"income" defined-NOTE: It must FIRST be "income" in order to be "gross income"!

Commissioner v. Duberstein, 363 U.S. 278 (1960):

"The exclusion of property acquired by gift from gross income under the federal income tax laws was made in the first income tax statute 4 passed under the authority of the Sixteenth Amendment, and has been a feature of the income tax statutes ever since. The meaning of the term "gift" as applied to particular transfers has always been a matter of contention. 5 Specific and illuminating legislative history on the point does not appear to exist. Analogies and inferences drawn from other revenue provisions, such as the estate and gift taxes, are dubious. See Lockard v. Commissioner, 166 F.2d 409. The meaning of the statutory term has been shaped largely by the decisional law."

26 U.S.C.A.

954 (1928): Gross Income (2.28 Mbytes)

26 U.S.C.A.

954 (1928): Gross Income (2.28 Mbytes)

26 U.S.C.A.

22 (1935): Gross Income (5.17 Mbytes)

26 U.S.C.A.

22 (1935): Gross Income (5.17 Mbytes)

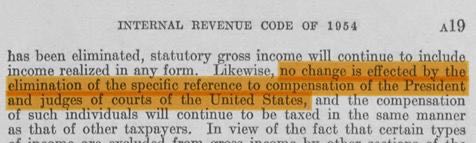

House Report 83-1337: Internal Revenue Code of 1954. Report of the Committee on Ways and Means, House of Representatives to accompany H.R. 8300 a bill to revise the internal revenue laws of the United States. March 9, 1954. -- Committed to the Committee of the Whole House on the State of the Union and ordered to be printed, Dec. 2, 1954

House Report 83-1337: Internal Revenue Code of 1954. Report of the Committee on Ways and Means, House of Representatives to accompany H.R. 8300 a bill to revise the internal revenue laws of the United States. March 9, 1954. -- Committed to the Committee of the Whole House on the State of the Union and ordered to be printed, Dec. 2, 1954;

SOURCE: https://www.govinfo.gov/app/details/SERIALSET-11746_00_00-002-1337-0000/context[EDITORIAL: That they had to remove the 22a provision about judges and president due to it not being Constitutional.....as to not sweep it under the rug, and to take the opportunity to gaslight the judges and public alike, they issued a peculiar statement in a congressional report about how we should interpret the removal of that provision....

To us the statement makes no sense when taking into consideration the old 22a, especially since they refer to "other taxpayers" who previously were not taxed on their compensation. They want you believe they are speaking of "no change" in regards to judges compensation but what I believe they are really referring to here is that there has been "no change" to the taxation of compensation generally and that judges are now taxed in the same fashion as other taxpayers, which is to say NOT AT ALL as the constitutional definition of income would have it all along!

Code of 1954:

"SEC. 7851. APPLICABILITY OF REVENUE LAWS.

(a) GENERAL RULES.—Except as otherwise provided in any section of this title—(1) SUBTITLE A.—

(A) Chapters 1, 2, 4, and 6 of this title shall apply only with respect to taxable years beginning after December 31, 1953, and ending after the date of enactment of this title, and with respect

to such taxable years, chapters 1 (except sections 143 and 144) and 2, and section 3801, of the Internal Revenue Code of 1939 are hereby repealed."Yes “broadly” NO ONE is required to include their compensation but they can if they want!

"Section 61. Gross income defined

This section corresponds to section 22 (a) of the 1939 Code. While the language in existing section 22 (a) has been simplified, the all inclusive nature of statutory gross income has not been affected".

How clever is that! The report was released before the bill was passed so they were able to use the word "existing" which is very suggestive when read after passing of the new code, even though the new code repeals the old 22a.

And whereas 1939 was repealed with 1954 they cannot coexist with any level of effectiveness. Clever.

The report was written and published before the passing of the new code so they were able to correctly use that word at the time.]

