Proof of Facts: What the geographical “United States” means in 26 U.S.C. 7701(a)(9) and (a)(10) (OFFSITE LINK) -SEDM. Important!

8 U.S.C. §1101 Definitions

TITLE 8 > CHAPTER 12 > SUBCHAPTER I > Sec. 1101. [Aliens and Nationality]

(a)(38) The term ''United States'', except as otherwise specifically herein provided, when used in a geographical sense, means the continental United States, Alaska, Hawaii, Puerto Rico, Guam, and the Virgin Islands of the United States.

18 U.S.C. §5 Definitions

TITLE 18 > PART I > CHAPTER 1 > § 5

The term “United States”, as used in this title in a territorial sense, includes all places and waters, continental or insular, subject to the jurisdiction of the United States, except the Canal Zone.

26 U.S.C. §7701 Definitions

TITLE 26 > Subtitle F > CHAPTER 79 > Sec. 7701. [Internal Revenue Code]

(a)(9) United States

The term ''United States'' when used in a geographical sense includes only the States and the District of Columbia.

26 C.F.R. §1.911-2 - Qualified individuals.

26 C.F.R. § 1.911-2 - Qualified individuals.

(g) United States.

The term “United States” when used in a geographical sense includes any territory under the sovereignty of the United States. It includes the states, the District of Columbia, the possessions and territories of the United States, the territorial waters of the United States, the air space over the United States, and the seabed and subsoil of those submarine areas which are adjacent to the territorial waters of the United States and over which the United States has exclusive rights, in accordance with international law, with respect to the exploration and exploitation of natural resources.

(h) Foreign country.

The term “foreign country” when used in a geographical sense includes any territory under the sovereignty of a government other than that of the United States. It includes the territorial waters of the foreign country (determined in accordance with the laws of the United States), the air space over the foreign country, and the seabed and subsoil of those submarine areas which are adjacent to the territorial waters of the foreign country and over which the foreign country has exclusive rights, in accordance with international law, with respect to the exploration and exploitation of natural resources.

[EDITORIAL Note also that the word "territory" in reference to the national government as used above includes NO PART OF ANY STATE OF THE UNION

https://famguardian.org/TaxFreedom/CitesByTopic/territory.htm"§1. Definitions, Nature, and Distinctions

"The word 'territory,' when used to designate a political organization has a distinctive, fixed, and legal meaning under the political institutions of the United States, and does not necessarily include all the territorial possessions of the United States, but may include only the portions thereof which are organized and exercise governmental functions under act of congress."

"While the term 'territory' is often loosely used, and has even been construed to include municipal subdivisions of a territory, and 'territories of the' United States is sometimes used to refer to the entire domain over which the United States exercises dominion, the word 'territory,' when used to designate a political organization, has a distinctive, fixed, and legal meaning under the political institutions of the United States, and the term 'territory' or 'territories' does not necessarily include only a portion or the portions thereof which are organized and exercise government functions under acts of congress. The term 'territories' has been defined to be political subdivisions of the outlying dominion of the United States, and in this sense the term 'territory' is not a description of a definite area of land but of a political unit governing and being governed as such. The question whether a particular subdivision or entity is a territory is not determined by the particular form of government with which it is, more or less temporarily, invested.

"Territories' or 'territory' as including 'state' or 'states." While the term 'territories of the' United States may, under certain circumstances, include the states of the Union, as used in the federal Constitution and in ordinary acts of congress "territory" does not include a foreign state.

"As used in this title, the term 'territories' generally refers to the political subdivisions created by congress, and not within the boundaries of any of the several states."

[86 C.J.S. [Corpus, Juris, Secundum, Legal Encyclopedia], Territories

See also Arnett v. Comm'r, 473 F.3d. 790(2007) for caselaw on this subject]

26 C.F.R. § 301.7701-7 - Trusts—domestic and foreign.

§ 301.7701-7 Trusts—domestic and foreign.

(c) The court test—(1) Safe harbor. A trust satisfies the court test if—

(i) Court. The term court includes any federal, state, or local court.

(ii) The United States.

The term the United States is used in this section in a geographical sense. Thus, for purposes of the court test, the United States includes only the States and the District of Columbia. See section 7701(a)(9). Accordingly, a court within a territory or possession of the United States or within a foreign country is not a court within the United States.

[EDITORIAL: There is the heart of the separation of powers, hidden in plain site in regulations that the irs is the only one who ever reads.IRS publications and websites are the exoteric. The code and regs the esoteric. It does seem like they included (on purpose) the article "the" by including it in the italic styling (why not just wrap it in quotes like other terms in the code?)...yet they invoke the entire def of 26 U.S.C. §7701(a)(9) inline, and ALSO reference it. I find that interesting. We think it really just comes down to what United States means in that context. Since its ONLY defined in a geographical sense, and since 26 C.F.R. §301.7701-7 mentions that United States is being used in a geographical sense, it opens up the floodgates, especially given the definition of American Employer in 26 U.S.C. §3121, that there are OTHER senses, not defined which can be presumed if its in the best interest of the taxpayer....and let the IRS or courts PROVE otherwise.

Certainly appears to me that only one of two possibilities are permitted as a definition for "the States" in 26 U.S.C. §7701(a)(9):

- "United States"=DC only from this. OR

- "The States" are those that consent to be treated AS IF they are within the jurisdiction of the I.R.C. BY COMPACT. This would be all the states that have income tax. SD, Florida, Texas, and Georgia excepted, of course, because they don't have income tax.

Item 2 above would seem to constitute a clear conspiracy to destroy the separation of powers at the heart of the constitution. See:

Government Conspiracy to Destroy the Separation of Powers, Form #05.023

https://sedm.org/Forms/05-MemLaw/SeparationOfPowers.pdfThis is the DEFAULT and ONLY geographical definition in the title. The rules of statutory construction and interpretation require that the law must give reasonable notice of all that is included to the reader, and that the reader cannot be required to guess or presume anything about meanings. So I'll punt and apply the first definition: DC only. This is the only thing consistent with the following SCOTUS ruling:

"Loughborough v. Blake, 5 Wheat. 317, 5 L. ed. 98, was an action of trespass or, as appears by the original record, replevin, brought in the circuit court for the District of Columbia to try the right of Congress to impose a direct tax for general purposes on that District. 3 Stat. at L. 216, chap. 60. It was insisted that Congress could act in a double capacity: in one as legislating [182 U.S. 244, 260] for the states; in the other as a local legislature for the District of Columbia. In the latter character, it was admitted that the power of levying direct taxes might be exercised, but for District purposes only, as a state legislature might tax for state purposes; but that it could not legislate for the District under art. 1, 8, giving to Congress the power 'to lay and collect taxes, imposts, and excises,' which 'shall be uniform throughout the United States,' inasmuch as the District was no part of the United States. It was held that the grant of this power was a general one without limitation as to place, and consequently extended to all places over which the government extends; and that it extended to the District of Columbia as a constituent part of the United States. The fact that art. 1 , 2, declares that 'representatives and direct taxes shall be apportioned among the several states . . . according to their respective numbers' furnished a standard by which taxes were apportioned, but not to exempt any part of the country from their operation. 'The words used do not mean that direct taxes shall be imposed on states only which are represented, or shall be apportioned to representatives; but that direct taxation, in its application to states, shall be apportioned to numbers.' That art. 1, 9, 4, declaring that direct taxes shall be laid in proportion to the census, was applicable to the District of Columbia, 'and will enable Congress to apportion on it its just and equal share of the burden, with the same accuracy as on the respective states. If the tax be laid in this proportion, it is within the very words of the restriction. It is a tax in proportion to the census or enumeration referred to.' It was further held that the words of the 9th section did not 'in terms require that the system of direct taxation, when resorted to, shall be extended to the territories, as the words of the 2d section require that it shall be extended to all the states. They therefore may, without violence, be understood to give a rule when the territories shall be taxed, without imposing the necessity of taxing them.'

[Downes v. Bidwell, 182 U.S. 244 (1901), https://caselaw.findlaw.com/court/us-supreme-court/182/244.html]

So it IS and always has been a tax on the government and its offices, and those who volunteer for those offices. The above says it is "without limitation as to place" and "wherever the GOVERNMENT extends".

1. The government consists of PROPERTY and OFFICES, which are also property. Government is not a physical thing but the property it owns is.

2. The obligation to pay taxes attaches to government offices and property, which are both public property. It is, in effect, a rental fee for the beneficial use of government property.

