|

Chapter

33

— Interest

on Our

Lord drove the money changers out of the Temple;

As most of the regular readers of the “Michael” Journal should know, the fundamental flaw of the present financial system is that all the existing money has been created by the banks, as a debt: banks create new money, money that did not exist before, every time they make a loan. These loans must be returned to the banks, but increased with interest. Even

coins and bank notes, which, in Canada, are respectively issued by the

Canadian Mint and the Bank of Canada — two State-owned institutions

— are put into circulation only when they are lent at interest by the

private chartered banks. And it is precisely this interest, which is

charged at the origin of money, that creates the problem, a mathematical

impossibility to pay the loan back: the bank creates the principal it

lends, but does not create the interest that must also be paid back. For example, let us suppose that the bank lends you

$100, at 10 per cent interest. The bank creates $100, but wants you to

pay back $110. You can pay back $100, but not $110: the $10 for the

interest does not exist, since only the bank has the right to create

money, and it created $100, not $110. The only way to pay back $110,

when there is only $100 in existence, is to also borrow this $10 from

the bank... and your problem is not solved; it has only gotten worse:

you now owe the bank $110, plus a 10-per-cent interest, which makes

$121... and as years pass, your debt gets bigger; there is no way to get

out of it. Some

borrowers, taken individually, can manage to pay back their loans in

totality, the principal plus the interest, but all the borrowers as a

whole can not. If some borrowers manage to pay back $110 when they

received only $100, it is because they take the $10 that is missing in

the money put into circulation through the loans granted to other

borrowers. In order for some borrowers to be able to pay back their

loans, others must go bankrupt. And it is only a matter of time before

all the borrowers, without exception, find it impossible to pay the

banker back. And note that even with an interest rate of only 1 per

cent, the debt would still be unpayable: if you borrow $100 at

1-per-cent interest, you will have to pay back $101 at the end of the

year, while there is only $100 in circulation. This means that any

interest charged on newly-created money — even a 1-per-cent interest

— is usury, is a robbery, is a racket. Some

may say that if one does not want to get into debt, one has only not to

borrow. But if no one borrowed money from the banks, there would simply

not be a penny in circulation at all: in order to have money in

circulation in our country — if only a few dollars — someone — an

individual, a corporation, or the Government—must borrow these dollars

from the bank, at interest. And this money borrowed from the bank cannot

remain in circulation indefinitely: it must be returned to the bank when

the loan is due... and returned with the interest, of course. Unpayable

debts

This

means that just to maintain the same amount of money in circulation,

year after year, unpayable debts must pile up. In the case of public

debts, the bankers are satisfied as long as the interest charges on the

debts are paid. Is it a favour they do for us? No, it only delays the

financial impasse for a few years since, after a while, even the

interest on the debt becomes unpayable. (See

example in the next chapter.) If

debts do not pile up, there can be no money in our country. So one

should not be surprised to see the public debts of all the nations

reaching astronomical proportions: for example, Canada's public debt,

which was $24 billion in 1975, reached the $200-billion mark ten years

later. (In

January, 1995, the debt of the Canadian Government reached the

$500-billion mark, with interest charges of about $49 billion per year,

or one-third of all the taxes collected by the Federal Government. If

one adds the debts of the provinces, corporations, and individuals, one

gets a total debt in Canada of over 2,800 billion dollars.)

Even though you take all the money that exists in Canada, even the money

in saving accounts, it will not be sufficient to pay off the debt. And

the same situation prevails in all the countries in the world. It

is impossible to pay off the public debt, since it is made up of money

that does not exist. Many Third-World nations have realized this

absurdity, and stopped servicing their debts. In fact, these loans to

Third-World countries are far from helping them: on the contrary, they

impoverish these nations even more, since these nations must pledge to

pay the bankers back more money than what was lent, which makes money

tighter among the people, and condemns them to live in poverty and

starvation. But can a country be run without borrowing the bankers'

debt-money? Yes, and it is very easy to understand: It is not the banker

that gives money its value; it is the production of the country. Without

the production of all the citizens in the country, the figures lent by

the bankers would be worthless. So, in reality, since this new money is

based on the production of society, this money also belongs to society.

