Purpose:

- To assist men and women with doing correct FOIA / PA (Freedom of Information Act & Privacy Act) requests for their IRS maintained IMF (Individual Master Files)

- Provide a IMF Decoder Software Program which helps them to decode their IMF and thereby find mistakes and errors in their IMF records.

- Show users how to demand that their IMF records be corrected so that they are not subjected to illegal enforcement and collection of taxes that they do not owe the government.

How to do your own FOIA / PA requests:

- Step 1: Get the MF Decoder Software Program. Click here to download.

- Step 2: Get the MF Decoder PDF documentation file to explain the software program. Click here to download.

- Step 3: Use the MF Decoder program to enter your personal information on the Users form. Then go to the "FOIA Request Generator" form and select and print the First Week FOIA request (FOIA template I01). Second week do the second FOIA request (FOIA template I02). Third week do the third week FOIA request (FOIA template I03). Then wait for the IRS to respond with the requested documents from these three FOIA requests. While you wait, educate yourself more from this website.

- Step 4: After your FOIA request responses arrive, enter your IMF data into the MF Decoder program so it can decode your IMF files for you. You will see the illegal procedures the IRS uses in doing your IMF and these illegal procedures make the IRS records invalid.

NOTE: What

you are looking for in your IMF especially are unauthorized

Substitute for Returns (SFRs)

assessing you with a liability. These returns are not authorized

for individuals or for those who would normally file a 1040 or 1040NR

form.

![]() Click here for a section from

the IRS' own

Internal Revenue

Manual (IRM) showing the specific forms for which SFR's are authorized

under 26 U.S.C.

6020(b).

Click here for a section from

the IRS' own

Internal Revenue

Manual (IRM) showing the specific forms for which SFR's are authorized

under 26 U.S.C.

6020(b).

Sample FOIA Request Documents:

-

Sample Privacy Act Request for your IRS Individual Master File (IMF)-Sovereignty Forms and Instructions Online->FORMS, form number 14.5

Actual sample IMF and AMDISA returned from FOIA Request:

-

Sample Internal IRS Form Used

to Request an IDRS Report in Response to a FOIA-(162 Kbytes)

this is the form the IRS Disclosure Officer fills out in order to

satisfy the FOIA request you send him and to request the correct

IDRS or IMF report.

Sample Internal IRS Form Used

to Request an IDRS Report in Response to a FOIA-(162 Kbytes)

this is the form the IRS Disclosure Officer fills out in order to

satisfy the FOIA request you send him and to request the correct

IDRS or IMF report. -

Sample "Unsanitized" IMF Specific

Obtained from IRS Through FOIA-(1.5 Mbytes) high resolution

sample. Look at this to make sure they sent you the unsanitized

rather than the sanitized version

Sample "Unsanitized" IMF Specific

Obtained from IRS Through FOIA-(1.5 Mbytes) high resolution

sample. Look at this to make sure they sent you the unsanitized

rather than the sanitized version -

Sample IMF Complete Obtained

from IRS Through FOIA- (672Kbytes) high resolution sample

Sample IMF Complete Obtained

from IRS Through FOIA- (672Kbytes) high resolution sample -

Sample AMDISA Obtained from IRS Through

FOIA-(108 Kbytes). Use this information to determine your

Activity Code, which is what type of entity the IRS thinks you are.

In most cases, it will be a business even if you are a natural person,

and this is always true if they are prosecuting you for Willful

Failure to File under 26 U.S.C. §7203.

Sample AMDISA Obtained from IRS Through

FOIA-(108 Kbytes). Use this information to determine your

Activity Code, which is what type of entity the IRS thinks you are.

In most cases, it will be a business even if you are a natural person,

and this is always true if they are prosecuting you for Willful

Failure to File under 26 U.S.C. §7203. -

TXMODA response-Second FOIA response. The reason to get

this is to cross-check for what they HIDE in the IMF MCC printouts.

The Blue arrows list several transactions codes different than in

the IMF MCC (like the first one is a TC 424R). TC-424R=Examination

Request Indicator (Transfer SFR generated on NMF or PCS Partnership

Control System [TEFRA] to IMF module. This is the hidden SFR

that they did over the top of my return that was:

TXMODA response-Second FOIA response. The reason to get

this is to cross-check for what they HIDE in the IMF MCC printouts.