3. The office and the officer are separate and distinct. They cannot be lawfully connected without the consent of the officer as a volunteer.

https://sedm.org/Forms/08-PolicyDocs/HowYouVolForIncomeTax.pdf4. The tax is upon the OFFICE. That office is the "taxpayer", "citizen", "resident", etc, not the officer consensually FILLING the office.

5. Taxes must be collected ONLY from property voluntarily attached to the office. The method of attachment is the SSN, which functions as a franchise mark as the FTC defines it. They cannot be collected from the PRIVATE property of the officer because it was never lawfully converted to public property with the consent of the owner.

6. When IRS does a levy under 6331, the levy is upon INSTRUMENTALITIES of the government and not the PRIVATE officers filling the office. Formerly private property attached to the office by connecting it with the franchise mark is the ONLY lawful subject of the levy. If the property isn't connected to the office with the franchise mark it can't be levied:

https://sedm.org/Forms/05-MemLaw/AboutSSNsAndTINs.pdfLevies aren't sent out on people who didn't voluntarily attach their earnings to the office by supplying a W-9 or W-4 containing the franchise mark.

IN CONCLUSION: Yes, the tax is ONLY upon the office and all formerly private property DONATED to a public use, a public office, and a public purpose by attaching a franchise mark to it. Unenumerated bank accounts are NEVER levied administratively. And YES, the tax is upon the PROPERTY of the government. Attaching the mark makes it property of the government. OF COURSE they have a right to lien an levy public property, which is what it is if you attach a franchise mark.

“Men are endowed by their Creator with certain unalienable rights,-'life, liberty, and the pursuit of happiness;' and to 'secure,' not grant or create, these rights, governments are instituted. That property [or income] which a man has honestly acquired he retains full control of, subject to these limitations:

[1] First, that he shall not use it to his neighbor's injury, and that does not mean that he must use it for his neighbor's benefit [e.g. SOCIAL SECURITY, Medicare, and every other public “benefit”];

[2] second, that if he devotes it to a public use, he gives to the public a right to control that use; and

[3] third, that whenever the public needs require, the public may take it upon payment of due compensation.”

[Budd v. People of State of New York, 143 U.S. 517 (1892) ]

See item 2 above.

"trade or business"=public office=public use. SSN is only required of those engaged in a trade or business. 26 CFR 301.6109-1(b).]

26 C.F.R. §301.6365-1 - Definitions

26 C.F.R. §301.6365-1 - Definitions

§ 301.6365-1 Definitions.(a) State. For purposes of subchapter E and the regulations thereunder, the term “State” shall include the District of Columbia, but shall not include the Commonwealth of Puerto Rico or any possession of the United States.

(b) Governor. For purposes of subchapter E and the regulations thereunder, the term “Governor” shall include the Mayor of the District of Columbia.

[T.D. 7577, 43 FR 59375, Dec. 20, 1978][EDITORIAL: Subchapter E no longer exists. According to Bing ChatGPT Chatbot:

"Subchapter E of the Internal Revenue Code was a part of the Accounting Periods and Methods of Accounting section of the code 1. It was repealed in 1986 as part of the Tax Reform Act of 1986 1. The subchapter applied to accounting periods and methods of accounting for taxable income 1. I hope this helps! Learn more:

1. 26 U.S. Code Subchapter E - Accounting Periods and Methods of Accounting | U.S. Code | US Law | LII / Legal Information Institute (cornell.edu)

https://www.law.cornell.edu/uscode/text/26/subtitle-A/chapter-1/subchapter-E]

28 U.S.C. §1603 Definitions

TITLE 28 > PART IV > CHAPTER 97 > Sec. 1603. [Judiciary and Judicial Procedure]

For purposes of this chapter [Chapter 97] -

(c) The ''United States'' includes all territory and waters, continental or insular, subject to the jurisdiction of the United States.

28 U.S.C. §3002 Definitions

TITLE 28 > PART VI > CHAPTER 176 > SUBCHAPTER A > Sec. 3002.

TITLE 28 - JUDICIARY AND JUDICIAL PROCEDURE

PART VI - PARTICULAR PROCEEDINGS

CHAPTER 176 - FEDERAL DEBT COLLECTION PROCEDURE

SUBCHAPTER A - DEFINITIONS AND GENERAL PROVISIONS

Sec. 3002. Definitions(15) ''United States'' means -

(A) a Federal corporation;

(B) an agency, department, commission, board, or other entity of the United States; or

(C) an instrumentality of the United States.

26 U.S.C. §3121 Definitions

TITLE 26 > Subtitle C > CHAPTER 21 > Subchapter C > Sec. 3121. [Employment Taxes: FICA]

Sec. 3121. - Definitions

(e) State, United States, and citizen

For purposes of this chapter [Chapter 21]-

(1) State

The term ''State'' includes the District of Columbia, the Commonwealth of Puerto Rico, the Virgin Islands, Guam, and American Samoa.

(2) United States

The term ''United States'' when used in a geographical sense includes the Commonwealth of Puerto Rico, the Virgin Islands, Guam, and American Samoa.

An individual who is a citizen of the Commonwealth of Puerto Rico (but not otherwise a citizen of the United States) shall be considered, for purposes of this section, as a citizen of the United States.

26 U.S.C. §4612 Definitions and special rules

TITLE 26 > Subtitle D > CHAPTER 38 > Subchapter A > Sec. 4612. [Environmental Taxes: Taxes on Petroleum]

Sec. 4612. - Definitions and special rules

(a) Definitions

For purposes of this subchapter [subchapter A]-

(4) United States

(A) In general

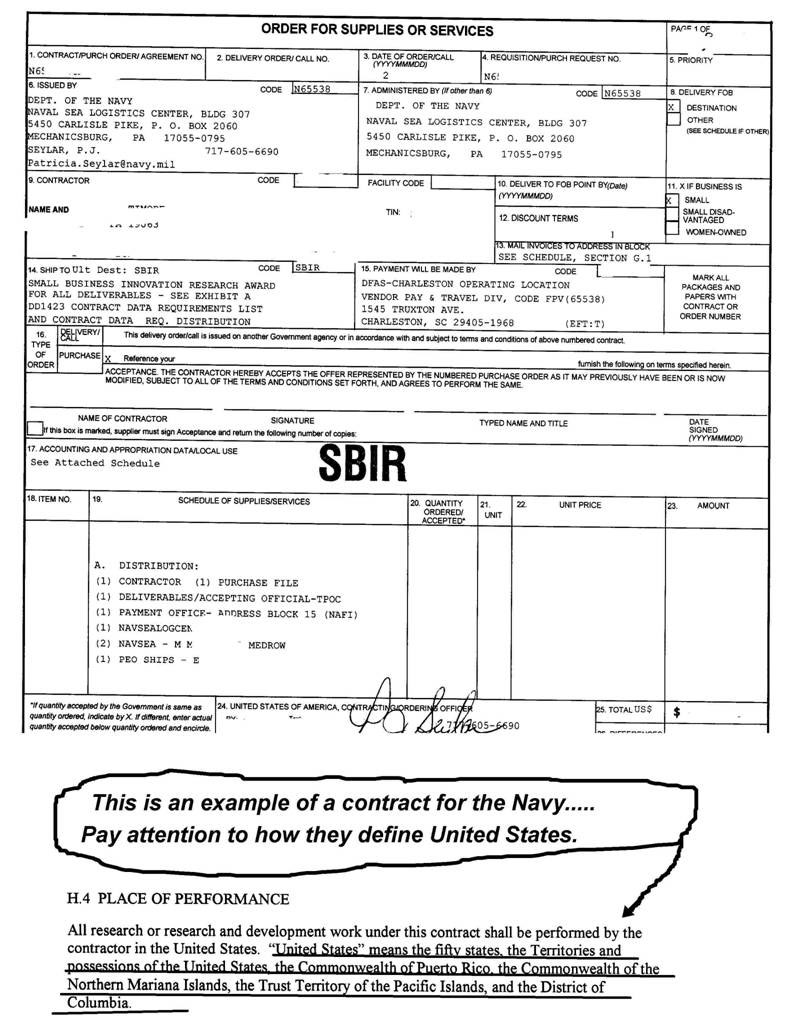

The term ''United States'' means the 50 States, the District of Columbia, the Commonwealth of Puerto Rico, any possession of the United States, the Commonwealth of the Northern Mariana Islands, and the Trust Territory of the Pacific Islands.

(B) United States includes continental shelf areas

The principles of section 638 shall apply for purposes of the term ''United States''.

