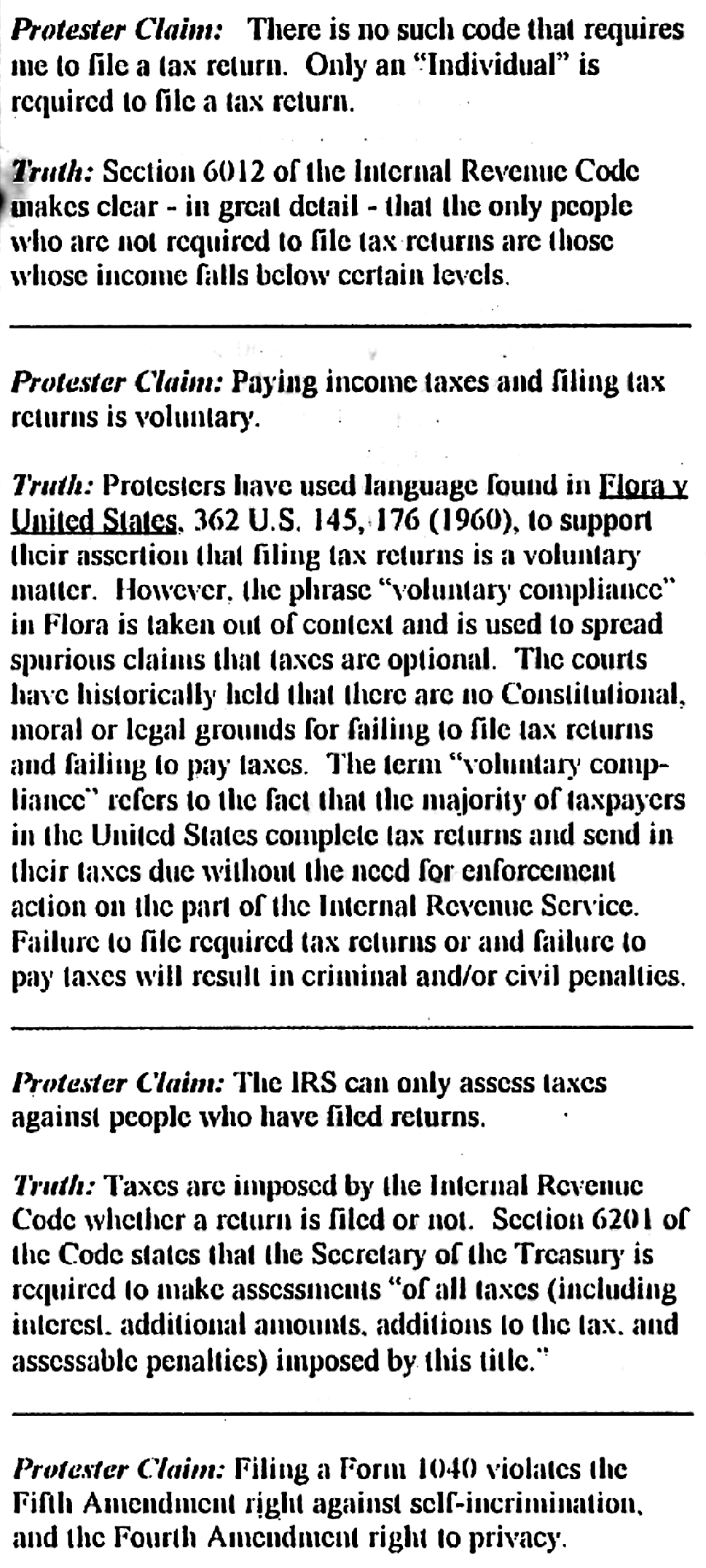

IRS CLAIM 3:

"Section 6012 of the Internal Revenue Code makes clear-in great detail- that the only

people

who are not required to file tax returns are

those whose income falls below certain levels."

REBUTTAL 3: There they go again ignoring the IRC section 861

source issue and "taxable income" or

"gross income" issues. Section 6012 does

indeed mention "gross income" and says that parties with a

gross income less than the exemption amount do not have to

file income tax returns. In fact, if people

used the IRC's own section 861 for identifying taxable

sources of income, then their gross income (which

is income that derives from a taxable source) would be

zero and therefore they would fall below the

exemption amount.

IRS CLAIM 4:

"However, the term 'voluntary compliance' in Flora is taken out of context and

is used to

spread spurious claims that taxes are optional. The courts

have historically held that there are no

Constitutional, moral, or legal grounds for failing to

file tax returns and failing to pay taxes. The term

'voluntary compliance' refers to the fact that the majority of

taxpayers in the United States complete tax

returns and send in their taxes due without the need for

enforcement action on the part of the Internal

Revenue Service. Failure to file required tax returns or

failure to pay taxes will result in criminal and/or

civil penalties."

REBUTTAL 4: They are correct that for SOME people taxes are

NOT optional, but the people they are

talking about are citizens with foreign income or

residents of Puerto Rico, the District of Columbia, or the

Virgin Islands, which are all taxable sources per the IRC

section 861. We'd like to remind you that you can

be a taxpayer without being LIABLE for paying tax!

The majority of citizens fit this category because

they do not have foreign income, but the IRS and Congress

have been remiss in reminding such people

that they don't need to pay because they don't mind

taking your "donations" and exploiting your

ignorance by a complicated and unnecessarily long tax

code.