

2. Constitutes a conspiracy to destroy equal protection and equal treatment that is the foundation of the Constitution, assigning all sovereignty to the government, and compelling everyone to worship and serve it without compensation.

3. Constitutes a conspiracy to destroy all Constitutional rights by compelling Americans through false reports to service the obligations of an office they cannot lawfully occupy and derive no benefit from:

"It has long been established that a State may not impose a penalty upon those who exercise a right guaranteed by the Constitution." Frost & Frost Trucking Co. v. Railroad Comm'n of California, 271 U.S. 583 . "Constitutional rights would be of little value if they could be indirectly denied,' Smith v. Allwriqht, 321 U.S. 649, 644 , or manipulated out of existence,' Gomillion v. Lightfoot, 364 U.S. 339, 345."

[Harman v. Forssenius, 380 U.S 528 at 540, 85 S.Ct. 1177, 1185 (1965) ]

4. Constitutes an abuse of tax forms as a federal election device to unlawfully elect those who aren’t eligible and without their consent into public office in the government, in criminal violation of 18 U.S.C. §912 .

5. Encourages Americans on a massive scale to file false reports against their neighbor that compel them into economic servitude and slavery without compensation:

“You shall not circulate a false report [information return]. Do not put your hand with the wicked to be an unrighteous witness.”

[Exodus, 23:1, Bible, NKJV]“You shall not bear false witness [or file a FALSE REPORT or information return] against your neighbor.”

[Exodus 10:16 , Bible, NKJV]“A false witness will not go unpunished, And he who speaks lies shall perish.”

[Prov. 19:9 , Bible, NKJV]“If a false witness rises against any man to testify against him of wrongdoing, then both men in the controversy shall stand before the LORD, before the priests and the judges who serve in those days. And the judges shall make careful inquiry, and indeed, if the witness is a false witness, who has testified falsely against his brother, then you shall do to him as he thought to have done to his brother; [enticement into slavery (pursuant to 42 U.S.C. §1994 )] to the demands of others without compensation] so you shall put away the evil from among you. And those who remain shall hear and fear, and hereafter they shall not again commit such evil among you. Your eye shall not pity: life shall be for life, eye for eye, tooth for tooth, hand for hand, foot for foot.”

[Deut. 19:16-21, Bible, NKJV]

6. Constitutes a plan to implement communism in America. The Second Plank of the Communist Manifesto is a heavy, progressive income tax that punishes the rich and abuses the taxation powers of the government to redistribute wealth.

7. Constitutes a conspiracy to replace a de jure Constitutional Republic into nothing but a big for-profit private corporation and business in which:

7.1. Government becomes a virtual or political entity rather than physical entity tied to a specific territory. All the “States” after the Civil War rewrote their Constitutions to remove references to their physical boundaries. Formerly “sovereign” and independent states have become federal territories and federal corporations by signing up for federal franchises:

At common law, a "corporation" was an "artificial perso[n] endowed with the legal capacity of perpetual succession" consisting either of a single individual (termed a "corporation sole") or of a collection of several individuals (a "corporation aggregate"). 3 H. Stephen, Commentaries on the Laws of England 166, 168 (1st Am. ed. 1845) . The sovereign was considered a corporation. See id., at 170; see also 1 W. Blackstone, Commentaries *467. Under the definitions supplied by contemporary law dictionaries, Territories would have been classified as "corporations" (and hence as "persons") at the time that 1983 was enacted and the Dictionary Act recodified. See W. Anderson, A Dictionary of Law 261 (1893) ("All corporations were originally modeled upon a state or nation"); 1 J. Bouvier, A Law Dictionary Adapted to the Constitution and Laws of the United States of America 318-319 (11th ed. 1866) ("In this extensive sense the United States may be termed a corporation"); Van Brocklin v. Tennessee, 117 U.S. 151, 154 (1886) ("`The United States is a . . . great corporation . . . ordained and established by the American people'") (quoting United [495 U.S. 182, 202] States v. Maurice, 26 F. Cas. 1211, 1216 (No. 15,747) (CC Va. 1823) (Marshall, C. J.)); Cotton v. United States, 11 How. 229, 231 (1851) (United States is "a corporation"). See generally Trustees of Dartmouth College v. Woodward, 4 Wheat. 518, 561-562 (1819) (explaining history of term "corporation").

[Ngiraingas v. Sanchez, 495 U.S. 182 (1990)]

7.2. All rights have been replaced with legislatively created corporate “privileges” and franchises. See:

|

Government Instituted

Slavery Using Franchises, Form #05.030 http://sedm.org/Forms/FormIndex.htm |

7.3. “citizens” and “residents” are little more than “employees” and officers of the corporation described in 26 U.S.C. §6671(b), 26 U.S.C. §7343, and 5 U.S.C. §2105. See:

|

Proof that There is

a “Straw Man”, Form #05.042 http://sedm.org/Forms/FormIndex.htm |

7.4. You join the club and become an officer and employee of the corporation by declaring yourself to be a statutory but not constitutional “U.S. citizen” on a government form. See:

|

Why You are a “national”

or a “state national” and Not a “U.S. citizen”, Form

#05.006 http://sedm.org/Forms/FormIndex.htm |

7.5. Social Security Numbers and Taxpayer Identification Numbers serve as de facto license numbers authorizing those who use them to act in the capacity of a public officer, trustee, and franchisee within the government. See:

|

Resignation of Compelled

Social Security Trustee, Form #06.002 http://sedm.org/Forms/FormIndex.htm |

7.6. Federal Reserve Notes (FRNs) serve as a substitute for lawful money and are really nothing but private scrip for internal use by officers of the government. They are not lawful money because they are not redeemable in gold or silver as required by the Constitution. See:

|

The Money Scam,

Form #05.041 http://sedm.org/Forms/FormIndex.htm |

7.7. So-called "Income Taxes” are nothing but insurance premiums to pay for “social insurance benefits”. They are also used to regulate the supply of fiat currency. See:

|

The Government “Benefits”