(C) United States includes foreign trade zones

The term ''United States'' includes any foreign trade zone of the United States.

49 U.S.C. §13102: Definitions

(20) United states. - The term ''United States'' means the States of the United States and the District of Columbia.

26 C.F.R. §301.7701(b)-1(c)(2)(ii)

26 C.F.R. §301.7701(b)-1(c)(2)(ii)

(ii) United States.

For purposes of section 7701(b) and the regulations thereunder, the term United States when used in a geographical sense includes the states and the District of Columbia. It also includes the territorial waters of the United States and the seabed and subsoil of those submarine areas which are adjacent to the territorial waters of the United States and over which the United States has exclusive rights, in accordance with international law, with respect to the exploration and exploitation of natural resources. It does not include the possessions and territories of the United States or the air space over the United States.

[EDITORIAL: The above deals with aliens and nonresidents who are also "aliens" in determining ONLY their residency and whether they meet the "presence test". This geography does NOT affect or expand the geographical source of income found in 26 U.S.C. §7701(a)(9) and (a)10) and 4 U.S.C. §110(d). Jurisdiction over aliens is throughout the COUNTRY, not just within the federal zone, because they are privileged. Nationals are NOT privileged and would not fall within the above regulation.Our cases have long recognized the preeminent role of the Federal Government with respect to the regulation of aliens within our borders. See, e. g., Mathews v. Diaz, 426 U.S. 67 (1976); Graham v. Richardson, 403 U. S. 365, 377-380 (1971); Takahashi v. Fish & Game Comm'n, 334 U. S. 410, 418-420 (1948); Hines v. Davidowitz, 312 U.S. 52, 62-68 (1941); Truax v. Raich, 239 U. S. 33, 42 (1915). Federal authority to regulate the status of aliens derives from various sources, including the Federal Government's power "[t]o establish [a] uniform Rule of Naturalization," U.S. Const., Art. I, § 8, cl. 4, its power "[t]o regulate Commerce with foreign Nations", id., cl. 3, and its broad authority over foreign affairs, see United States v. Curtiss-Wright Export Corp., 299 U.S. 304, 318 (1936); Mathews v. Diaz, supra, at 81, n. 17; Harisiades v. Shaughnessy, 342 U.S. 580, 588-589 (1952).

[Toll v. Moreno, 458 U.S. 1 (1982)]Regulating aliens is a foreign affairs function that the national government has PLENARY, DIRECT legislative power over. 5 U.S.C. §553(a)(2) and 44 U.S.C. §1505(a). Both of these statutes say essentially that Congress may DIRECTLY LEGISLATE relating to "military or foreign affairs functions" WITHOUT the need for implementing regulations.

Nationals or state nationals who are ALSO "nonresident aliens", on the other hand, are not "aliens" and therefore DO NOT fall in the foreign affairs function so they would be excluded from the geographical definition in the above reg. More on the privileges of "aliens" at:

Sovereignty Forms and Instructions Online, Form #10.004, Cites by topic: "alien"]

26 C.F.R. §31.3306(j)-1: State, United States, and citizen

Title 26: Internal Revenue

PART 31—EMPLOYMENT TAXES AND COLLECTION OF INCOME TAX AT SOURCE

Subpart D—Federal Unemployment Tax Act (Chapter 23, Internal Revenue Code of 1954)

§ 31.3306(j)-1 State, United States, and citizen.(a) When used in the regulations in this subpart, the term “State” includes the District of Columbia, the Territories of Alaska and Hawaii before their admission as States, and (when used with respect to remuneration paid after 1960 for services performed after 1960) the Commonwealth of Puerto Rico.

(b) When used in the regulations in this subpart, the term “United States”, when used in a geographical sense, means the several States (including the Territories of Alaska and Hawaii before their admission as States), and the District of Columbia. When used in the regulations in this subpart with respect to remuneration paid after 1960 for services performed after 1960, the term “United States” also includes the Commonwealth of Puerto Rico when the term is used in a geographical sense, and the term “citizen of the United States” includes a citizen of the Commonwealth of Puerto Rico.

[T.D. 6658, 28 FR 6641, June 27, 1963]

AN INVESTIGATION INTO THE MEANING OF THE TERM "UNITED STATES"- by Alan Freedman

U.S. v. USA according to "The Bluebook: A Uniform System of Citation"

WORD STUDY OF "UNITED STATES" v.

"UNITED STATES OF AMERICA" IN THE U.S. CODE

WORD STUDY OF "UNITED STATES" v.

"UNITED STATES OF AMERICA" IN THE U.S. CODE

WORDS AND PHRASES:

"UNITED STATES"

-detailed analysis of the words "United States" from THE AUTHORITY

WORDS AND PHRASES:

"UNITED STATES"

-detailed analysis of the words "United States" from THE AUTHORITY

IRS Publication 521, p. 7: Definition of United States-this definition will surprise you!

IRS Publication 521, p. 7: Definition of United States-this definition will surprise you!

Wikipedia Encyclopedia Definition of "United States"-excellent

Uniform Commercial Code, Section 9-307

Uniform Commercial Code (U.C.C.)

§ 9-307. LOCATION OF DEBTOR.(h) [Location of United States.]

The United States is located in the District of Columbia.

[SOURCE: https://www.law.cornell.edu/ucc/9/9-307]

California Commercial Code, Section 9307(h)

CALIFORNIA COMMERCIAL CODE

DIVISION 9: SECURED TRANSACTIONS

CHAPTER 3: PERFECTION AND PRIORITY

SECTION 9307(h)The United States is located in the District of Columbia.

Downes v. Bidwell, 182 U.S. 244 (1901):

"The earliest case is that of Hepburn v. Ellzey, 2 Cranch, 445, 2 L. ed. 332, in which this court held that, under that clause of the Constitution limiting the jurisdiction of the courts of the United States to controversies between citizens of different states, a citizen of the District of Columbia could not maintain an action in the circuit court of the United States. It was argued that the word 'state.' in that connection, was used simply to denote a distinct political society. 'But,' said the Chief Justice, 'as the act of Congress obviously used the word 'state' in reference to that term as used in the Constitution, it becomes necessary to inquire whether Columbia is a state in the sense of that instrument. The result of that examination is a conviction that the members of the American confederacy only are the states contemplated in the Constitution , . . . and excludes from the term the signification attached to it by writers on the law of nations.' This case was followed in Barney v. Baltimore, 6 Wall. 280, 18 L. ed. 825, and quite recently in Hooe v. Jamieson, 166 U.S. 395 , 41 L. ed. 1049, 17 Sup. Ct. Rep. 596. The same rule was applied to citizens of territories in New Orleans v. Winter, 1 Wheat. 91, 4 L. ed. 44, in which an attempt was made to distinguish a territory from the District of Columbia. But it was said that 'neither of them is a state in the sense in which that term is used in the Constitution.' In Scott v. Jones, 5 How. 343, 12 L. ed. 181, and in Miners' Bank v. Iowa ex rel. District Prosecuting Attorney, 12 How. 1, 13 L. ed. 867, it was held that under the judiciary act, permitting writs of error to the supreme court of a state in cases where the validity of a state statute is drawn in question, an act of a territorial legislature was not within the contemplation of Congress."

[Downes v. Bidwell, 182 U.S. 244 (1901)]

Using the Laws of Property to Respond to a Federal or State Tax Collection Notice, Form #14.015

13. Insofar as “sources in the United States” is concerned, it appears to me that the United States in the I.R.C. is mostly referring to is the FICTIONAL corporation as a public officer and not the geography, because slavery, peonage, and human trafficking are unconstitutional and possibly even criminal everywhere in the Union and even the world, not just within a physical state protected by the Constitution. Any other interpretation would lead to an interference with the private right to contract and associate. The U.S. Supreme Court held in Downes v. Bidwell, 182 U.S. 244 (1901) and Loughborough v. Blake, 5 Wheat. 317, 5 L.Ed. 98 that an income tax on the District of Columbia, which is what “United States” is defined as in 26 U.S.C. §7701(a)(9) and (a)(10), is a tax upon THE GOVERNMENT and not upon the GEOGRAPHY, and extends wherever and ONLY where that GOVERNMENT extends. To claim that I am IN THIS “United States” or worst yet that I am rendering “services in THIS United States” is to falsely claim that I am a public officer participating in an excise taxable franchise, which I am not in this case and which the national government cannot even lawfully do within the borders of a constitutional state per the License Tax Cases, 72 U.S. 462 (1866) without unconstitutionally INVADING them in violation of Article 4, Section 4 of the Constitution.