Clark v. United States, 211 F.2d 100, 102 (8th Cir. 1954)

“Of course, gross income and not gross receipts is the foundation of income-tax liability, for it is only earnings, profits and gains which the statute subjects to tax. And manifestly, gross receipts can not be called gross income, insofar as they consist of borrowings of capital, returns of capital, or any of the other items which section 22 of the Internal Revenue Code, 26 U.S.C.A. § 22, has excluded from gross income. But when all of these things have duly been taken into account, no matter by what process it has been done, the amount remaining of Gross Receipts necessarily may, in its character as a result, properly reflect the taxpayer's Gross Income, which it is his duty to report.”

[Clark v. United States, 211 F.2d. 100, 102 (8th Cir. 1954)]

26 U.S.C. 61 Gross Income Defined

(a) General definition

Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items:

(1) Compensation for services, including fees, commissions, fringe benefits, and similar items;

(2)Gross income derived from business;

(3) Gains derived from dealings in property;

(4) Interest;

(5) Rents;

(6) Royalties;

(7) Dividends;

(8) Annuities;

(9) Income from life insurance and endowment contracts;

(10) Pensions;

(11) Income from discharge of indebtedness;

(12)Distributive share of partnership gross income;

(13) Income in respect of a decedent; and

(b) Cross references

For items specifically included in gross income, see part II (sec. 71 and following). For items specifically excluded from gross income, see part III (sec. 101 and following).

(Aug. 16, 1954, ch. 736, 68A Stat. 17; Pub. L. 98–369, div. A, title V, § 531(c), July 18, 1984, 98 Stat. 884; Pub. L. 115–97, title I, § 11051(b)(1)(A), Dec. 22, 2017, 131 Stat. 2089.)

NOTE: The above so-called "definition" uses "gross income" to define ITSELF. Therefore, it is a tautology. A tautology is a definition that uses itself to define a word. A definition that uses a "tautology" is not a definition AT ALL and therefore cannot be trusted! Also, The above does not define "income". The Rules of Statutory Construction and interpretation require that when a word is not defined, the ordinary meaning is implied. In an ordinary sense, "income" means earnings, however, the courts have ruled that "income" does NOT mean everthing you make!

The phrase "whatever source derived" appearing above comes from the Sixteenth Amendment, but that amendment conferred NO NEW TAXING POWERS! See:

The term "income", according to the U.S. Supreme Court, cannot be defined by Congress, but by the Constitution. That is why there is no statutory definition. Below is that definition issued AFTER the Sixteenth Amendment was fraudulently ratified:

There is only ONE definition of "Income" in the Internal Revenue Code, at 26 U.S.C. §643(b), but that definition excludes "gross income" from its definition:

We must therefore conclude that there is a definition of "income", and that it means gains or profits from corporate activities. Anyone who wishes to challenge this definition has the burden of proving that it EXPRESSLY includes anything OTHER than the above. Absent court admissible proof, they are committing fraud and violating due process of law by presumption. For details on "due process of law", see:

Compensation FOR services is clearly a fundamentally different thing from gains derived FROM this or that source. “For” is obviously not the same thing as “from”. “For” in “compensation for services” suggests an exchange of things that have equal value, a quid pro quo. You swap one thing for another thing of equal value (if it’s not of equal value, why would you swap?) But a gain or income or anything else DERIVED FROM a source by definition cannot be the same thing as the source. The classic analogy is fruit from a tree. I think a better analogy is that wine is derived from grapes. But a tax on wine derived from grapes cannot be construed to be a tax on grapes. So compensation for services might be a source of profits for say, a law firm that brings in revenue in the form of compensation for the services of its attorneys. The profits are income, but the compensation is only a source. The clue is in the word “for”. It can’t be automatically assumed that the gross receipts you got FOR your car you just sold are income. There is a computation involved to determine profit. There is no computation involved in compensation for services. The value of the services is what someone is willing to pay for them. They might pay less than that! But they are very unlikely to pay you more than what they think your services are worth. And even if they do, that is just hypothetical—the true value is measured by what they paid. That’s the amount they are permitted to deduct as a business expense. It is absurd to pretend that there is no value in someone’s labor or services in order to pretend that all gross receipts obtained in exchange for that labor somehow constitute “profits, gains or income”. If there was no value, no one would be paying for it, or the payment would not be deemed a legitimate business expense to the payer but only a gift. |

Adkins v. Children's Hospital of DC, 261 US 525 (1923)