The Blue arrows list several transactions codes different than in

the IMF MCC (like the first one is a TC 424R). TC-424R=Examination

Request Indicator (Transfer SFR generated on NMF or PCS Partnership

Control System [TEFRA] to IMF module. This is the hidden SFR

that they did over the top of my return that was:

- Not IRS procedurally correct

- Without delegation authority to do.

- 6020(b) can not be on certain forms without person agreement not on a 1040.

- Totally bogus out of the air accounting number used.

-

MF Decoder Program (OFFSITE LINK)

-

IMF

Decoding Freedom of Information Act Requests, Form #03.015 (OFFSITE

LINK) - SEDM Forms

page

IMF

Decoding Freedom of Information Act Requests, Form #03.015 (OFFSITE

LINK) - SEDM Forms

page -

IRS Freedom of Information Act (FOIA) Request, Form #03.014 (OFFSITE LINK) - SEDM Forms page

-

IRS Transcripts-(850 Kbytes)

from early Internal Revenue Manual. Very informative

IRS Transcripts-(850 Kbytes)

from early Internal Revenue Manual. Very informative -

IMF Decoding PDF -PDF

with links for each area of the printout showing what the symbols

mean. This file is outdated and we are updating it now.

Will post a new version soon.

IMF Decoding PDF -PDF

with links for each area of the printout showing what the symbols

mean. This file is outdated and we are updating it now.

Will post a new version soon. -

IRS 6209 Manual-our local version. The version on the IRS website was removed in an effort to obstruct justice. Use this file to decode your IMF File Manually

-

Citizens Guide to Using

the Freedom of Information Act and the Privacy Act-(280Kbytes)

U.S. Government Printing Office

Citizens Guide to Using

the Freedom of Information Act and the Privacy Act-(280Kbytes)

U.S. Government Printing Office -

Disclosure Litigation Reference Book-(1.32 Mbytes) by the IRS.

Describes how the IRS litigates to keep you from getting information

about your files and about them

Disclosure Litigation Reference Book-(1.32 Mbytes) by the IRS.

Describes how the IRS litigates to keep you from getting information

about your files and about them -

Internal Revenue Manual (IRM), Part 21, Section 2, Chapter 3: Transcripts- how to request the type of transcript you need and want

Related articles:

-

Tax Deposition Questions, Section 12: Individual Master Files (IMFs)

-

Tax Truth Newsletter

Vol 3, No. 10 on Individual Master Files-Eddie Kahn

Tax Truth Newsletter

Vol 3, No. 10 on Individual Master Files-Eddie Kahn -

How the

IRS Performs Fraudulent Time-Barred Assessments in Your Individual

Master File (IMF)-(HOT!)

FRAUD! Submitted by one of our readers who had fraudulent

time-barred assessments

How the

IRS Performs Fraudulent Time-Barred Assessments in Your Individual

Master File (IMF)-(HOT!)

FRAUD! Submitted by one of our readers who had fraudulent

time-barred assessments -

How the IRS Falsifies Your Individual Master File (IMF) to create

a bogus liability-(HOT!)

FRAUD! Submitted by one of our readers who had fraudulent

IRS assessments

How the IRS Falsifies Your Individual Master File (IMF) to create

a bogus liability-(HOT!)

FRAUD! Submitted by one of our readers who had fraudulent

IRS assessments -

Great IRS Hoax, Section 7.9.5: Fraudulent Assessments-describes how the IRS falsifies your Individual Master File (IMF) to create a fraudulent or time-barred assessment

-

Use the FOIA, Privacy Act, and Discovery to Gain an Advantage-Sovereignty Forms and Instructions Online->INSTRUCTION, step 4.5

-

IRS Removes their 6209/"ADP and IDRS" Manual from their website-(HOT!) 03/17/2003. Manual used to decode your IRS IMF computer records is conspicuously removed from the FOIA area of the IRS website

-

Debunking IMF Translations and Decodes Using NMF Codes-it is commonplace for individuals to misconstrue the content of the IMF they obtained from the IRS using the FOIA. This article debunks common misconceptions

-

IRS

Systems of Records available under the Freedom of Information Act

IRS

Systems of Records available under the Freedom of Information Act

Wouldn't you love to see what types of data is on your official IRS record for free? One particular VERY IMPORTANT IRS information file that you can request through the Freedom of Information Act (FOIA) is the 'Individual Master File' (IMF).

