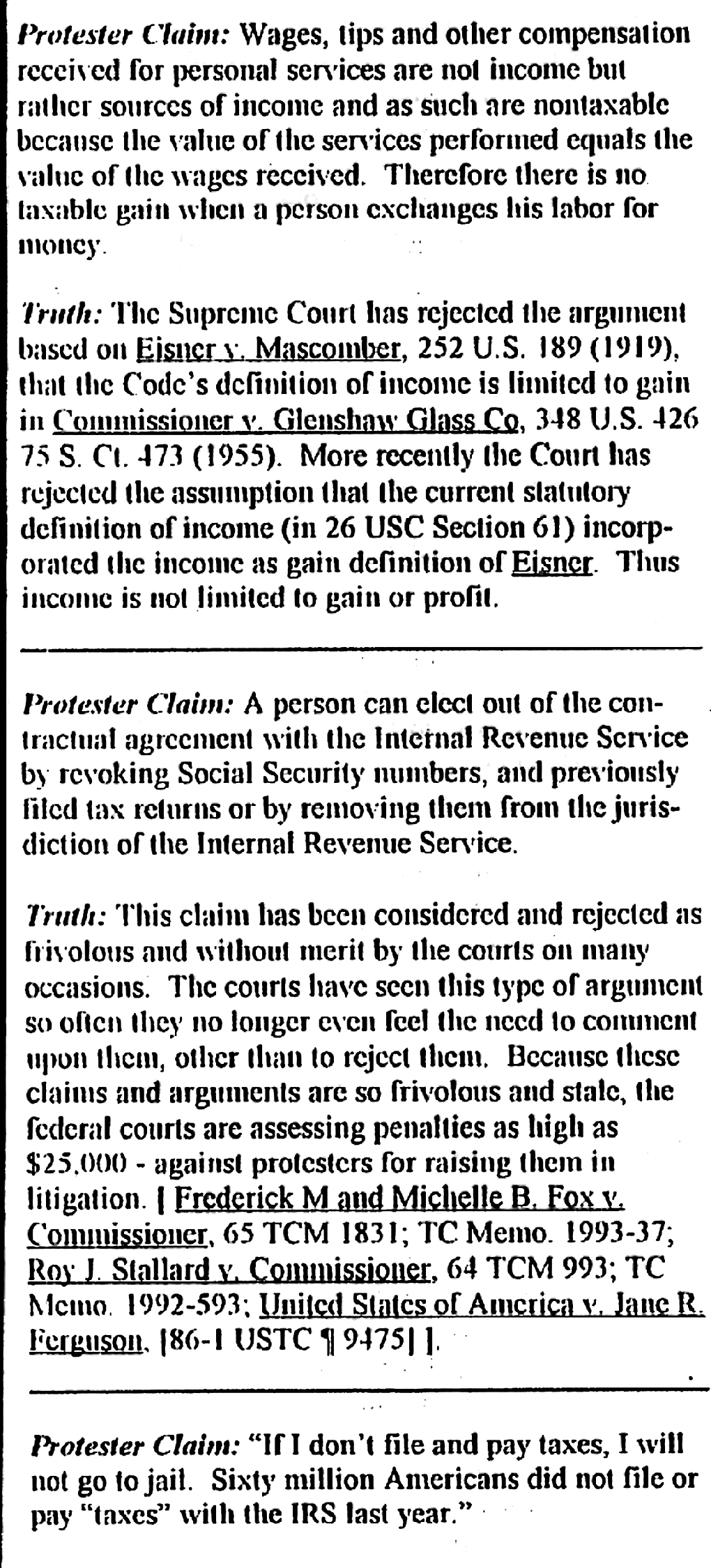

IRS CLAIM 7:

"Wages, tips, and other compensation received for services are not income, but rather

sources of income and as such are nontaxable because the value

of the services performed equals the

value of the wages received. Therefore there is no

taxable gain when a person exchanges his labor for

money."

REBUTTAL 7: Lawyers are really good at getting people to

argue about the wrong things to keep attention

off the real issue, aren't they? This is a good red

herring for the real claim they are afraid

to address

anywhere in their comical pamplet, because they

can't deal with this one, and it has NEVER been in front

of the U.S. Supreme Court for a decision because they are

scared to death that it will be competently

represented and shut off the vast majority of their

income, which is:

"'Wages, tips, and other compensation' in block 10 of

a W-2 are synonymous with 'gross income', and are

definitely 'types' of income, but income is not

taxable or considered 'gross income' until it comes from a

taxable 'source' as defined in 26 U.S.C. section 861

(IRC 861), at such time it becomes 'gross income'. But

domestic (within the 50 states) income of U.S. Citizens

does not qualify as either 'gross income' or

'wages, tips, and other compensation' on a W-2, both

of which are synonymous forms of taxable income,

and therefore this income is NONTAXABLE. With an

essentially zero taxable income, it is pointless for a

citizen (notice we didn't say 'taxpayer', because

that word doesn't necessarily mean 'one liable for tax') to

file an income tax return and a person cannot be compelled under

those circumstances to do so because

they fall below the minimum exemption amount

identified in section 6012 of the Internal Revenue Code."