Certainly the employer by paying a fair equivalent for the service rendered, though not sufficient to support the employee, has neither caused nor contributed to her poverty. On the contrary, to the extent of what he pays he has relieved it. In principle, there can be no difference between the case of selling labor and the case of selling goods. If one goes to the butcher, the baker or grocer to buy food, he is morally entitled to obtain the worth of his money but he is not entitled to more. If what he gets is worth what he pays he is not justified in demanding 559*559 more simply because he needs more; and the shopkeeper, having dealt fairly and honestly in that transaction, is not concerned in any peculiar sense with the question of his customer's necessities. Should a statute undertake to vest in a commission power to determine the quantity of food necessary for individual support and require the shopkeeper, if he sell to the individual at all, to furnish that quantity at not more than a fixed maximum, it would undoubtedly fall before the constitutional test. The fallacy of any argument in support of the validity of such a statute would be quickly exposed. The argument in support of that now being considered is equally fallacious, though the weakness of it may not be so plain. A statute requiring an employer to pay in money, to pay at prescribed and regular intervals, to pay the value of the services rendered, even to pay with fair relation to the extent of the benefit obtained from the service, would be understandable. But a statute which prescribes payment without regard to any of those things and solely with relation to circumstances apart from the contract of employment, the business affected by it and the work done under it, is so clearly the product of a naked, arbitrary exercise of power that it cannot be allowed to stand under the Constitution of the United States.

26 C.F.R. §1.61-2

(a) In general.

(1) Wages, salaries, commissions paid salesmen, compensation for services on the basis of a percentage of profits, commissions on insurance premiums, tips, bonuses (including Christmas bonuses), termination or severance pay, rewards, jury fees, marriage fees and other contributions received by a clergyman for services, pay of persons in the military or naval forces of the United States, retired pay of employees, pensions, and retirement allowances are income to the recipients unless excluded by law. Several special rules apply to members of the Armed Forces, National Oceanic and Atmospheric Administration, and Public Health Service of the United States; see paragraph (b) of this section.

[EDITORIAL: WHY is this PLURAL? Why do they even need the phrase "to the recipients" at all? Because we might get confused and think those things are income to the PAYER? This is a subtle recognition of the strawman--IT and you the living man in the corporation sole are potential "recipients" of wages or salary that MIGHT be included in "income". The reason the language "to the recipient" is there in this provision is in recognition of the recipient's RIGHT to determine if his wage or salary he received is "excluded by law." The recipient is obviously the one who would be doing the "excluding by law" though the sentence is framed so as to sound like the law ITSELF might establish the exclusion. Of course this provision is written to give the impression that you must prove a negative i.e. that a wage or salary is "excluded by law". But of course you need not prove a negative. A party who claims your wage or salary is INLCUDED in income properly has the burden of proof. If this provision were written more honestly, it would say "wages and salaries are NOT income to the recipients UNLESS included by the recipients in their reported "gross income". That is how wages and salaries actually BECOME "gross income"--otherwise they cannot qualify as "income" let alone "gross income" because they are not a gain or profit derived from a source. The "by law" part of "exclude by law" made me think a bit. I think it is phrased that way to make it clear that the exclusion must be LAWFUL--as in an exclusion made by a taxpayer who comprehends his RIGHT to exclude these things from income, not just someone who decides to NOT report these things as "income" with a dishonest intent. Intent is an essential element of the crime of filing false information under 26 USC 7206; the objective truth does not even matter--the crime is due to the filer of a return or document subscribed under the penalties of perjury (another clue that this is all contractual--as there is clearly more than one penalty for perjury, notwithstanding the Constitutional restriction on double-jeopardy) "which he does not BELIEVE TO BE TRUE AND CORRECT as to every material matter" So the phrase "unless excluded by law" could be translated as "unless the recipients know what they are talking about and know that they have the RIGHT to exclude wages and salary from income".]

26 C.F.R. §1.861-4

§ 1.861-4 Compensation for labor or personal services.(a) Compensation for labor or personal services performed wholly within the United States.

(1) Generally, compensation for labor or personal services, including fees, commissions, fringe benefits, and similar items, performed wholly within the United States is gross income from sources within the United States.

