|

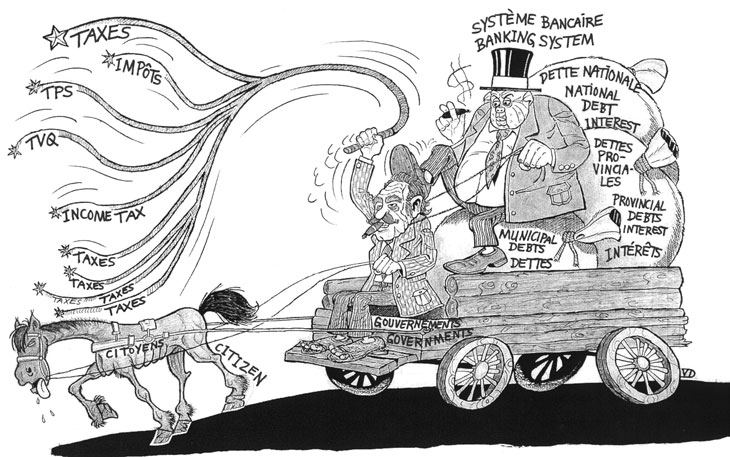

Chapter 9 The Monetary Defect The

situation amounts to this inconceivable thing: all the money in

circulation comes only from the banks. Even coins and paper money come

into circulation only if they are released by the banks. But

the banks put money into circulation only by lending it out at interest.

This means that all money in circulation comes from the banks and must

be returned to the banks some day, swelled with interest. The

banks remain the owners of the money. We are only the tenants, the

borrowers. If some manage to hang on to their money for a long time and

even permanently, other people are made incapable of fulfilling their

commitments. A

multiplicity of personal and corporate bankruptcies, mortgages upon

mortgages, and the continuous growth of the public debt, are the natural

fruits of such a system. Charging

interest on money at birth, as it comes into existence, is illegitimate

and absurd, antisocial, and contrary to good arithmetic. The monetary

defect is therefore as much a technical defect as a social defect. As

our country grows, in production as well as in population, more money is

a must. But it is impossible to get new money without contracting a

debt, which collectively cannot be paid. So

we are left with the alternatives of either stopping growth or going

into debt; of either plunging into mass unemployment or of having an

unrepayable debt. And it is precisely this dilemma that is being debated

in every country. Aristotle,

and later, Saint Thomas Aquinas, wrote that money does not produce

offspring, does not breed more money. But the bankers bring money into

existence, provided only that it breeds more money. Since neither

governments nor the public create money, no one creates the offspring

(the interest) claimed by the banker. Even legalized, this form of issue

remains vicious and insulting. Decline

and degradation

This

way of creating our country's money, by putting governments and

individuals in debt, establishes a real dictatorship over governments

and individuals alike. The

sovereign government has become a signatory of debts owed to a small

group of profiteers. A minister, who represents all of the population of

the country, signs unrepayable debts. The banker, who represents a few

shareholders who thirst after profits, manufactures our country's money. This

is one striking aspect of the degeneration of power, of which Pope Pius

XI spoke: governments have surrendered their noble functions, and have

become the servants of private interests. The

Government, instead of guiding Canada, has become a mere tax collector,

and the biggest item in government expenditures is precisely debt

servicing: payment of the interest on the public debt. Furthermore,

legislation consists mainly in taxing the citizens, and erecting,

everywhere, restrictions to freedom. There

are laws to make sure that the money creators are repaid. There are none

to prevent human beings from dying in dire poverty. Tight

money develops a mentality of wolves in individuals. In front of plenty,

everyone tries to get the too scarce symbols of the goods that give a

right to a share in this plenty. Hence, frantic competition, patronage,

denunciations, the tyranny of the boss, domestic strife, etc. A

handful of people preys on the others; the great mass of the people

groan; many founder in the most degrading poverty. Sick

people remain without care, children are poorly or insufficiently

nourished, talents go undeveloped, youths can neither find jobs nor

start homes and families, farmers lose their farms, industrialists go

bankrupt, families struggle with difficulties all this without any

other cause than the lack of money. The banker's pen imposes privations on the public and servitude on the governments.

|