[. . .]

15. According to the U.S. Supreme Court, when I am incapable of receiving “benefits”, then anything you collect outside my FOREIGN domicile in a constitutional state is “EXTORTION” as legally defined. The states and not the national government protect private property where I have my domicile. I don’t need you to protect me from THEM. I want THEM to protect me from YOU and the constitution says in Article 4, Section 4, that you are INVADING the states by trying to setup a “benefit” or “social insurance” business there not expressly authorized in the constitution.

“The power of taxation, indispensable to the existence of every civilized government, is exercised upon the assumption of an equivalent rendered to the taxpayer in the protection of his person and property, in adding to the value of such property, or in the creation and maintenance of public conveniences in which he shares — such, for instance, as roads, bridges, sidewalks, pavements, and schools for the education of his children. If the taxing power be in no position to render these services, or otherwise to benefit the person or property taxed, and such property be wholly within the taxing power of another state, to which it may be said to owe an allegiance, and to which it looks for protection, the taxation of such property within the domicil of the owner partakes rather of the nature of an extortion than a tax, and has been repeatedly held by this Court to be beyond the power of the legislature, and a taking of property without due process of law. Railroad Company v. Jackson, 7 Wall. 262 ; State Tax on Foreign-Held Bonds, 15 Wall. 300; Tappan v. Merchants’ National Bank, 19 Wall. 490, 499 ; Delaware &c. R. Co. v. Pennsylvania, 198 U.S. 341, 358 . In Chicago &c. R. Co. v. Chicago, 166 U.S. 226, it was held, after full consideration, that the taking of private property [199 U.S. 203] without compensation was a denial of due process within the Fourteenth Amendment. See also Davidson v. New Orleans, 96 U.S. 97, 102; Missouri Pacific Railway v. Nebraska, 164 U.S. 403, 417; Mt. Hope Cemetery v. Boston, 158 Mass. 509, 519.”

[Union Refrigerator Transit Company v. Kentucky, 199 U.S. 194 (1905)]

________________________________

“With respect to the words general welfare, I have always regarded them as qualified by the detail of powers connected with them. To take them in a literal and unlimited sense would be a metamorphosis of the Constitution into a character which there is a host of proofs was not contemplated by its creator.”

“If Congress can employ money indefinitely to the general welfare, and are the sole and supreme judges of the general welfare, they may take the care of religion into their own hands; they may appoint teachers in every State, county and parish and pay them out of their public treasury; they may take into their own hands the education of children, establishing in like manner schools throughout the Union; they may assume the provision of the poor; they may undertake the regulation of all roads other than post-roads; in short, every thing, from the highest object of state legislation down to the most minute object of police, would be thrown under the power of Congress…. Were the power of Congress to be established in the latitude contended for, it would subvert the very foundations, and transmute the very nature of the limited Government established by the people of America.”

“If Congress can do whatever in their discretion can be done by money, and will promote the general welfare, the government is no longer a limited one possessing enumerated powers, but an indefinite one subject to particular exceptions.”

[James Madison. House of Representatives, February 7, 1792, On the Cod Fishery Bill, granting Bounties]

[Using the Laws of Property to Respond to a Federal or State Tax Collection Notice, Form #14.015]

The United States Isn't a Country. Its a Corporation

O'Donohue v. United States, 289 U.S. 516,53 S.Ct. 740 (1933):

"As the only judicial power vested in Congress is to create courts whose judges shall hold their offices during good behavior, it necessarily follows that, if Congress authorizes the creation of courts and the appointment of judges for limited time, it must act independently of the Constitution upon territory which is not part of the United States within the meaning of the Constitution."

[O'Donohue v. United States, 289 U.S. 516, 53 S.Ct. 740 (1933)]

Valmonte v. I.N.S., 136 F.3d. 914 (C.A.2, 1998)

"The principal issue in this petition is the territorial scope of the term "the United States" in the Citizenship Clause of the Fourteenth Amendment. U.S. Const. amend. XIV, § 1 ("All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside." (emphasis added)). Petitioner, who was born in the Philippines in 1934 during its status as a United States territory, argues she was "born ... in the United States" and is therefore a United States citizen.

Petitioner's argument is relatively novel, having been addressed previously only in the Ninth Circuit. See Rabang v. INS, 35 F.3d 1449, 1452 (9th Cir.1994) ("No court has addressed whether persons born in a United States territory are born 'in the United States,' within the meaning of the Fourteenth Amendment."), cert. denied sub nom. Sanidad v. INS, 515 U.S. 1130, 115 S.Ct. 2554, 132 L.Ed.2d. 809 (1995). In a split decision, the Ninth Circuit held that "birth in the Philippines during the territorial period does not constitute birth 'in the United States' under the Citizenship Clause of the Fourteenth Amendment, and thus does not give rise to United States citizenship." Rabang, 35 F.3d at 1452. We agree.

Despite the novelty of petitioner's argument, the Supreme Court in the Insular Cases provides authoritative guidance on the territorial scope of the term "the United States" in the Fourteenth Amendment. The Insular Cases were a series of Supreme Court decisions that addressed challenges to duties on goods transported from Puerto Rico to the continental United States. Puerto Rico, like the Philippines, had been recently ceded to the United States. The Court considered the territorial scope of the term "the United States" in the Constitution and held that this term as used in the uniformity clause of the Constitution was territorially limited to the states of the Union. U.S. Const. art. I, § 8 ("[A]ll Duties, Imposts and Excises shall be uniform throughout the United States." (emphasis added)); see Downes v. Bidwell, 182 U.S. 244, 251, 21 S.Ct. 770, 773, 45 L.Ed. 1088 (1901) ("[I]t can nowhere be inferred that the territories were considered a part of the United States. The Constitution was created by the people of the United States, as a union of States, to be governed solely by representatives of the States; ... In short, the Constitution deals with States, their people, and their representatives."); Rabang, 35 F.3d at 1452. Puerto Rico was merely a territory "appurtenant and belonging to the United States, but not a part of the United States within the revenue clauses of the Constitution." Downes, 182 U.S. at 287, 21 S.Ct. at 787.

The Court's conclusion in Downes was derived in part by analyzing the territorial scope of the Thirteenth and Fourteenth Amendments. The Thirteenth Amendment prohibits slavery and involuntary servitude "within the United States, or any place subject to their jurisdiction." U.S. Const. amend. XIII, § 1 (emphasis added). The Fourteenth Amendment states that persons "born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside." U.S. Const. amend XIV, § 1 (emphasis added). The disjunctive "or" in the Thirteenth Amendment demonstrates that "there may be places within the jurisdiction of the United States that are no[t] part of the Union" to which the Thirteenth Amendment would apply. Downes, 182 U.S. at 251, 21 S.Ct. at 773. Citizenship under the Fourteenth Amendment, however, "is not extended to persons born in any place 'subject to [the United States '] jurisdiction,' " but is limited to persons born or naturalized in the states of the Union. Downes, 182 U.S. at 251, 21 S.Ct. at 773 (emphasis added); see also id. at 263, 21 S.Ct. at 777 ("[I]n dealing with foreign sovereignties, the term 'United States' has a broader meaning than when used in the Constitution, and includes all territories subject to the jurisdiction of the Federal government, wherever located.").

Following the decisions in the Insular Cases, the Supreme Court confirmed that the Philippines, during its status as a United States territory, was not a part of the United States. See Hooven & Allison Co. v. Evatt, 324 U.S. 652, 678, 65 S.Ct. 870, 883, 89 L.Ed. 1252 (1945) ("As we have seen, [the Philippines] are not a part of the United States in the sense that they are subject to and enjoy the benefits or protection of the Constitution, as do the states which are united by and under it."); see id. at 673-74, 65 S.Ct. at 881 (Philippines "are territories belonging to, but not a part of, the Union of states under the Constitution," and therefore imports "brought from the Philippines into the United States ... are brought from territory, which is not a part of the United States, into the territory of the United States.").

Accordingly, the Supreme Court has observed, without deciding, that persons born in the Philippines prior to its independence in 1946 are not [CONSTITUTIONAL] citizens of the United States. See Barber v. Gonzales, 347 U.S. 637, 639 n. 1, 74 S.Ct. 822, 823 n. 1, 98 L.Ed. 1009 (1954) (stating that although the inhabitants of the Philippines during the territorial period were "nationals" of the United States, they were not "United States citizens"); Rabang v. Boyd, 353 U.S. 427, 432 n. 12, 77 S.Ct. 985, 988 n. 12, 1 L.Ed.2d. 956 (1957) ("The inhabitants of the Islands acquired by the United States during the late war with Spain, not being citizens of the United States, do not possess right of free entry into the United States." (emphasis added) (citation and internal quotation marks omitted)).