(i) The labor or services are performed by a nonresident alien individual temporarily present in the United States for a period or periods not exceeding a total of 90 days during his taxable year,

(ii) The compensation for such labor or services does not exceed in the aggregate a gross amount of $3,000, and

(iii) The compensation is for labor or services performed as an employee of, or under any form of contract with -

(a) A nonresident alien individual, foreign partnership, or foreign corporation, not engaged in trade or business within the United States, or

(b) An individual who is a citizen or resident of the United States, a domestic partnership, or a domestic corporation, if such labor or services are performed for an office or place of business maintained in a foreign country or in a possession of the United States by such individual, partnership, or corporation.

[EDITORIAL: Compensation for labor or personal services performed wholly within the United States is gross income from sources within the United States, per 26 C.F.R. §1.861-4 UNLESS performed as an employee for a foreign person not engaged in a trade or business OR for a federal person if the labor or services are performed for an office or business maintained in a "foreign country" or in a possession of the United States by the person for whom the labor or service is performed. The exclusions from "gross income from sources within the United States" that are provided in 26 C.F.R. §1.861-4 seem built for the nonresident alien individual needing an exclusion from "gross income" for his wages and salary that the IRS will recognize, without having to argue that such wages and salary are not "income"--though clearly they are NOT necessarily income, per 26 C.F.R. §1.61-2. It seems to me that 26 C.F.R. §1.61-2 is there mostly to give the "government" plausible deniability, so they can say they never claimed that ALL wages and salaries are "income".

Thanks to this provision at 26 C.F.R. §1.861-4, a nonresident alien individual need not worry about denying that his remuneration for labor is "income" or worry about denying that it is "compensation for services" (which is clearly listed as an item of "gross income" at Section 61) or even worry about denying that his labor or services were "not wholly in the U.S." All the nonresident alien individual needs to do is recognize that EVEN IF his remuneration is "income" and EVEN IF it is "compensation for services" (that would OTHERWISE be "gross income" under IRC 61) and even IF his labor or services were performed "wholly within the U.S." he is NONETHELESS entitled under 26 USC Sec. 872 to EXCLUDE this from his "gross income" as income NOT from a source within the U.S., so long as he was an employee or working under a contract for a foreign person not engaged in a trade or business. Or so long as he performed the labor or services (even for a U.S. person) IF the labor or services was performed FOR an office or place of business maintained in a foreign country or in a U.S. possession. How easy is it to prove to yourself that any American company employing you or hiring you for labor is NOT a domestic entity? Then the only possible question to ask yourself would be whether they engaged in a "trade or business". If a nonresident alien individual can't be certain, doubt is resolved in HIS favor and he may ASSUME he is entitled to exclude his compensation for labor or services from his "gross income".]

26 U.S.C. §872

TITLE 26 > Subtitle A > CHAPTER 1 > Subchapter N > PART II > Subpart A > Sec. 872.

Sec. 872. - Gross income

(a) General rule

In the case of a nonresident alien individual, except where the context clearly indicates otherwise, gross income includes only -

(1) gross income which is derived from sources within the United States [** the federal zone] and which is not effectively connected with the conduct of a trade or business within the United States [** federal zone], and

(2) gross income which is effectively connected with the conduct of a trade or business within the United States [** federal zone].

26 C.F.R. §1.872-2 Exclusions from gross income of nonresident alien individuals.

Title 26: Internal Revenue

PART 1—INCOME TAXES

nonresident alien individuals

§ 1.872-2 Exclusions from gross income of nonresident alien individuals.(f) Other exclusions.

Income which is from sources without [outside] the United States [federatl territory per 26 U.S.C. 7701(a)(9) and (a)(10) and 4 U.S.C. §110(d)], as determined under the provisions of sections 861 through 863, and the regulations thereunder, is not included in the gross income of a nonresident alien individual unless such income is effectively connected for the taxable year with the conduct of a trade or business in the United States by that individual. To determine specific exclusions in the case of other items which are from sources within the United States, see the applicable sections of the Code. For special rules under a tax convention for determining the sources of income and for excluding, from gross income, income from sources without the United States which is effectively connected with the conduct of a trade or business in the United States, see the applicable tax convention. For determining which income from sources without the United States is effectively connected with the conduct of a trade or business in the United States, see section 864(c)(4) and §1.864–5.