Simple justice therefore requires it to be issued by society —

interest free — and not by the banks. Instead of having a money

created by the banks, a banking credit, one would have a money created

by society, a social credit. Our

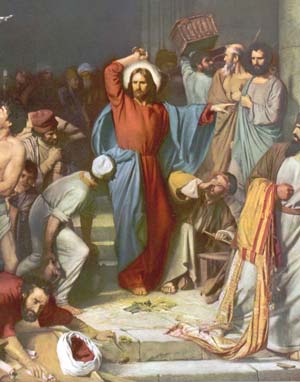

Lord drives the money changers out of the Temple As

Louis Even said, “Interest at the origin of money is illegitimate,

absurd, anti-social, and anti-arithmetic.” To charge interest on

newly-created money is therefore a very great crime that cannot be

justified. As a matter of fact, the only passage in the Gospel where it

is mentioned that Jesus used force, is when He drove the money changers

out of the Temple with a scourge of cords, and overthrew their tables

(as reported in Matthew 21:12-13 and Mark 11:15-19), precisely because

they were lending money at interest. There was, at that time, a law that the tithes or taxes

of the Temple could be paid only in one certain coin called the “half

shekel of the sanctuary”, of which the money changers had managed to

obtain the monopoly. There were several different coins at that time,

but the people had to obtain this particular coin with which to pay

their Temple Tax. Moreover, the doves and the animals that the people

bought for sacrifice also could only be bought with this same special

coin that the money changers exchanged to the pilgrims, but at a cost of

twice or more times its actual worth, when it was used to buy

commodities. So Jesus overthrew their tables and said: “My house shall

be called a house of prayer; but you have made it a den of thieves.” In

his book, Money and Its True Function, F.R.

Burch has the following comment on this text of the Gospel: “As long as Christ confined His teachings to the

realm of morality and righteousness, He was undisturbed; it was not till

He assailed the established economic system and cast out the profiteers

and overthrew the tables of the money changers, that He was doomed. The

following day, He was questioned, betrayed on the second, tried on the

third, and on the fourth, crucified.” One

would be tempted to make the parallel with the Pilgrims of Saint

Michael, the “White Berets” of the “Michael” Journal: as long as

they content themselves with talking about moral renovation, the

Financiers can still tolerate it; but when the “White Berets” dare

to attack the debt-money system, this is an “unforgivable sin”, and

the Financiers are then ready to do everything to silence the “White

Berets”. But these attempts of the Financiers are vain, since the

truth always triumphs in the end. The teaching of the Church The

Bible contains several texts that clearly condemn the lending of money

at interest. Moreover, more than 300 years before Jesus Christ, the

great Greek philosopher Aristotle also condemned lending at interest,

pointing out that “money, being naturally barren, to make it breed

money is preposterous.” Furthermore, the Fathers of the Church, since

the remotest times, always denounced, unequivocally, usury. Saint Thomas

Aquinas, in his Summa

Theologica (2, 2, Q. 78), thus summarized the teaching of the

Church on lending money at interest: “It is written in the Book of Exodus (22, 24): `If

you lend money to any of my people who is poor, that dwells with you,

you shall not be hard upon them as an extortioner, nor oppress them with

usury.' He who takes usury for a loan of money acts unjustly, for he

sells what does not exist, and such an action evidently constitutes an

inequality and, consequently, an injustice... It follows then that it is

wrong in itself to take a price (usury) for the use of money lent, and

as in the case of other offenses against justice, one is bound to make

restitution of his unjustly acquired money.” In

reply to the text of the Gospel on the parable of the talents (Matthew

25:14-30 and Luke 19:12-27) which, at first sight, seems to justify

interest (“Wicked and slothful servant... why did you not put my money

into the bank, so that I might have recovered it with interest when I

came?”), Saint Thomas Aquinas wrote: “The interest mentioned in the Gospel must

be taken in a figurative sense; it means the additional spiritual goods

asked of us by God, who wants us to always make better use of the goods

He entrusted us with, but this is for our benefit and not His.” So

this text of the Gospel cannot justify interest since, as Saint Thomas

says, “an argument cannot be based on figurative expressions.” Another

passage of the Bible that presents difficulties is Deuteronomy 23:20-21:

“You shall not demand interest from your brother on a loan of money or

food or of anything else. You may demand interest from a foreigner, but

not from your brother.” Saint Thomas explains: “The Jews were forbidden to take interest from `their brothers', that is to say, from other Jews; this means that demanding interest on a loan from anyone is wrong, strictly speaking, for one must consider every man as `one's neighbour and brother', especially according to the evangelical law that must rule mankind. So the Psalmist, talking about the just man, says unreservedly: `he who lends not his money at usury' (14:4) and Ezekiel (18:17): `a son who accepts no interest or usury'.” If