Petitioner, notwithstanding this line of Supreme Court authority since the Insular Cases, argues that the Fourteenth Amendment codified English common law principles that birth within the territory or dominion of a sovereign confers citizenship. Because the United States exercised complete sovereignty over the Philippines during its territorial period, petitioner asserts that she is therefore a citizen by virtue of her birth within the territory and dominion of the United States. Petitioner argues that the term "the United States" in the Fourteenth Amendment should be interpreted to mean "within the dominion or territory of the United States." Rabang, 35 F.3d at 1459 (Pregerson, J., dissenting); see United States v. Wong Kim Ark, 169 U.S. 649, 693, 18 S.Ct. 456, 473-74, 42 L.Ed. 890 (1898) (relying on the English common law and holding that the Fourteenth Amendment "affirms the ancient and fundamental rule of citizenship by birth within the territory, in the allegiance and under the protection of the country" (emphasis added)); Inglis v. Sailors' Snug Harbour, 28 U.S. (3 Pet.) 99, 155, 7 L.Ed. 617 (1830) (Story, J., concurring and dissenting) (citizenship is conferred by "birth locally within the dominions of the sovereign; and ... birth within the protection and obedience ... of the sovereign").We decline petitioner's invitation to construe Wong Kim Ark and Inglis so expansively. Neither case is reliable authority for the citizenship principle petitioner would have us adopt. The issue in Wong Kim Ark was whether a child born to alien parents in the United States was a citizen under the Fourteenth Amendment. That the child was born in San Francisco was undisputed and "it [was therefore] unnecessary to define 'territory' rigorously or decide whether 'territory' in its broader sense (i.e. outlying land subject to the jurisdiction of this country) meant 'in the United States' under the Citizenship Clause." Rabang, 35 F.3d at 1454. Similarly, in Inglis, a pre-Fourteenth Amendment decision, the Court considered whether a person, born in the colonies prior to the Declaration of Independence, whose parents remained loyal to England and left the colonies after independence, was a United States citizen for the purpose of inheriting property in the United States. Because the person's birth within the colonies was undisputed, it was unnecessary in that case to consider the territorial scope of common law citizenship.

The question of the Fourteenth Amendment's territorial scope was not before the Court in Wong Kim Ark or Inglis and we will not construe the Court's statements in either case as establishing the citizenship principle that a person born in the outlying territories of the United States is a United States citizen under the Fourteenth Amendment. See Rabang, 35 F.3d at 1454. "[G]eneral expressions, in every opinion, are to be taken in connection with the case in which those expressions are used. If they go beyond the case, they may be respected, but ought not to control the judgment in a subsequent suit when the very point is presented for decision." Cohens v. Virginia, 19 U.S. (6 Wheat.) 264, 399, 5 L.Ed. 257 (1821) (Marshall, C.J.).In sum, persons born in the Philippines during its status as a United States territory were not "born ... in the United States" under the Fourteenth Amendment. Rabang, 35 F.3d at 1453 (Fourteenth Amendment has an "express territorial limitation which prevents its extension to every place over which the government exercises its sovereignty."). Petitioner is therefore not a United States citizen by virtue of her birth in the Philippines during its territorial period.

Petitioner makes several additional arguments that we address and dispose of quickly. First, contrary to petitioner's argument, Congress' classification of the inhabitants of the Philippines as "nationals" during the Philippines' territorial period did not violate the Thirteenth Amendment. The Thirteenth Amendment "proscribe[s] conditions of 'enforced compulsory service of one to another.' " Jobson v. Henne, 355 F.2d. 129, 131 (2d Cir.1966) (quoting Hodges v. United States, 203 U.S. 1, 16, 27 S.Ct. 6, 8, 51 L.Ed. 65 (1906)).

Furthermore, contrary to petitioner's argument, Congress had the authority to classify her as a "national" and then reclassify her as an alien to whom the United States immigration laws would apply. Congress' authority to determine petitioner's political and immigration status was derived from three sources. Under the Constitution, Congress has authority to "make all needful Rules and Regulations respecting the Territory ... belonging to the United States," see U.S. Const. art. IV, § 3, cl. 2, and "[t]o establish an uniform Rule of Naturalization," id. art. I, § 8, cl.4. The Treaty of Paris provided that "the civil rights and political status of the native inhabitants ... shall be determined by Congress." Treaty of Paris, supra, art. IX, 30 Stat. at 1759. This authority was confirmed in Downes where the Supreme Court stated that the "power to acquire territory by treaty implies not only the power to govern such territory, but to prescribe upon what terms the United States will receive its inhabitants, and what their status shall be." Downes, 182 U.S. at 279, 21 S.Ct. at 784; see Rabang v. Boyd, 353 U.S. 427, 432, 77 S.Ct. 985, 988, 1 L.Ed.2d. 956 (1957) (rejecting argument that Congress did not have authority to alter the immigration status of persons born in the Philippines).Congress' reclassification of Philippine "nationals" to alien status under the Philippine Independence Act was not tantamount to a "collective denaturalization" as petitioner contends. See Afroyim v. Rusk, 387 U.S. 253, 257, 87 S.Ct. 1660, 1662, 18 L.Ed.2d. 757 (1967) (holding that Congress has no authority to revoke United States citizenship). Philippine "nationals" of the United States were not naturalized United States citizens. See Manlangit v. INS, 488 F.2d. 1073, 1074 (4th Cir.1973) (holding that Afroyim addressed the rights of a naturalized American citizen and therefore does not stand as a bar to Congress' authority to revoke the non-citizen, "national" status of the Philippine inhabitants).

[Valmonte v. I.N.S., 136 F.3d. 914 (C.A.2, 1998)]

Although this argument was not raised before the immigration judge or on appeal to the BIA, it may be raised for the first time in this petition. See INA, supra, § 106(a)(5), 8 U.S.C. § 1105a(a)(5).For the purpose of deciding this petition, we address only the territorial scope of the phrase "the United States" in the Citizenship Clause. We do not consider the distinct issue of whether citizenship is a "fundamental right" that extends by its own force to the inhabitants of the Philippines under the doctrine of territorial incorporation. Dorr v. United States, 195 U.S. 138, 146, 24 S.Ct. 808, 812, 49 L.Ed. 128 (1904) ("Doubtless Congress, in legislating for the Territories would be subject to those fundamental limitations in favor of personal rights which are formulated in the Constitution and its amendments." (citation and internal quotation marks omitted)); Rabang, 35 F.3d at 1453 n. 8 ("We note that the territorial scope of the phrase 'the United States' is a distinct inquiry from whether a constitutional provision should extend to a territory." (citing Downes v. Bidwell, 182 U.S. 244, 249, 21 S.Ct. 770, 772, 45 L.Ed. 1088 (1901))). The phrase "the United States" is an express territorial limitation on the scope of the Citizenship Clause. Because we determine that the phrase "the United States" did not include the Philippines during its status as a United States territory, we need not determine the application of the Citizenship Clause to the Philippines under the doctrine of territorial incorporation. Cf. United States v. Verdugo-Urquidez, 494 U.S. 259, 291 n. 11, 110 S.Ct. 1056, 1074 n. 11, 108 L.Ed.2d 222 (1990) (Brennan, J., dissenting) (arguing that the Fourth Amendment may be applied extraterritorially, in part, because it does not contain an "express territorial limitation[ ]").

De Lima v. Bidwell, 182 U.S. 1, 21 S.Ct. 743, 45 L.Ed. 1041 (1901); Dooley v. United States, 182 U.S. 222, 21 S.Ct. 762, 45 L.Ed. 1074 (1901); Armstrong v. United States, 182 U.S. 243, 21 S.Ct. 827, 45 L.Ed. 1086 (1901); and Downes v. Bidwell, 182 U.S. 244, 21 S.Ct. 770, 45 L.Ed. 1088 (1901).

Congress, under the Act of February 21, 1871, ch. 62, § 34, 16 Stat. 419, 426, expressly extended the Constitution and federal laws to the District of Columbia. See Downes, 182 U.S. at 261, 21 S.Ct. at 777 (stating that the "mere cession of the District of Columbia" from portions of Virginia and Maryland did not "take [the District of Columbia] out of the United States or from under the aegis of the Constitution.").