26 C.F.R. §1.871-7 Taxation of nonresident alien individuals not engaged in U.S. business.

Title 26: Internal Revenue

PART 1—INCOME TAXES

nonresident alien individuals

§ 1.871-7 Taxation of nonresident alien individuals not engaged in U.S. business.(a) Imposition of tax

(4) Except as provided in §§1.871–9 and 1.871–10, a nonresident alien individual not engaged in trade or business in the United States during the taxable year has no income, gain, or loss for the taxable year which is effectively connected for the taxable year with the conduct of a trade or business in the United States. See section 864(c)(1)(B) and §1.864–3.

26 C.F.R. §31.3402(p)-1

26 C.F.R. Sec. 31.3402(p)-1

Title 26

CHAPTER I

SUBCHAPTER C

PART 31

Subpart E

Sec. 31.3402(p)-1 Voluntary withholding agreements.(a) In general. An employee and his employer may enter into an agreement under section 3402(b) to provide for the withholding of income tax upon payments of amounts described in paragraph (b)(1) of Sec. 31.3401(a)-3, made after December 31, 1970. An agreement may be entered into under this section only with respect to amounts which are includible in the gross income of the employee under section 61, and must be applicable to all such amounts paid by the employer to the employee. The amount to be withheld pursuant to an agreement under section 3402(p) shall be determined under the rules contained in section 3402 and the regulations thereunder. (b) Form and duration of agreement. (1)(i) Except as provided in subdivision (ii) of this subparagraph, an employee who desires to enter into an agreement under section 3402(p) shall furnish his employer with Form W-4 (withholding exemption certificate) executed in accordance with the provisions of section 3402(f) and the regulations thereunder. The furnishing of such Form W-4 shall constitute a request for withholding.

(ii) In the case of an employee who desires to enter into an agreement under section 3402(p) with his employer, if the employee performs services (in addition to those to be the subject of the agreement) the remuneration for which is subject to mandatory income tax withholding by such employer, or if the employee wishes to specify that the agreement terminate on a specific date, the employee shall furnish the employer with a request for withholding which shall be signed by the employee, and shall contain -

(a) The name, address, and social security number of the employee making the request,

(b) The name and address of the employer,

(c) A statement that the employee desires withholding of Federal income tax, and applicable, of qualified State individual income tax (see paragraph (d)(3)(i) of Sec. 301.6361-1 of this chapter (Regulations on Procedures and Administration)), and (d) If the employee desires that the agreement terminate on a specific date, the date of termination of the agreement. If accepted by the employer as provided in subdivision (iii) of this subparagraph, the request shall be attached to, and constitute part of, the employee's Form W-4. An employee who furnishes his employer a request for withholding under this subdivision shall also furnish such employer with Form W-4 if such employee does not already have a Form W-4 in effect with such employer.(iii) No request for withholding under section 3402(p) shall be effective as an agreement between an employer and an employee until the employer accepts the request by commencing to withhold from the amounts with respect to which the request was made.

{2) An agreement under section 3402 (p) shall be effective for such period as the employer and employee mutually agree upon. However, either the employer or the employee may terminate the agreement prior to the end of such period by furnishing a signed written notice to the other. Unless the employer and employee agree to an earlier termination date, the notice shall be effective with respect to the first payment of an amount in respect of which the agreement is in effect which is made on or after the first 'status determination date' (January 1, May 1, July 1, and October 1 of each year) that occurs at least 30 days after the date on which the notice is furnished. If the employee executes a new Form W-4, the request upon which an agreement under section 3402 (p) is based shall be attached to, and constitute a part of, such new Form W-4.

(86 Stat. 944, 26 U.S.C. 6364; 68A Stat. 917, 26 U.S.C. 7805) (T.D. 7096, 36 FR 5216, Mar. 18, 1971, as amended by T.D. 7577, 43 FR 59359, Dec. 20, 1978)