Scam, Form #05.040 http://sedm.org/Forms/FormIndex.htm |

7.8. The so-called “law book”, the Internal Revenue Code, is the private law franchise agreement which regulates compensation to and “kickbacks” from the officers of the corporation, which includes you. See:

|

The “Trade or Business”

Scam, Form #05.001 http://sedm.org/Forms/FormIndex.htm |

7.9. Federal courts are really just private binding corporate arbitration for disputes between fellow officers of the corporation. See:

|

What Happened to Justice?,

Form #06.012 http://sedm.org/Forms/FormIndex.htm |

7.10. Terms in the Constitution have been redefined to limit themselves to federal territory not protected by the original de jure constitution through judicial and prosecutorial word-smithing.

“When words lose their meaning, people will lose their liberty " .”

[Confucius, 500 B.C. ]“Judicial verbicide is calculated to convert the Constitution into a worthless scrap of paper and to replace our government of laws with a judicial oligarchy.”

[Senator Sam Ervin, during Watergate hearing]

See:

7.10.1.

Legal Deception, Propaganda, and Fraud, Form #05.014

http://sedm.org/Forms/FormIndex.htm

7.10.2.

Rules of Presumption and Statutory

Interpretation, Litigation Tool #01.006

http://sedm.org/Litigation/LitIndex.htm

8. Constitutes a plan to unwittingly recruit the average American into servitude of this communist/socialist effort.

TITLE 50 > CHAPTER 23 > SUBCHAPTER IV > Sec. 841.

Sec. 841. - Findings and declarations of factThe Congress finds and declares that the Communist Party of the United States [consisting of the IRS, DOJ, and a corrupted federal judiciary], although purportedly a political party, is in fact an instrumentality of a conspiracy to overthrow the [de jure] Government of the United States [and replace it with a de facto government ruled by the judiciary]. It constitutes an authoritarian dictatorship [IRS, DOJ, and corrupted federal judiciary in collusion] within a [constitutional] republic, demanding for itself the rights and privileges [including immunity from prosecution for their wrongdoing in violation of Article 1, Section 9, Clause 8 of the Constitution] accorded to political parties, but denying to all others the liberties [Bill of Rights] guaranteed by the Constitution. Unlike political parties, which evolve their policies and programs through public means, by the reconciliation of a wide variety of individual views, and submit those policies and programs to the electorate at large for approval or disapproval, the policies and programs of the Communist Party are secretly [by corrupt judges and the IRS in complete disregard of the tax laws] prescribed for it by the foreign leaders of the world Communist movement [the IRS and Federal Reserve]. Its members [the Congress, which was terrorized to do IRS bidding recently by the framing of Congressman Traficant] have no part in determining its goals, and are not permitted to voice dissent to party objectives. Unlike members of political parties, members of the Communist Party are recruited for indoctrination [in the public schools by homosexuals, liberals, and socialists] with respect to its objectives and methods, and are organized, instructed, and disciplined [by the IRS and a corrupted judiciary] to carry into action slavishly the assignments given them by their hierarchical chieftains. Unlike political parties, the Communist Party [thanks to a corrupted federal judiciary] acknowledges no constitutional or statutory limitations upon its conduct or upon that of its members. The Communist Party is relatively small numerically, and gives scant indication of capacity ever to attain its ends by lawful political means. The peril inherent in its operation arises not from its numbers, but from its failure to acknowledge any limitation as to the nature of its activities, and its dedication to the proposition that the present constitutional Government of the United States ultimately must be brought to ruin by any available means, including resort to force and violence [or using income taxes]. Holding that doctrine, its role as the agency of a hostile foreign power [the Federal Reserve and the American Bar Association (ABA)] renders its existence a clear present and continuing danger to the security of the United States. It is the means whereby individuals are seduced into the service of the world Communist movement, trained to do its bidding, and directed and controlled in the conspiratorial performance of their revolutionary services. Therefore, the Communist Party should be outlawed

9. Constitutes an effort to create and perpetuate a state-sponsored religion and to compel “tithes” called income tax to the state-sponsored church, which is the government:

|

Socialism: The New

American Civil Religion, Form #05.016 http://sedm.org/Forms/FormIndex.htm |

To close this section, we highly recommend the following FOIA you can send to the IRS and the Social Security Administration that is useful as a reliance defense to expose the FRAUD described in this section upon the American people:

|

Information Return

FOIA: "Trade or Business", Form #03.023 http://sedm.org/Forms/FormIndex.htm |