There are many very good reasons why you should request a copy of your IMF, including the following:

-

To uncover fraudulent transactions in your file. These kinds of transactions are very common for people who have high-income or who make a LOT of trouble for the IRS, like us.

-

To identify bogus, time-barred assessments by the computer operator.

-

To establish the current status of your account or the reason you keep getting IRS notices after you paid your tax.

-

To identify specific Document Locator Numbers (DLNs) that you should request in future FOIA requests in order to establish the legitimacy of IRS assessments or penalties.

1 What is the IMF?

The Individual Master File (IMF) is a magnetic tape record of all individual income tax filers, in Social Security Number sequence, and is maintained at the IRS National Computer Center.

All tax data and related information pertaining to individual income tax payers are posted to the IMF so that the file reflects a continuously updated and current record of each Citizen's account.

All settlements with Citizens are effected through computer processing of the IMF account and the data therein is used for accounting records, for issuance of refund checks, bills or notices, answering inquiries, classifying returns for audit, preparing reports and other matters concerned with the processing and enforcement activities of the IRS.

Keep in mind that this request is most often free... unless your IMF file is 100 pages or more, which is unlikely. If there is a charge, they will notify you of the cost so that you can send it in.

The IMF is designed to accumulate in each American's account all data pertaining to the income taxes for which the Citizen is liable.

The account is further sectionalized into separate tax periods (tax modules) each reflecting the balance, status, and transactions applicable to the specific tax period. This includes the returns filed, assessments, debit and credit transactions, and all changes made to the filed tax returns.

After requesting a copy of your IMF you will receive your information from the IRS.

Now, if you've ever seen one of these files there are a bunch of numbers and letters in groups that you skip over because they mean nothing to you. But, in reality, these are codes and are really what they know about you, or in many documented cases, simply manufactured about you. But that's not the best part... This file is what "they" think they know about you, and they code it because they don’t want you to know what they think they know about you.

The "IMF MCC TRANSCRIPT-SPECIFIC" file, which is the one that we will be ordering, contains data that you otherwise would not receive. The "IMF MCC TRANSCRIPT-SPECIFIC" is the file you have to ask for when you request your information from them.

You look over this information and again there are these codes they used to identify you and your particulars. Unless you're familiar with these codes you wouldn't know whether they claim that you own a business in some Caribbean Island or whether you deal in either firearms, alcohol or tobacco would you? This is how they justify taking your money. These codes all mean something to them. The trick is finding out what those meanings are.

It is important to keep in mind that the various files on record regarding you are vital in keeping yourself and your family on strong foundation when dealing with the various U.S. GOVERNMENT agencies..... especially the IRS. Combine the evidence of errors and sometimes fraud documented with your FOIA's along with the strategy of rebutting the presumption of your receiving "taxable income" in the reports made by employers, accountants, and you, this creates the certainty of negating any case against you that the IRS can possibly have.

2. Requesting Your IMF

Use the sample letter contained in Section 9.15.5 to request a copy of your IMF. When you request your IMF, be advised of the following very important considerations:

1. There are two versions of your IMF:

1.1. The sanitized version, which the IRS will give you by default. This is also called the “IMF SPECIFIC”

1.2. The unsanitized version, which is also called the “IMF MCC TRANSCRIPT-SPECIFIC”. This version of your IMF is the best to get because it contains every detail available about every aspect of every transaction. According to Victoria Osborne, this file can be used to prove the existence of time-barred assessments and fraud committed by IRS agents, which she says is very common. Because the IRS knows this file is extremely incriminating, they will often strongly resist attempts to obtain it. In some cases, you may need to visit your local IRS district office and camp out on their doorstep until they will give it to you because they know their goose is cooked once you get ahold of this if you have a copy of IRS Publication 6209 and know how to decode the file.

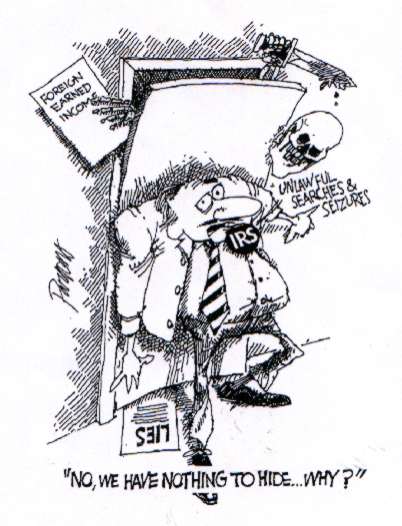

2. The IRS will do everything in its power to conceal the contents of your IMF and prevent you from being able to use it to your advantage. The IMF is a very powerful tool in court and the IRS knows this. They are scared of Americans who know how to read it!

