Below each panel, we will set the record straight with a rebuttal to the IRS' claims in order to clarify the points and set the record straight.

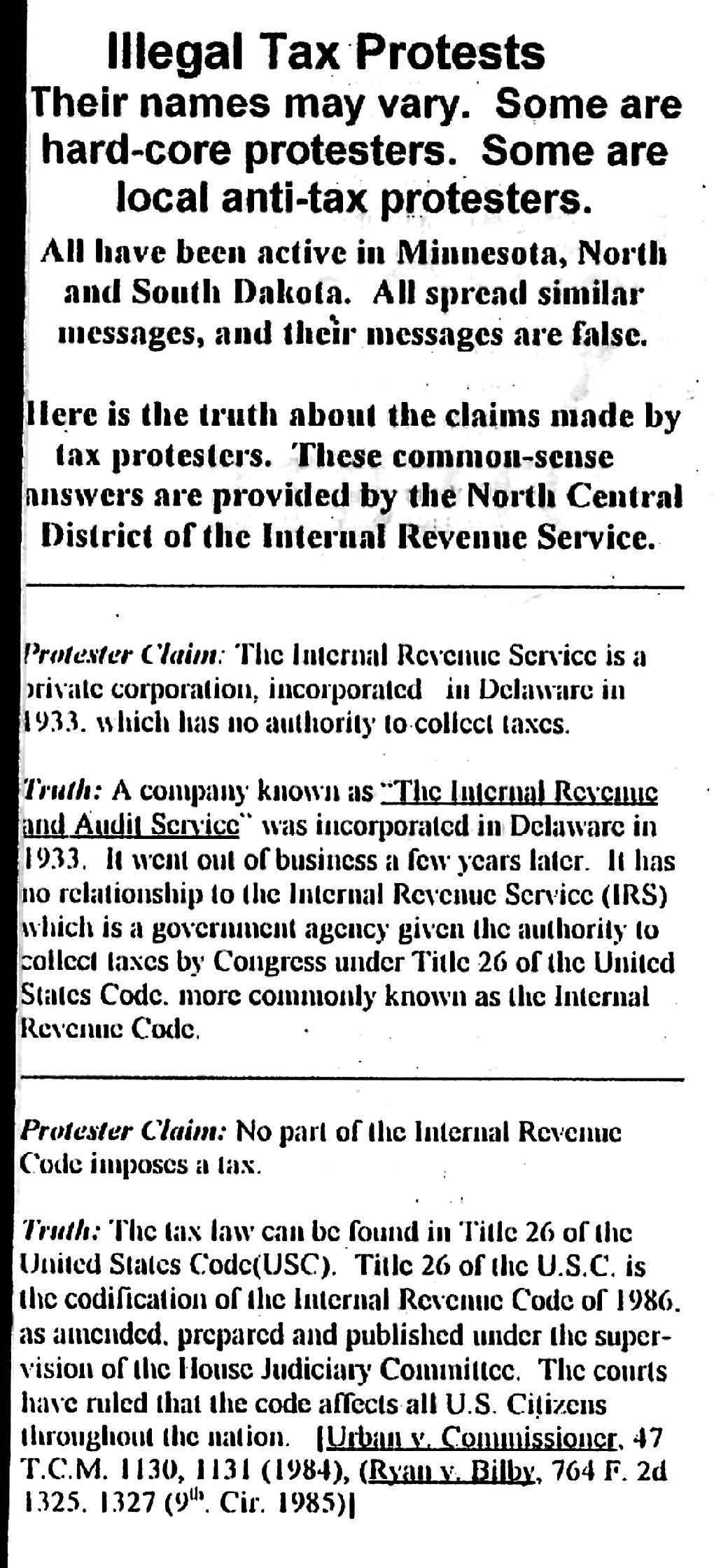

The first page reads:

Serving Minnesota, North Dakota, & South Dakota |

IRS' Tax Protester Rebuttal, Page 2

- REBUTTAL:

IRS CLAIM 1: "All

spread similar messages and their messages are false."

REBUTTAL 1: The IRS is spreading the largest amount of false

information by not clearly defining the

significance of the term "source" as it pertains

to gross income, and by progressively obfuscating the tax

code over the years to complicate it so badly that

your average citizen doesn't have a clue what is in

it's 2,000 pages to figure out what he owes.

In order

to qualify as gross income that is

taxable, income must not only be of the type that is taxable, but must

also derive from a taxable source, as

narrowly defined in IRC section 861 (26 U.S.C. 861).

Nowhere in this section do you find income of citizens

from domestic sources as being classifed as "gross income"

from a taxable source. This is consistent with

the U.S. Constitution in Article 1, Section

8, Clauses 1 through 3, which limits the role of the federal

government to that of regulating foreign

commerce and interstate (not "intrastate") business transactions

and trades, which are subject to excise

taxes.

IRS CLAIM 2: "The

courts have ruled that the code affects all U.S. Citizens throughout the nation."

REBUTTAL 2: More IRS subterfuge. Did you notice that

they didn't say the code "makes ALL US

CITIZENS liable for paying tax", nor did they

define WHO is liable for paying tax? Why? Because they

could be prosecuted for fraud if they said that U.S.

Citizens living in the 50 states with domestic income

have income that is defined as gross income that is

taxable under IRC section 861. There is a big difference

between being "affected by" (in

this case being aware of) the tax codes and being "liable" for

tax!