This point is well illustrated by the Court's ambiguous pronouncements on the territorial scope of common law citizenship. See Rabang, 35 F.3d at 1454; compare Wong Kim Ark, 169 U.S. at 658, 18 S.Ct. at 460 (under the English common law, "every child born in England of alien parents was a natural-born subject" (emphasis added)), and id. at 661, 18 S.Ct. at 462 ("Persons who are born in a country are generally deemed citizens and subjects of that country." (citation and internal quotation marks omitted; emphasis added)), with id. at 667, 18 S.Ct. at 464 (citizenship is conferred by "birth within the dominion").

De Lima v. Bidwell, 182 U.S. 1 (1901)

“There is no boundary to the Constitution other than the whole sphere of the activity of the Federal Government. Outside of that sphere, beyond that boundary, the Federal Government can only act by usurpation — a government of force — not of law, and officials assuming to act for the United States outside of the prescriptions of the Constitution are, however well intentioned, outside of the law.”)

[. . .]

“In the Pinckney draft of the Constitution, evidently with a view to make clear one of the meanings of the term "United States" as used in the Constitution, appears the following: "The United States shall be forever considered as one body corporate in law, and entitled to all the rights and privileges which to bodies corporate do, or ought to, appertain." That it has, however, a third meaning, is also evident. It means not only the States united and the body corporate or governmental power which represents them, but it means — and this is its ordinary meaning in the language of the day — that whole portion of the earth's surface over which the flag of the United States flies in sovereign dominion.”

[De Lima v. Bidwell, 182 U.S. 1 (1901)]

American Jurisprudence 2d, Volume 77, Section 2: "United States"

"[T]he term 'United States' has a broader meaning than when used in the Constitution, and includes all territories subject to the jurisdiction of the Federal Government wherever located."

[77 Am.Jur.2d, §2, "United States"]

19 Corpus Juris Secundum

(CJS) §§883-884 (Publication date 2003): Foreign Corporations-The United States government is a foreign corporation with respect to a state.

19 Corpus Juris Secundum

(CJS) §§883-884 (Publication date 2003): Foreign Corporations-The United States government is a foreign corporation with respect to a state.

U. S. v. Curtis-Wright Corp., 299 U. S. 304, 57 S. Ct. 216 (1936).

"With respect to the free white de jure citizens of the States the United States is sovereign in respect to foreign affairs; domestically only powers granted or reasonably implied from the Constitution LIMIT its sovereignty to certain specific spheres."

Hooven & Allison Co. v. Evatt, 324 U.S. 652, (1945)

"The term 'United States' may be used in any one of several senses. [Definition 1, abbreviated "United States*" in our Great IRS Hoax book] It may be merely the name of a sovereign occupying the position analogous to that of other sovereigns in the family of nations. [Definition 2, abbreviated "United States**" or "federal United States" or "federal zone" in our Great IRS Hoax book] It may designate the territory over which the sovereignty of the United States extends, or [Definition 3, abbreviated "United States***" in our Great IRS Hoax book] it may be the collective name of the states which are united by and under the Constitution."

[WARNING: You should NOT assume or presume that when you see the term "United States" used in a law, that it simultaneously has ALL the above three definitions associated with it. The definition depends on the context it is used, and as you can see from the article below, if it is the Constitution, then it implies Definitions 1 and 3 above, while if it is a federal statute or an "Act of Congress", it instead implies only Definition 2 above in most cases.]

United States-Definition from Wikipedia Online Encyclopedia

Helvering v. Stockholms c. Bank, 293 U.S. 84, 91-93 (1934)

“Second. Is the United States a resident within the meaning of the words "residents, corporate or otherwise"? We thinks it is. It many times has been held that the United States or a state is a "person" within the meaning of statutory provisions applying only to persons. See Ohio v. Helvering, 292 U.S. 360, 370, and cases cited. In Martin v. State, 24 Tex. 61, 68, this was held in respect of a criminal statute, notwithstanding the general rule that such statutes are to be construed strictly. The statute there penalized the false making or fraudulent alteration of a public record when done "with intent that any person be defrauded." The state supreme court held that the state was to be taken as a "person" within the meaning of the statute, and one who made the entry with intent to defraud the state violated the statute. The Texas decision was expressly followed by this court in Stanley v. Schwalby, 147 U.S. 508, 517, where it was held that the word "person" used in the statute there under consideration would include the United States "as a body politic and corporate." Blackstone, writing on the rights of persons (1 Bl. 123) says: "Persons also are divided by the law into either natural persons, or artificial. Natural persons are such as the God of nature formed us; artificial are such as are created and devised by human laws for the purposes of society and government, which are called corporations or bodies politic." While it cannot be said that the United States, in its corporate capacity as an artificial person, has a bodily presence in any place, it is not unreasonable to hold that in the eye of the law, it has a residence, and especially so when a contrary holding would defeat the evident purpose of a statute. This may be in the nature of a legal fiction; but legal fictions have an appropriate place in the administration of the law when they are required by the demands of convenience and justice. Thus, intangible personal property has been held to have a situs at the domicile of the owner, although intangibles ordinarily have no actual situs and the paper evidence of their existence may be elsewhere. First National Bank v. Maine, 284 U.S. 312, 328-329. If to carry out the purpose of a statute it be admissible to construe the word "person" as including the United States, it is hard to see why, in like circumstances, it is inadmissible to construe the word "resident" as likewise including the United States.”

[Helvering v. Stockholms c. Bank, 293 U.S. 84, 91-93 (1934)]

[EDITORIAL: The United States is a PERSON, according to SCOTUS, and can have a RESIDENCE]

Helvering v. Stockholms c. Bank, 293 U.S. 84, 93-94 (1934)

“In the foregoing discussion, we have not been unmindful of the rule, frequently stated by this court, that taxing acts "are not to be extended by implication beyond the clear import of the language used," and that doubts are to be resolved against the government and in favor of the taxpayer. The rule is a salutary one, but it does not apply here. The intention of the lawmaker controls in the construction of taxing acts as it does in the construction of other statutes, and that intention is to be ascertained, not by taking the word or clause in question from its setting and viewing it apart, but by considering it is connection with the context, the general purposes of the statute in which it is found, the occasion and circumstances of its use, and other appropriate tests for the ascertainment of the legislative will. Compare Rein v. Lane, L.R. 2 Q.B. Cases 144, 151. The intention being thus disclosed, it is enough that the word or clause is reasonably susceptible of a meaning consonant therewith, whatever might be its meaning in another and different connection. We are not at liberty to reject the meaning so established and adopt another lying outside the intention of the legislature, simply because the latter would release the taxpayer or bear less heavily against him. To do so would be not to resolve a doubt not in his favor, but to say that the statute does not mean what it means.”

“"The rule of strict construction is not violated by permitting the words of a statute to have their full meaning, or the more extended of two meanings. The words are not to be bent one way or the other, but to be taken in the sense which will best manifest the legislative intent. United States v. Hartwell, 6 Wall. 385, 396; United States v. Corbett, 215 U.S. 233, 242." Sacramento Nav. Co. v. Salz, 273 U.S. 326, 329. The rule of strict construction applies to penal laws, but such laws are not to be construed so strictly as to defeat the obvious intention of the legislature; or so applied as to narrow the words of the statute to the exclusion of cases which those words, in the sense that the legislature has obviously used them, would comprehend. United States v. Wiltberger, 5 Wheat. 76, 95. That view, expressed by Chief Justice Marshall, has since been frequently followed by this court. See, for example, American Fur Co. v. United States, 2 Pet. 358, 367; United States v. Morris, 14 Pet. 646, 475; United States v. Hartwell, supra, 395-6; Donnelley v. United States, 276 U.S. 505, 512.”

[Helvering v. Stockholms c. Bank, 293 U.S. 84, 93-94 (1934)][EDITORIAL: Context is very important]

THE DEFINITION OF "UNITED STATES" -LANGDELL'S ARTICLE "THE STATUS OF OUR NEW TERRITORIES"

The supreme court case of Hooven & Allison Co. v. Evatt, 324 U.S. 653 (1945) is often cited within the tax honesty movement for the definition of the term "United States" ...

"The term 'United States' may be used in any one of several senses. [Definition 1, abbreviated "United States*" in our Great IRS Hoax book] It may be merely the name of a sovereign occupying the position analogous to that of other sovereigns in the family of nations. [Definition 2, abbreviated "United States**" or "federal United States" or "federal zone" in our Great IRS Hoax book] It may designate the territory over which the sovereignty of the United States extends, or [Definition 3, abbreviated "United States***" in our Great IRS Hoax book] it may be the collective name of the states which are united by and under the Constitution. (6)"Hooven, supra

There is a footnote to the Hooven cite:

[ Footnote 6 ] See Langdell, 'The Status of our New Territories', 12 Harv.L.Rev. 365, 371; see also Thayer, 'Our New Possessions', 12 Harv.L.Rev. 464; Thayer, 'The Insular Tariff Cases in the Supreme Court', 15 Harv.L.Rev. 164; Littlefield, 'The Insular Cases', 15 Harv.L.Rev. 169, 281.

The first article cited by the Supreme Court is the one relied on for the definition of the term "United States." Therefore, knowing what this article has to say would give the proper interpretation of the definitions mentioned by the court.

THE STATUS OF OUR NEW TERRITORIES

What extent of territory do the United States of America comprise? In order to answer this question intelligently, it is necessary to ascertain the meaning of the term "United States."

[Definition 3 in Hooven & Allison above] First. -- It is the collective name of the States which are united together by and under the Constitution of the United States; and, prior to the adoption of that Constitution, and subsequently to the Declaration of Independence, it was the collective name of the thirteen States which made that declaration, and which from the time of the adoption of the Articles of Confederation to that of the adoption of the Constitution, were united together by and under the former. This, moreover, is the original, natural, and literal meaning of the term. Between the time of the first meeting of the Continental Congress, and that of the Declaration of Independence, the term "United Colonies" came into general use, and, upon independence being declared, as the thirteen colonies became the thirteen States, the term was of course changed to "United States." In the declaration of Independence both terms are used. When the articles of Confederation were framed, "United States of America" was declared to be the name and style of the confederation created by those articles. This, however, had no other effect than to confirm the existing practice, and to increase the use of the term in the sense which it had already acquired; and accordingly, during the whole period of Confederation, "United States" meant the same as "the thirteen United States," and the primary reason for using either term was to save the necessity of enumerating the thirteen States by name.

Indeed, the Articles of Confederation were merely an agreement between the thirteen States in their corporate capacity, or, more correctly, an agreement by each of the thirteen States with all the others. There were, therefore, thirteen parties to the confederation, and no more, and the people of the different States as individuals had directly no relations with it. Accordingly, it was the States in their corporate capacity that voted in the Continental Congress, and not the individual members of the Congress; and hence the voting power of a State did not at all depend upon the number of its delegates in Congress, and in fact each State was left to determine for itself, within certain limits, how many delegates it would send. Hence also each State had the same voting power. Even the style of the Continental Congress was "The United States in Congress assembled," -- not (as the present style would suggest) "The Delegates of the United States in Congress assembled"; and if the style had been "The Thirteen United States in Congress assembled," the meaning would have been precisely the same.

Evidence to the same effect, as to the sense in which the term "United States" was used prior to the time of the adoption of the Constitution, is furnished by the treaties made during the period of the Confederation. Thus, the Treaty of Alliance made with France, February 6, 1778, begins: "The Most Christian King and the United States of North America, New Hampshire," etc. So the Treaty of Amity and Commerce made with Holland, October 8, 1782, begins: "Their High Mightinesses, the States-General of the United Netherlands, and the United States of America, namely, New Hampshire," etc. Sot the Treaty of Amity and Commerce made with Sweden, April 3, 1783, begins: "The King of Sweden and the thirteen United States of North America, namely, New Hampshire," etc. Lastly, the Definitive Treaty of Peace with England, September 3, 1783, by which our independence was established, after a recital, proceeds thus: "Art. I. His Britannic Majesty acknowledges the said United States, namely, New Hampshire, &c., to be free, sovereign and independent States; that he treats with them as such; and relinquishes all clams to the government, propriety, and territorial rights."

With the adoption of the Constitution there came a great change; for the Constitution was not an agreement, but a law, -- a law, too, superior to all other laws, coming as it did from the ultimate source of all laws, namely, the people, and being expressly declared by them to be the supreme law of the land. At the same time, however, it neither destroyed not consolidated the States, nor even affected their integrity; and though it was established by the people of the United States; yet it was not established by them as one people, nor was its establishment a single act; but on the contrary, its establishment in each State was the act of the people of that State; and if the people of any State had finally refused to ratify and adopt it, the consequence would have been that that State would have ceased to be one of the United States. Indeed, the Constitution and the Articles of Confederation differ from each other, in respect to the source of their authority, in one particular only, namely, that, while the former proceeded from the people of each State, the latter proceeded from the Legislature of each State. In respect to their effect and operation also, the two instruments differ from each other in one particular way only, namely, that, while the Articles of Confederation merely imposed an obligation upon each State, in its corporate and sovereign capacity, in favor of the twelve other States, the Constitution binds as a law, not each State, but all persons and property in each State. These differences, moreover, fundamental and important as they undoubtedly are, do not, nor does either of them , at all affect either the meaning or use of the term "United States"; and therefore, the conclusion is that the meaning or the use of the term had the day after Independence was declared, it still retains, and that this is its natural and literal meaning.

Regarded, then, as simply the collective names of the States, do the United States comprise territory? Directly, they certainly do not; indirectly, they do comprise the territory of the forty-five States, and no more. That they comprise this territory only indirectly, appears from the fact that such territory will always be identified with the territory of all the States in the aggregate, -- will increase as that increases, and diminish as that diminishes.

[Definition 1 in Hooven & Allison above] Secondly. -- Since the adoption of the Constitution, the term "United States" has been the name of the sovereign, and that sovereign occupies a position analogous to that of the personal sovereignties of most European countries. Indeed the analogy between them is close, at least in one respect, than at first sight appears; for a natural person who is also a sovereign has two personalities, one natural, the other artificial and legal, and it is the latter that is sovereign. It is as true, therefore, of England (for example) as it is of this country, that her sovereign is an artificial and legal person (i.e., a body politic and corporate), and, therefore, never dies. The difference between the two sovereigns is, that, while the former consists of a single person, the latter consists of many persons, each of whom is a member of the body politic. In short, while the former is a corporation sole, the latter is a corporation aggregate.

Who, then, are those persons of whom the United States as a body politic consists, and who constitute its members? Clearly, they must be either the States in their corporate capacity, i.e., artificial and legal persons, or the citizens of all the States in the aggregate; and it is not difficult to see that they are the former. Indeed, the latter do not form a political unit for any purpose. The citizens of each State form the body politic of that State, and the States form the body politic of the United States. The latter, therefore, consisted at first of the original thirteen States, just as the Confederation did; but, as often as a new State was admitted, a new member was received into the body politic, -- which, therefore, now consists of forty-five members. It will be seen, therefore, that, while the United States, in its second sense, signifies the body politic created by the Constitution, in its first sense it signifies the members of that body politic in the aggregate. A consequence is that, while in its first sense the term "United States" is always plural, in its second sense it is in strictness always singular.

The State of New York furnishes a good illustration of the two senses in which the term "United States" is used under the Constitution; for the style of that State, as a body politic, is "The People of the State of New York," and the members of that body politic are the citizens of the State. The term "people," therefore, in that State, means, first, all the citizens of the State in the aggregate (i.e., the members of the body politic), and secondly, the body politic itself; and while in the former sense it is plural, in the latter sense it is singular.

The term "United States" is used in its second sense whenever it is used for the purpose of expressing legal or political relations between the United States and the particular States, or between the former and foreign sovereigns or states, or legal relations between the former and private persons, while it is used in its first and original sense whenever it is desired to designate the particular States collectively, either as such or as members of the body politic of the United States It is also used in that sense whenever it is used to designate the territory of all the States in the aggregate.

As a substitute for the term "United States," when used in its second sense, the term "Union" is often employed. The original difference between "United States" and "Union" was that, while the former was concrete, the latter was abstract; and hence it is that the latter cannot be substituted for the former when used in its original sense.

When used in its second sense, it is plain that the term "United States" has no reference to extent of territory, either directly or indirectly. Regarded as a body politic, the United States may and does own territory, and may be and is a sovereign over territory, but to speak of its constituting or comprising territory would be no less absurd than to predicate the same thing of a personal sovereign, though the absurdity would be less obvious.