3. You can request a copy of your IMF through the Freedom of Information Act and the Privacy Act using the form in Forms section 14.5. The IRS will drag its feet in providing it.

4. After you request your IMF and the IRS receives your Privacy Act Request, they will deliberately print out the IMF using an old dot matrix printer with a bad ribbon. When was the last time you even saw a dot matrix printer in the store? They do this so you can’t read most of it. You should therefore demand and insist that the copy they provide meets the following requirements:

4.1. Bold print.

4.2. Legible print (all portions of every number or letter on the form are completely legible)

4.3. Ink not impossible to read.

You should send your FOIA/Privacy Act request to the address you locate on the following website:

Your service center:

https://famguardian.org/Subjects/Taxes/Contacts/Contacts.htm

Your local office:

https://www.irs.gov/help/contact-your-local-irs-office

Address your FOIA inquiry to the address identified above and on the second line of the address, indicate “Disclosure Officer”.

Our Master File Decoder program automatically generates FOIA requests for your IMF information in several formats appropriate for your specific situation. You can download this excellent program from the website at:

3 Falsification of IMF and BMF records: The chief IRS tool of illegal extortion

We pointed out earlier throughout all of chapter 5 of the Great IRS Hoax that individuals are not liable for Subtitle A income taxes, that the IRS cannot do a lawful assessment or enforcement action against a natural person, and that our personal income tax system is entirely voluntary. You would never know these truths by observing the behavior of the lawless and avaricious IRS, however, now would you! How do they get away with such blatant disregard for the law? This section will show you exactly how they manufacture a fraudulent liability that makes you responsible to pay a tax you don’t owe by falsifying the computer records they maintain on you. The fraud is sophisticated and subtle so that it can easily be hidden. It therefore takes a trained eye to recognize the technical method to their fraud, and we intend to train your eye so you can immediately recognize the fraud and thereby blow the whistle on them.

The computer files that the IRS maintains on people are called the IMF, or Individual Master File. Three references below define the rules for how this file is manipulated and updated:

1. 6209 Manual: This manual tells you what the codes mean in your computer file and allows you to decipher it. The manual is available on our website at:

This manual was also available online at the IRS website, but after tax freedom fighters focused on it and started requesting their master files and decoding them, the IRS pulled it off their website to hide the evidence of their wrongdoing on 3/17/2003.

2. Internal Revenue Manual (I.R.M. or I.R. Manual): available on the IRS website at: https://www.irs.gov/irm.

3. IMF Operations Manual: An IRS publication that gives details concerning an IMF and also shows you that the IRS keeps 52 different types of transcripts on you. Available from Richard Standring.

The most useful of the above three references is the 6209 Manual, followed by the IRM. You can figure most of what you need to know from these two manuals. The IRS website provides a hidden advanced search button that allows you to quickly find the information you are looking for in the 500+ Mbyte IRM at:

The IRS maintains your tax records in an electronic system called the Integrated Data Retrieval System, or “IDRS” for short. This system files everything for a particular year under your Social Security Number. Each document has a number associated with it called the Document Locator Number or DLN. The Document Locator Number is described in detail in section 4 of the 6209 Manual. It is a 14 digit number made up of 7 different fields. Codes within each of these fields are further defined elsewhere in the 6209 Manual. When you are requesting information about your tax account from the IRS, you use the Privacy Act, 5 U.S.C. §552a, and the Freedom of Information Act (FOIA) to request your IMF records, and you can specify specific documents you want by providing your SSN and the DLN of the document. Section 3.4.7 later describes how you can order a copy of your IMF using the FOIA. Because decoding your IMF can be difficult, we have developed a free Microsoft Access database that automatically decodes the IMF for you consistent with the content of the IRS 6209 Manual. The program is available at:

Each event or document entered into your tax record has a Document Code (DC) and a Transaction Code (TC) associated with it. The document code identifies the IRS form that corresponds to the transaction. IRS forms and their DC’s are identified in Section 2 of the 6209 Manual. The IMF computer screen in which data entry is made by revenue agents is described on pages 13-26 through 13-31 of the 6209 Manual. This is the screen that the agent types your tax return information into.

