At every stage of both the administrative and the legal process, it is extremely important that you structure your dealings with the taxing authorities in such a way as to maximize the production of authentic evidence that will be useful for you in court should you ever have to litigate your case. Such evidence is a very effective offensive weapon in the courtroom. Furthermore, it gives you plenty to talk about when you walk into court, and an effective way to entertain and enlighten the jury about the government fraud and extortion that is going on vis a vis the income tax. Because most judges don’t like especially pro per litigants talking about the law in the courtroom (see section 6.8.1 of the Great IRS Hoax, the case of Dr. Phil Roberts as one example), having lots of evidence of your good-faith dealings and your sincere search for truth and justice will prevent you from being prosecuted for a “Willful Failure To File” 26 U.S.C. §7203 charge and could make the IRS look really bad. For instance, if you can record an IRS agent being unhelpful, obnoxious, or unwilling to provide evidence of his authority or the law that makes you liable, then it will be easier to smear the IRS.

Below are some pointers on how to maximize evidence gathering that we have found effective:

- Send everything to your employer and the IRS as an affidavit with a proof of service by mail. Keep the certified mail receipts and copies of all correspondence for your records stapled together.

- Insist that all responses from both the IRS, your employer, or your financial institutions must be IN WRITING and that you will not accept phone calls unless you initiate them at a prearranged time so you can record them at home.

- All items of evidence should be serialized with a sequential number, locked up in a safe place, and the serial number and document description entered into a log book or electronic record. All evidence needs to be carefully protected, organized, and maintained under your positive control at all times. This is the only way you can authenticate the evidence for the judge and the court and later get it admitted.

- IMPORTANT: When you send correspondence requesting the IRS or your state income taxing authority confirm certain findings of yours, always give them a time limit to respond, and notify them quite clearly that if they don’t respond, they have admitted the truthfulness of your conclusions. Identify your correspondence as a “Legal Notice” and tell them you are abiding by the Uniform Commercial Code section 1-205, which allows that as long as you give them advance notice of the established rule, they must conform. If they refuse to respond to any of your issues and instead respond with a notice that your tax return is frivolous, send them a “Verified Affidavit of Default” documenting the facts they have admitted to and sign it under penalty of perjury.

- If you want to increase the authority of your “Verified Affidavit Of Default” above, then you can tell the IRS to send their response to your correspondence to the Notary Public instead of directly to you, and have the Notary Public sign the “Verified Affidavit of Default” instead of you. The Notary Public is a licensed officer of the court who has more credibility than you do.

- Buy a video recorder, a tripod, and have spare tapes and batteries. If the IRS visits your house or calls you in for a deposition or a summons, then record the entire event on video tape.

- Buy a Telephone Recording Control online and hook it up to the microphone jack on your computer. This device plugs into your sound card mic input and monitors both sides of a telephone conversation surreptitiously.

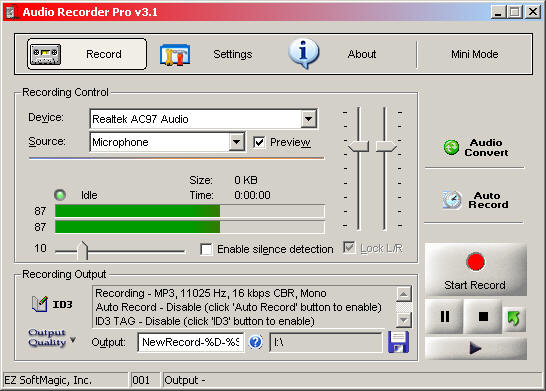

- Buy sound recording software. Our favorite is Audio Recorder

Pro for $29. This program records any audio coming into the

mic jack as an MP3 file. It is available at:

http://www.ezaudiorecorder.com/ - Make all calls related to income taxes to either your employer

or the IRS from your home phone so you can record them. Before

you start the call, open the

Audio Recorder

Pro program. You can access this from the

START->Programs->Audio

Recorder Pro>Audio Recorder Pro menu.

NOTE: The Windows Sound Recorder can record for no more than 60 seconds at a time. If you want to record longer phone conversations, you will need to buy a third party program like Audio Recorder Pro. We surveyed and tried several programs and this turns out to be the easiest to use, cheapest, and most functional of them all.

- On the Audio Recorder Pro, select the Source->Microphone.

- Create a shortcut on your Windows STARTBAR with the Audio Recorder Pro icon so you can very quickly start up the Audio Recorder if the IRS calls you unannounced. Be prepared so you don’t lose evidence.

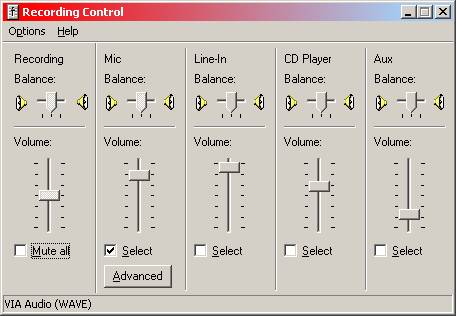

- Select START->Control Panel->Sounds and Audio Devices.

- On the Sounds and Audio Devices

dialog box, click the

Audio

tab.

- In the Audio Properties dialog box, click on the Volume button for the Sound Recording option group.

- Check the Select check box under the MIC input to select the

Telephone Recording Control connected to the MIC input for recording.

- Start the Audio Recorder Pro in Record mode by clicking on the Red Dot and then make your call.

- When you contact the person you wish to speak with, tell them

the following:

I’d like to remind you that this call is being recorded for quality control purposes

This will keep you out of trouble. Some states are what is called “two party” states, where the consent of parties on BOTH ends of the conversation must be obtained in order to avoid committing a crime in the process of recording an otherwise private conversation.

- At the conclusion of the conversation, stop the Sound Recorder

and save your *.WAV file. Save the sound file it with a standard

filename such as the following:

IRSYYYYMMDD-800-432-6566.WAV

Where:

IRS=The person you talked to

YYYY=The four digit year.

MM=The month

DD=The day

800-432-6566= The phone number you dialed.

- Keep everything related to evidence on your computer backed up. We bought a 2 GB Iomega Jaz drive and back everything up frequently. We also keep an off-site backup in case the IRS decides to get cute and raid you with the blessing of some corrupt judge’s court order to destroy your evidence.

- DO NOT accept calls from the IRS at work because you can’t record them! Instead, insist with everyone you deal with that you initiate all calls at a prearranged time from your home so you can record everything. Don’t give them your work number, because they will try to call you there unannounced and catch you off guard.

For your entertainment and education, we have recorded most of our calls with the IRS and have them posted on our website to educate you on some of the tactics you can use in dealing with the IRS on the phone.