[Definition 2 in Hooven & Allison above] Thirdly. -- Since the treaty with England of September 3, 1783, the term "United States" has often been used to designate all territory over which the sovereignty of the United States extended [under Article 1, Section 8, Clause 17 of the federal Constitution]. The occasion for so using the term could not of course arise until the United States acquired the sovereignty over territory outside the limits of any State, and they first acquired such territory by the treaty just referred to . For although, as has been said, that treaty was made with each of the thirteen States, yet, in fixing the boundaries, the thirteen States were treated as constituting one country, England not being interested in the question how that country should be divided among the several States. Moreover, the boundaries established by the treaty embraced a considerable amount of territory in the Northwest to which no State had any separate claim, and which, therefore, belonged to the united States; and the territory thus acquired was enlarged from time to time by cessions from different States, until at length it embraced the entire region within the limits of the treaty, and west of Pennsylvania, Virginia, North Carolina, and Georgia, as the western boundaries of those States were afterwards established, with the exception of the territory now constituting the States of Kentucky. Then followed in succession the acquisitions from France, Spain, Texas, and Mexico. Out of all the territory thus acquired, twenty-eight great States have been from time to time carved; and yet there has never been a time, since the date of the treaty before referred to, when the United States had not a considerable amount of territory outside the limits of the any State.

It is plain, therefore, that for one hundred and fifteen years there has been more or less need of some word or term by which to designate as well the territories of the United States as the States themselves; and such word or term ought, moreover to have been one signifying directly not territory, but sovereignty, sovereignty being the only thing that can be predicated alike of States and territories. The same need was long since felt by England as well as by other European countries, and the word "empire" was adopted to satisfy it; and perhaps we should have adopted the same word, if we had felt the need of a new word or term more strongly. Two peculiarities have, however, hitherto characterized the territory held by the United States outside the limits of any State: first, such territory has been a virtual wilderness; secondly, it has been looked upon merely as material out of which new States were to be carved just as soon as there was sufficient population to warrant the taking of such a step; and hence the need of a single term which would embrace territories as well as States has not been greatly felt. At all events, no such term has been adopted; and hence "United States" is the only term we have had to designate collectively either the States alone, or the States and territories; and accordingly, while it has always been used for the former of these two purposes, it has also been used for the latter.

It is very important, however, to understand that the use of the term "United States" to designate all territory over which the United States is sovereign, is, like the similar use of the word "empire" in England and other European countries, purely conventional; and that it has, therefore, no legal or constitutional significance. Indeed, this use of the term has no connection whatever with the Constitution of the United States, and the occasion for it would have been precisely the same if the Articles of Confederation had remained in force to the present day, assuming that, in other respects, our history had been what is has been.

The conclusion, therefore, is that, while the term "United States" has three meanings, only the first and second of these are known to the Constitution; and that is equivalent to saying that the Constitution of the United States as such does not extend beyond the limits of the States which are united by and under it, -- a proposition the truth of which will, it is believed, be placed beyond doubt by an examination of the instances in which the term "United States" is used in the Constitution.

Its use first occurs in the preamble, in which it is used twice. The first time it is plainly used in its original sense, i.e., as the collective name of the States which should adopt it. If the words had been "We, the people of the thirteen United States respectively," the sense in which "United States" was used would have been precisely the same. Nor is there any doubt that it is used in the same sense at the end of the preamble. Of course there is a very strong presumption that when a constitution is made by a sovereign people, it is made exclusively for the country inhabited by that people, and exclusively for that people regarded as a body politic, and so having perpetual succession; and the same is true, mutatis mutandis, of a constitution made by the people of the several sovereign States united together for that purpose. The preamble, however, does not leave it to presumption to determine for what regions of country and what people the Constitution of the United States was made; for it expressly declares that its purposes and objects are, first, to form a more perfect union (i.e., among the thirteen States, or as many of them as shall adopt it). The follow four other objects which, though in terms indefinite as to their territorial scope, are by clear implication limited to the same States; and lastly its purpose and object are declared to be to secure the blessings of liberty to the people by whom it is ordained and established, and their successors; for though the word is "posterity," it is clearly not used with literal accuracy, but in the sense of "successors." According to the preamble, therefore, the Constitution is limited to the thirteen States which were united under the Articles of Confederation; and it is by virtue of Art. 4, sect. 3, subsect. I, and in spite of the preamble, that new States have been admitted upon an equal footing with the original thirteen.

In the phrases, "Congress of the United States," "Senate of the United States," "President of the United States," or "Vice president of the United States," "office under the United States," "officers of the United States," "on the credit of the United States," "securities and current coin of the United States," "service of the United States," "government of the United States," "granted by the United States," "Treasury of the United States," "Constitution of the United States," "army and navy of the United States," "offences against the United States," "judicial power of the United States," "laws of the United States," "controversies to which the United States shall be a party," "treason against the United States," "territory or other property belonging to the United States," "claims of the United States," "the United States shall guarantee," "shall be valid against the United States," "under the authority of the United States," "court of the United States," "delegated to the United States," "public debt of the United States," "insurrection or rebellion against the United States," "shall not be denied or abridged by the United States," "neither the United States nor any State shall assume or pay," the term "United States is used in its second sense [as the name of the sovereign.] It seems also to be used in the same sense in the phrase "citizen of the United States;" for it is only as a unit, a body politic, and a sovereign, that the United States can have citizens, - not as the collective name of forty-five States. In the phrase, "common defence and general welfare of the United States," it seems to be used in its first or original sense, [the States united under the Constitution] especially as "common defence" and "general welfare" are taken from the preamble. Certainly there is no pretence for saying it is used in its third sense [territory over which the sovereignty of the United States extends.] In the phrase "throughout the United States," there is believed to be no doubt that it is used in its original sense, though it may be claimed that it is used in the third sense. That it is used in its original sense in one instance is certain; and when the phrase is used in different parts of the Constitution, a strong presumption arises that it is always used in the same sense.

In the phrase, "resident within the United States," there can be no doubt that "United States" is used in its original sense, the meaning being the same as if the words had been, "resident in one or more of the United States."

The phrase, "one of the United States," affords a good instance of the use of the "United States" in its original sense.

In the phrase, "shall not receive any other emolument from the United States or any one of them," it is certain that "United States" is used in its second sense, though it is also certain that the draughtsman supposed he was using it in its original sense.

In the phrase, "all persons born or naturalized in the United States," it seems clear that "United States" is used in its original sense; for, first, it is either used in that sense, or in its third sense, and as the latter is not a constitutional or legal sense, there is a presumption that the term is not used in that sense in an amendment of the Constitution; secondly, it is declared that the same persons shall be citizens of the State in which they reside, and this shows that the authors of the amendment contemplated only States, for, if they would have contemplated Territories as well, they would have said "citizen of the State or Territory in which they reside"; thirdly, the whole of the 14th Amendment had reference exclusively to the then late war, and was designed to secure its results, - in particular to secure to persons of African descent certain political rights, and to take from the States respectively in they might reside the power to deprive them of those rights. Moreover, the amendment consists mainly of prohibitions, and these are all (with a single exception which need not be mentioned) aimed exclusively against the States. It was no part of the object of the amendment to restrain the power of Congress (which its authors did not distrust), and hence there was no practical reason for extending its operations to the Territories, in which all the power resided in Congress. What is the true meaning of the "United States" in the phrase under consideration is certainly a question of great moment, for on its answer depends the question whether all persons hereafter born in any of our recently acquired islands will be by birth citizens of the United States.

The foregoing comprise all the instances but one in which the term "United States" is used either in the original Constitution, or in any of its amendments. The other instance is found in the 13th Amendment, - in which "United States" is plainly used in its original sense, if the words which follow it are to have any meaning; and yet, if the authors of that amendment had understood the term "United States," when used in the Constitution to express extent of territory, had its third meaning, they would have omitted the words, "or any place subject to their jurisdiction."

Harvard Law Review - Vol. XII, NO. 6 - January 25, 1899

How many of the “Secrets” of 28 U.S.C. Section 1746 can you find in that section?

- The United States is only federal territory.

- The United States of America is the government of the States.

- The law of the United States is federal law in federal territory and Washington, D. C.

- Outside the United States means outside federal territory or outside Washington, D. C.

- Federal law applies to federal territory and property without an oath.

- Federal law can only apply to a human being by an oath taken by or given by another human.

- The law of the United States of America is government law of the States.

- The English common law does not require an oath.

- The English common law is not part of the Constitution.

TITLE 28--JUDICIARY AND JUDICIAL PROCEDURE

PART V--PROCEDURE

CHAPTER 115--EVIDENCE; DOCUMENTARY

Title 28 U.S.C. Sec. 1746. Unsworn declarations under penalty of perjury