The IDRS computer contains built-in safeguards that disallow revenue agents to create assessments against individuals without their voluntary consent as evidenced by their submission of a 1040 form. If they don’t voluntarily submit the form themselves, then the IRS isn’t authorized to do it for them as evidenced by section 5.18.2.3 of the IRM. See our Tax Deposition Questions, section 13 below for further details on why they can’t file Substitute For Returns against individuals:

If an American submits a 1040 or 1040NR return and pays the taxes listed on the form, the IMF screen on pages 13-26 through 13-31 of the 6209 Manual is used to enter the assessment and zero the balance due against the assessment. This is done using Transaction Codes 424 for the assessment and 425 to zero the assessment. Some Transaction Codes have a debit associated with them and others have a credit. Section 7 of the 6209 Manual tells which are Debit transactions and which are Credit Transactions. If you order your IMF transcript for a year in which you paid a tax, TC 424 transactions will not appear in your record because the computer system will hide them. The system hides them because the IRS doesn’t want you to know how they manufacture an assessment if you decide to order your IMF. According to the IRM in section 9.4.4.2.1.4, after 27 months of inactivity and a zero balance in your account because you paid the tax you assessed against yourself, the IMF tax records or “modules” associated with that tax year are archived in an entity called the Retention Register. Note that IMF transaction records can only enter the Retention Register if they have no liability associated with them: this is important.

Subsequent to exporting and archiving your electronic tax records to the Retention Register for a given year, if you then initiate refund litigation or some other correspondence or event or if a revenue agent needs to work your records again for that year, these records must be re-imported back into your IMF so they can be edited. This importation occurs using a Transaction Code (TC) of 370. While the records are archived in the Retention Register, they can be manually doctored by the operator, thus bypassing the safeguards within the IMF portion of the system preventing agents from doing illegal assessments on people. Most of this doctoring occurs within the NMF or Partnership Control Files. The importation step with Transaction Code of 370 also allows the operator to edit the records coming in to correct for errors in the Retention Register. This manual step of importation and the doctoring of the Retention Register is where the falsification occurs, typically. Remember, however, that records can only enter the Retention Register to begin with if there is no liability associated with them, so when they are reimported back into the IMF, why are they allowed to have a nonzero balance or amount due? The answer is they can’t, so there is no reason why importation would need to occur for an individual at all. The article below on our website describes in detail how they enter these fraudulent assessments into your IMF record:

How can you see that your record has been falsified by an unscrupulous IRS agent? Look in the IMF transcript you obtained through FOIA for the years in question and look for a Transaction Code of 370. All the doctored records appear immediately following the TC 370 on your transcript and have the same Julian Date as the TC 370 transaction. This is where illegal and fabricated penalties and assessments will be added to your record by the agent. The most frequent motive for why these fraudulent records are added is because the revenue officer is pissed at you for making his life difficult. If you submit a long and complicated return that forces him to think, if you challenge his authority, and especially if you criticize or denigrate him, then you have encouraged him to retaliate by assessing you with a false liability. This is how agents abuse their power to keep people subservient to them and not questioning authority.

Another area where falsification of your IMF records is commonplace is with the Assessment Statute Expiration Date (ASED). The IRS has a certain amount of time from a given tax year to the last year when they can legally perform an assessment on you for that year. After the Assessment Statute tolls, the IRS can no longer do an assessment for back taxes for the affected years without your voluntary consent, as evidenced by you voluntarily submitting an IRS Form 872 entitled “Consent to Extend the Time to Extend Tax”. After you submit this form, the agent enters this in your IMF as a transaction number 560, or TC 560. In most cases, agents will lie to the computer if you never filed and fall outside the ASED date by entering a fraudulent TC 560 in order that they can go back and enter bogus assessments, penalties, and interest for a particular year. This is called entering a “Time-Barred Assessment” and it is highly illegal. You can expose this kind of fraud the same way you do with the TC 370 transactions we indicated above: requesting an electronic copy of your IMF and BMF over the years in which a controversy exists between you and the IRS. See the following article on our website for a description of how the IRS accomplishes these Time-Barred Assessments: