"…Yes, all of you be submissive to one another, and be clothed with humility, for

God [and his followers] resists the proud,

But gives grace to the humble.

Therefore humble yourselves under the mighty hand of God, that He may exalt you in due time, casting all your care upon Him, for He cares for you.

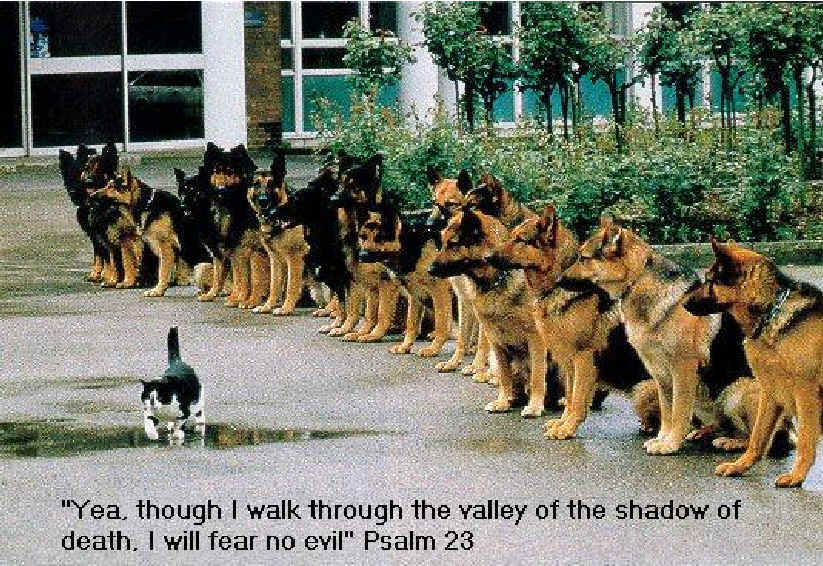

Be sober, be vigilant; because your adversary the devil walks about like a roaring lion, seeking whom he may devour.

Resist him, steadfast in the faith, knowing that the same sufferings are experienced by your brotherhood in the world.

But may the God of all grace, who called us to His eternal glory by Christ Jesus, after you have suffered a while, perfect, establish, strengthen, and settle you."

[1 Peter 5:5-9, Bible, NKJV]

___________________________________________

"Nothing in the world can take the place of persistence. Talent will not;. . . Genius will not;. . . Education will not; . . . Persistence and determination alone are omnipotent.”

[Calvin Coolidge]

The chief IRS weapon is fear. Fear is the best weapon they have to in effect compel people to "voluntarily comply". How do they perpetuate this fear?

- By making your experiences with them so painful, complex, costly, and time-consuming that you try to avoid the hassle by just paying your taxes and don't "question authority" as we encourage you to do throughout this document.

- By trying to shift the burden of proof to the taxpayer. By default, if you don't dispute prima facie evidence presented against you about your income tax liability, then they are guaranteed to eventually win their case. As soon as you learn that your gross or taxable income is misreported by your employer, you should promptly bring it to their attention and raise a formal complaint, and submit evidence to the contrary that they then have an obligation to refute with the law.

- By abusing the due process rights guaranteed to you by the 5th and 14th Amendments to U.S. Constitution. This means they will try to take your property from you without a hearing or a trial. Then after they have taken your property, you can't afford to litigate to defend your rights so they have won.

- By refusing to discuss the legal aspects of the tax laws with you. We called their 800 number and were put on hold for almost an hour and then an arrogant agent came on the phone who wouldn't even give us his name for fear of retribution. Do you think if they were really focused on helping people and telling them the truth about the tax laws, that they would need to worry about retribution? Then he proceeded to tell us that he isn't there to give me legal advice. I didn't ask for legal advice, but I asked him for what legal authority makes me liable for income taxes as a citizen of the united States (not a U.S. Citizen, big difference!) who has income only from within the 50 states. I asked him what his interpretation of 26 U.S.C. section 861 was that justified his position, and he got belligerant and tried to hang up on me. Then I asked him who in the IRS can answer my technical (not legal) questions about 26 U.S.C. sec. 861 since he refused to. He said "the courts". I said "who specifically, and what is their phone number." "I don't have a name. " "You're not being very helpful, and you're wasting my tax money running me in circles like this. Give me a name and phone number and email address of someone in the IRS who can answer the technical question you currently refuse to answer," I said. He wouldn't help me, and I was polite but never waivered off the point.

- By not being legally responsible for any of the advice they might give you when you call them for help and ensuring that you know that.

- By making the tax laws as long and as

complicated as they can (Title 26, the Internal Revenue Code, is 9,500

pages!) to discourage you from reading and understanding them. And then

when you do the research and interpret them correctly, they try to use

scare tactics that are just meaningless babble, including:

- "I believe your interpretation of the law is wrong." When you hear this kind of nonsense, then ask them "What interpretation of 26 U.S.C. sec. 861 supports any your position or any position but the one I have mentioned?" and watch them try to tapdance around the issue and tell you that you need your own attorney, as though attorneys are the ones who old the truth hostage for a ransom that equals your income tax check.

- "The courts have consistently

ruled against that issue." Ask them for just one

case citation that proves their theory and ask them if it has ever

been appealed or overruled. Then look up the case on the website

at http://www.findlaw.com and

call them back about it. The 26 U.S.C. Sec. 861/source position

advocated in this document has never been ruled on

in their favor by the U.S. supreme Court, but there are plenty of

examples where it has been ruled against them, most notably in the

case of Evens v. Gore, 247 U.S. 165, where the supreme Court ruled:

""After further consideration, we adhere to that view and accordingly hold that the Sixteenth Amendment does not authorize or support the tax in question. " [A direct tax on salary income of a federal judge]"

- "You are going to end up in jail if you pursue that course of action." More scare tactics to compel you with fear to be compliant.

- By using confusing terms and language

in the tax code (obfuscating it). We pointed this out in Great IRS Hoax, Form #11.302, Section 3.9.1

entitled "Words of Art: Lawyer Deception Using Definitions" and also in:

Legal Deception, Propaganda, and Fraud, Form #05.014

http://sedm.org/Forms/FormIndex.htm

- By obfuscating the issues raised in this document by creating a series of IRS publications that conflict with the tax laws as written (the Internal Revenue Code, in particular), and claiming "plausible deniability" by pretending they are unfamiliar with the issues you raise. Of course they are going to do this, since they undoubtedly know that they can be fired and the IRS criminally fined up to $1M for wrongful taking of taxes if they try to collect more taxes than they are due. Ask them when you call them what takes precedence, the Internal Revenue Code or the IRS publications. They won't advertise to you that the IRS publications don't have the force of law and aren't usable as evidence of reasonable cause in a court of law. They are simply hearsay not admissible as evidence and are subordinate to the Internal Revenue Code. And yet when you talk to the IRS, they will refuse to discuss the IRC and the fraud it exposes with you and will try to steer you to the IRS publications!

- By firing their own IRS historian so citizens can't find out the history and the truth behind the IRS and how the truth about income taxes has been buried and hidden deeper and deeper with "legalese" in the tax code every year.

- By hiding any evidence they might have about you from the discovery process. Refusing to show you the evidence they have against you and not giving you a chance to cross-examine any witnesses who are testifying against you. Refusing to respond to your Freedom Of Information Act queries for their files on you.

- By mailing you legal notices that expire in 10 days and dating them ten days before they actually mailing them, so that they are expired before you even get them! You should be on the look-out for this and write the date received and the date postmarked on the back of every letter. You might even want to tape the postmark onto the back of each correspondence you get from them.

For all the above reasons, you can expect that if you raise any of the issues in this document, you are very likely to be stonewalled by the IRS or frivolously and illegally penalized in seeking or applying the truths found here. That's the only tactic they can use to stay out of trouble and not play a game they know they can't win. Basically, as the IRS has done to so many others before you who pursued the issues raised in this document, they will likely refuse to respond to your official correspondence or evidence or refute any of your claims. This behavior by government we call a “Fifth Amendment” response and you need not be afraid of it because you can use it to your advantage in the next section.

As you begin to learn techniques for fighting the IRS beast, you may encounter occasions when they are attempting to assess you with penalties and compound interest. This has happened to us. We established clearly in sections 5.4.16 of the Great IRS Hoax that the IRS has no lawful authority to assess such penalties or interest for Subtitle A income taxes. We also established in section 5.4.15 that the IRS has no lawful authority to assess you with a Subtitle A income tax liability because the only person who can create such a liability is you. We have used the Notary Certificate of Default Method documented in Notary Certificate of Dishonor Process, Form #07.006 to completely eliminate $2,500 in proposed penalties by the California Franchise Tax Board and the IRS. It has worked very successfully for us and chances are very good that it will work for you as well! Even if you have to pay a few penalties initially, the best way to look on these penalties is as “tuition” in the process of learning how to be sovereign and free again. It is an investment in your freedom and sovereignty. As your techniques and knowledge improve and expand, the penalties will be eliminated and you will teach the ignorant and incompetent agents you are corresponding with the truth eventually. You can also prosecute these same agents for malfeasance, conspiracy against rights, constructive fraud, obstruction of justice, racketeering, mailing threatening communications, and several other crimes.

How can you fight your irrational fears about the IRS as you are learning to be free and the government is trying to abuse you so you will be incentivized to stay ignorant and stay a slave? Knowledge and love and preparedness and organization cast out fear. Be in loving relationships but more importantly, GET EDUCATED ABOUT THE LAW by reading this publication! Be an informed Citizen, pro per litigant, voter, and juror. Know your rights and understand the law. Be more organized and disciplined in your fight than they are! Then they will lose the biggest weapon they have to create fear: your own laziness and ignorance and disorganization. Knowledge and a disciplined approach truly are power, especially in the legal field. James Madison, one of our founding fathers, said about this issue in a letter to W.T. Barry, August 4, 1822:

"Knowledge will forever govern ignorance; and a people who mean to be their own governors must arm themselves with the power which knowledge gives."

The more you know and the more persuasively and skillfully you can communicate it, the more likely it is that you will win in your fight with the tyrant thieves at the IRS. This document is a very good starting point for getting informed enough to be very dangerous to their hidden agenda of fear. You can do it! When the going gets tough, the tough get going! One of our readers had the following very insightful things to say about the writings in this book:

Chris,

I'm writing to say thank you for all the information you have gathered and the free document you created [The Great IRS Hoax] to help further the truth. I think what you are doing is noble. I think what you are doing is Christian. Your efforts are monumental. With all that said, I have to confess to you that I have come to the conclusion that we live in a conquered country. We are conquered financially and legally. There is blatant disregard for fair, impartial judgment where the legal system is manned by people who get benefits from perpetuating the status quo. You, who are far more ahead of me in the legal realm, have probably come to this conclusion but remain hopeful that the government that perpetrated this fraud would suddenly feel ashamed and stop defrauding billions of dollars from it's slave force.

This, I believe, they will never let happen. I would like to remain optimistic and believe there is a shred of decency left in Washington but I don't believe that to be true. Right now the veil is in place and the legal community chooses to overlook people like you who know the law because there isn't enough "meat" (Booty, Loot, Pillage) to go after [if they do] and in their eyes people like us are annoying but until such time as they no longer have to keep a semblance of freedom, liberty and just law in this country, they pull the curtain back in place and the man behind it goes on with his machinations.

I do tell every one I know about your site. I even keep pieces of paper with [your] web address on it to hand out to anyone who cares to listen. Unfortunately, we live in a country of cloth and stick wavers (flag), who believe every bit of propaganda passed to them through the media and from it's elected officials. They wouldn't know their rights if the book fell on their heads. Case in point, Bob Schulz, laboring away to get redress from his government. He expects them to respond. Yet many people see this and regard Bob and his people "extremists". I don't understand their reasoning other than they have lived all their life under a slave mentality and would never think of questioning the legality of anything put before them by the Washington ruling elect.

I will close by saying that what you are doing is good, decent work. The problem is we don't know freedom because we have never lived free. We have always been under rule and by today's standards our fore-fathers would be considered 'terrorists'. I am saddened to think that the titles 'patriot', 'militia' or 'constitutionalist' have been transmogrified into slander and evil. But then we live in a conquered country.

Timothy L. Harrington

Here was our response to that insightful inquiry:

Tim,

That was a tremendously insightful way to explain the fraud and slavery we are currently living under. I'm very impressed and thank you for sharing your thoughts on the subject.

The slavery continues because of ignorance. The only thing I can do is educate and thereby liberate the masses of sheep that are out there and hope they will use their new found knowledge prudently in order to free themselves from the slavery. This world would be a pretty dreary place without hope that things could ever get better and that freedom was the light at the end of the tunnel that we are all heading for.

“But sanctify the Lord God in your hearts, and always be ready

to give a defense to everyone who asks you a reason for the hope that is

in you, with meekness and fear; having a good conscience, that when

they defame you as evildoers, those who revile your good conduct in Christ

may be ashamed. For it is better, if it is the will of God, to suffer

for doing good than for doing evil.”

[1 Peter 3:15-17, Bible,

NKJV]

God bless you for your diligence in learning and spreading the truth. Keep up the good work, my friend and brother.

Family Guardian Fellowship

Therefore, when you are really discouraged about our present situation and the slavery to the legal field that we find ourselves under, we recommend reading Matthew 5:1-12 in the Bible, where Jesus offers encouragement to all those who believe in him. Pay special attention to Matt. 5:10-12, which are the last three verses:

3 Blessed are the poor in spirit, for theirs is the kingdom of heaven.

4 Blessed are those who mourn , for they shall be comforted.

5 Blessed are the meek, for they shall inherit the earth.

6 Blessed are those who hunger and thirst for righteousness, for they shall be filled.

7 Blessed are the merciful, for they shall obtain mercy.

8 Blessed are the pure in heart, for they shall see God.

9 Blessed are the peacemakers, for they shall be called sons of God.

10 Blessed are those who are persecuted for righteousness’ sake, for theirs is the kingdom of heaven.

11 Blessed are you when they revile and persecute you, and say all kinds of evil against you falsely for My sake.

12 Rejoice and be exceedingly glad, for great is your reward in heaven, for so they persecuted the prophets who were before you.

See also 1 Peter 4:12-17 for more inspiration. When our wicked government has afflicted you and persecuted you for following the law, which clearly says we don’t owe income taxes, use the occasion not only to learn man’s law, but also God’s law:

“It is good for me that I have been afflicted, that I may learn

Your statutes. The law of Your mouth is better to me than

thousands of coins of gold and silver.”

[Psalm

119:71-72, Bible, NKJV]

Do not worry what you will say when you go up in front of the judge:

“Now when they bring you to the synagogues and magistrates and authorities,

do not worry about how or what you should answer, or what you should say.

For the Holy Spirit will teach you in that very hour what you ought to say.”

[Luke

12:11, Bible, NKJV]

And remember that Jesus is your Lawyer and your Counselor!:

“And His name will be called Wonderful, Counselor, Mighty

God, Everlasing Father, Prince of Peace.”

[Isaiah

9:6, Bible, NKJV]

You will be blessed for fighting the IRS monster and for doing what is right above and beyond your own selfish interests. It may not happen during your earthly lifetime, but for eternity and the life hereafter you will be blessed and you will sit at the right hand of your Father in Heaven. What greater honor could there be? This life is only an illusion and a test of your faith to see if you are worthy to survive the judgment talked about in Revelations and be rejoined with God. You couldn’t get this kind of blessing by asking for it or by what you do. You can only get it by being persecuted by the ignorant and evil people at the IRS who are greedy deceivers, liars, and who disdain God’s word. Don’t be discouraged!

“Today's mighty oak is just yesterday's nut that held its ground.”