the Jews were allowed to demand interest from a foreigner, Saint Thomas

wrote, it was tolerated in order to avoid a greater evil, for fear that

they might charge interest to other Jews, the worshippers of the true

God. Saint Ambrose, commenting on the same text, gives to the word

“foreigners” the meaning of “enemies”, and concludes: “One may

seek interest from the one he legitimately wants to harm, from the one

whom it is lawful to wage war with.” Saint Ambrose also said: “What is usury, if not

killing a man?” Saint John Chrysostom: “Nothing is more shameful or

cruel than usury.” Saint Leo: “The avarice that claims to do its

neighbour a good turn while it deceives him is unjust and insolent... He

who, among the other rules of a pious conduct, will not have lent his

money at usury, will enjoy eternal rest... whereas he who gets richer to

the detriment of others deserves, in return, eternal damnation.” In

1311, at the Council of Vienna, Pope Clement V declared null and void

all secular legislation in favour of usury, and “all who fall into the

error of obstinately, maintaining that the exaction of usury is not

sinful, shall be punished as heretics.” On

November 1, 1745, Pope Benedict XIV issued the encyclical letter Vix

Pervenit, addressed to the Bishops of Italy, about contracts,

and in which usury, or money-lending at interest, is clearly condemned.

On July 29, 1836, Pope Gregory XVI extended this encyclical to the whole

Church. It says: “The kind of sin called usury, which lies in the

loan, consists in the fact that someone, using as an excuse the loan

itself — which by nature requires one to give back only as much as one

has received — demands to receive more than is due to him, and

consequently maintains that, besides the capital, a profit is due to

him, because of the loan itself. It is for this reason that any profit

of this kind that exceeds the capital is illicit and usurious. “And in order not to bring upon oneself this infamous

note, it would be useless to say that this profit is not excessive but

moderate; that it is not large, but small... For the object of the law

of lending is necessarily the equality between what is lent and what is

given back... Consequently, if someone receives more than he lent, he is

bound in commutative justice to restitution...” The

teaching of the Church on this matter is therefore quite clear but, as

Louis Even wrote (in the previous chapter): “In spite of all Christian

teaching to the contrary, the practice has made so much headway that, so

as not to lose in the furious competition around the fertility of money,

everybody must behave today as if it was natural for money to breed

money. The Church has not abrogated her laws, but it has become

impossible for her to insist on their application.” Islamic banking On this matter, it is interesting to consider the

experience of the Islamic banks: the Koran — the holy book of the

Moslems — forbids usury, as the Bible of the Christians does. But the

Moslems took these words seriously and have set up, since 1979, a

banking system that conforms with the rules of the Koran: Islamic banks

charge no interest on either current or deposit accounts. They invest in

business, and pay a share of any profits to their depositors. This is

not the Social Credit system implemented in its entirety yet but, at

least, it is a more than worthy attempt at putting the banking system in

keeping with moral laws. On this point, the Christians should be

inspired by this example of the Moslems. Interest and dividends This

article should have shown clearly enough that any interest on

newly-created money is unjustifiable. But this may bring some fear among

those who have money deposited in banks: if interest is thus condemned,

will they still receive some interest on their money deposited in banks?

Read what Mr. Even wrote in the previous chapter, under the subtitle

“Interest and dividends” (“So that our

readers do not pass out…”). Mr.

Even concluded that money can claim dividends where there are fruits.

Otherwise, no. But in order to make this possible, the production

increase must automatically create an increase in money. Otherwise the

dividend, while being perfectly justifiable, becomes impossible to give

in practice. In

the example of the $5,000 that was used to buy ploughing implements, the

lender is entitled to a share of the results, since production

increased, thanks to his loan. If he accepts to be paid in goods, there

is no problem. But if he wants to be paid in money, it is quite another

story since, even if production increased, there was no corresponding

increase in the money in circulation. The Social Credit system, which

makes money come into being interest free, as new production is made,

would settle this problem. And

for those who worry about the fate of the banks if they did not charge

interest on their loans, let us just mention for now that the wages and

salaries of their employees would be paid by the National Credit Office,

the authority in charge of the creation of new money in the country.

(This point is explained in detail in Louis Even's brochure: A

Sound and Efficient Financial System.) Just like Our Lord drove

the money changers out of the Temple, it is high time we drove out the

International Financiers and their debt-money system, and set up an

honest debt-free money system — money issued by society. May this

passage of the Gospel inspire us, and let us ask Christ to fill us with

the same zeal as His for the interests of God and for justice.

|

(An

article of Alain Pilote, published in the January-February, 1991 issue

of the Michael Journal.)

(An

article of Alain Pilote, published in the January-February, 1991 issue

of the Michael Journal.)